The Shiba Inu ($SHIB) investor who in August 2020 bet $8,000 on the meme-inspired cryptocurrency and at one point saw the value of his tokens swell past the $5.7 billion mark, has started moving his giant stash.

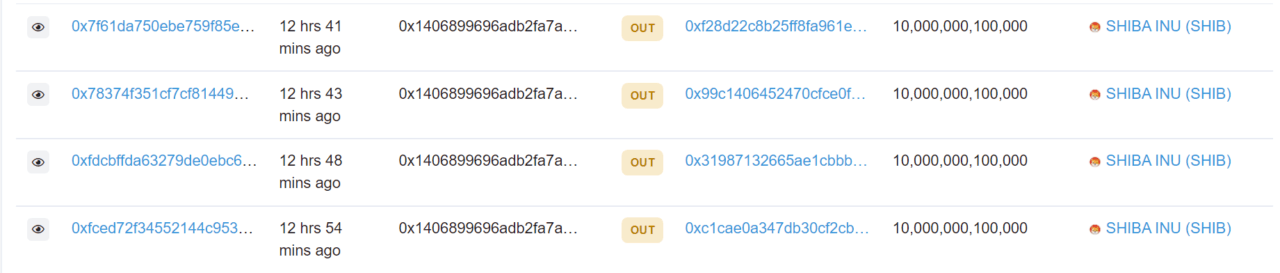

According to data from Ethereum blockchain explorer Etherscan, the investor has moved his funds in tranches of 10 trillion SHIB each to different wallets, although the funds do not appear to have been sent to centralized trading platforms.

Each of these wallets now has over $650 million worth of SHIB tokens that the investor bought when the cryptocurrency was trading at $0.000000000189 a coin. Data from CryptoCompare shows SHIB is now trading at $0.0000651.

Shiba Inu’s price, as CryptoGlobe has been reporting, exploded in the last few months to the point it has become the third-most Googled cryptocurrency so far this year. A study has shown Shiba Inu received 2.8 million searches on average per month so far this year, while bitcoin received 22 million average monthly searches. In second place came Ethereum, with 6.3 million average searches per month.

The cryptocurrency’s trading volume has surged to rival that of Ethereum after a supporter asked Tesla and SpaceX CEO Elon Musk, who has been a vocal supporter of rival meme-inspired cryptocurrency Dogecoin how much SHIB Musk was holding. Musk revealed he only hold BTC, ETH, and DOGE.

As reported, digital asset-focused research firm Delphi Digital has revealed that historically dog coins, meaning cryptocurrencies inspired by the popular Shiba Inu meme, have historically been “a pretty good indication of an overheated market.”

The firm pointed out that from April to May of this year and in early September dog coins were “all the rage and quickly crated as crypto markets cooled off or saw a fairly deep de-leveraging.”

SHIB’s price has notably started dropping after the whale moved its stash to different wallets As they hold a significant portion of the cryptocurrency’s supply, some investors likely sold their funds expecting the whale to dump their tokens on the market.

At press time, SHIB is down over 5% in the last 24-hour period, and nearly 12% over the past week.

Recently, Famous American whistleblower Edward Snowden has cautioned investors against the meme-inspired cryptocurrency Shiba Inu, suggesting on social media that the cryptocurrency is more of a gamble than an investment.

Michael Burry, the investor best known for his lucrative bet against the housing bubble ahead of the 2008 financial crisis that was immortalized in the book and movie “The Big Short,” has also revealed he is not a fan of SHIB.

In a now-deleted tweet, the head of Scion Asset Management shared Coinbase’s description of the cryptocurrency and highlighted its supply, which exceeds one quadrillion tokens, and suggested it is not a good investment because of the vast amount in circulation.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash