Bitcoin’s price rise could keep on taking further market share away from gold in the so-called “store of value” market, according to analysts from Goldman Sachs who, in a report, touted BTC could hit $100,000 in the future.

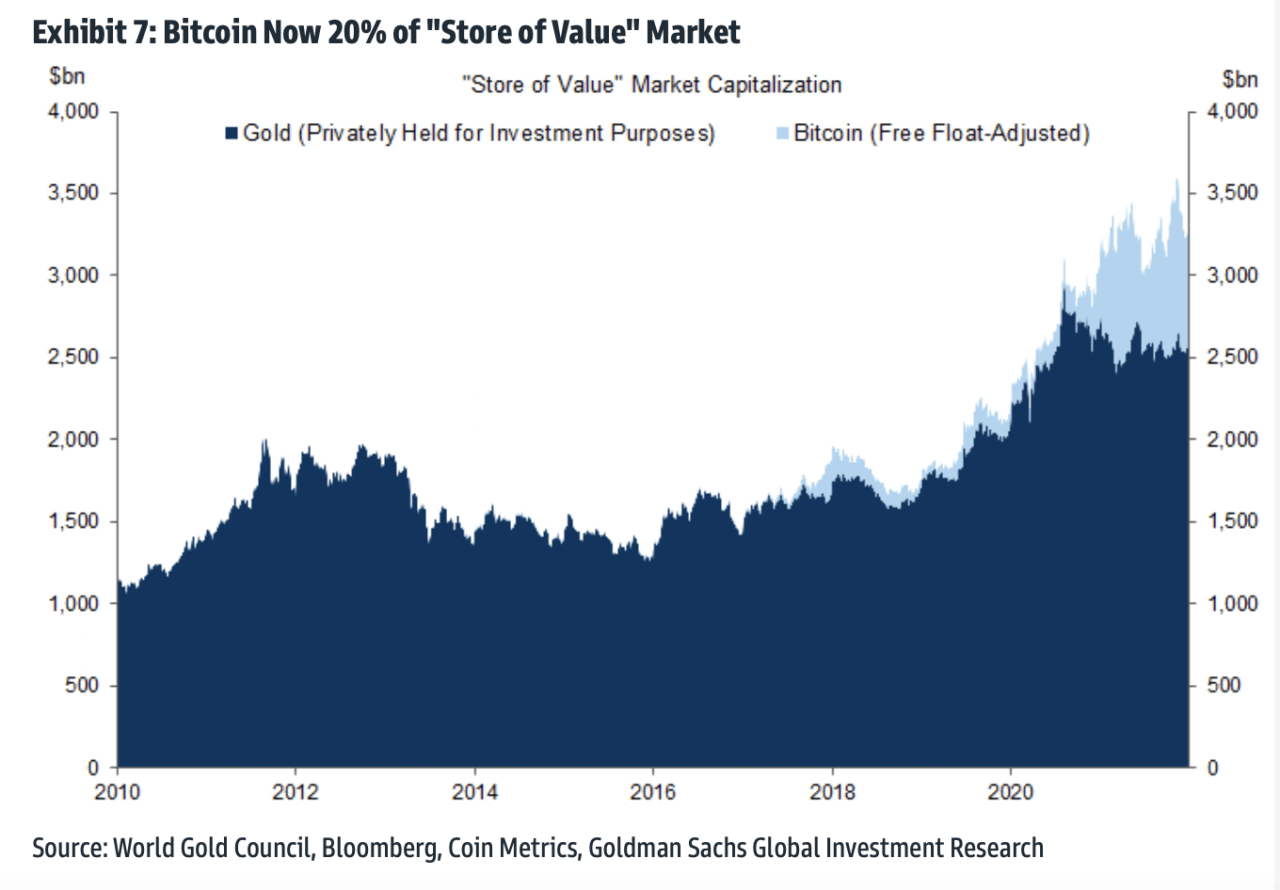

As first reported by Bloomberg, Goldman Sachs’ analysts have estimated that Bitcoin’s float-adjusted market capitalization is just under $700 billion, accounting for 20% of the total “store of value” market, which is currently comprised of gold and BTC. In their analysis, they pointed out the value of gold available for investment is around $2.6 trillion.

Hypothetically, the analysts added, if Bitcoin’s share of the store of value market rose to 50% over the next five years, each coin would trade at just over $100,000, which would mean a compound annualized return of 17% to 18%.

The note added that Bitcoin’s consumption of energy resources may be an obstacle for its institutional adoption, but is not going to stop demand for it altogether. Bitcoin, it’s worth noting, has been often referred to as “digital gold” for its properties, although critics criticize it the same way they do gold: it pays no interest or dividends.

Goldman Sachs also noted that Bitcoin adding other applications beyond being a store of value could further help it grow. The analysts wrote that while digital asset markets are “much bigger than Bitcoin” they believe “comparing its market capitalization to gold can help put parameters on plausible outcomes for Bitcoin returns.”

Goldman Sachs’ analysts, as CryptoGlobe reported, have last year predicted the second-largest cryptocurrency by market capitalization, Ethereum’s ether, could hit $8,000 before the end of 2021. Ethereum’s price failed to breach the $4,700 mark last year amid a crypto market downturn and is now trading at $3,800, according to CryptoCompare data.

In June 2021, the investment bank started trading Bitcoin futures on behalf of clients with the help of Galaxy Digital.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash