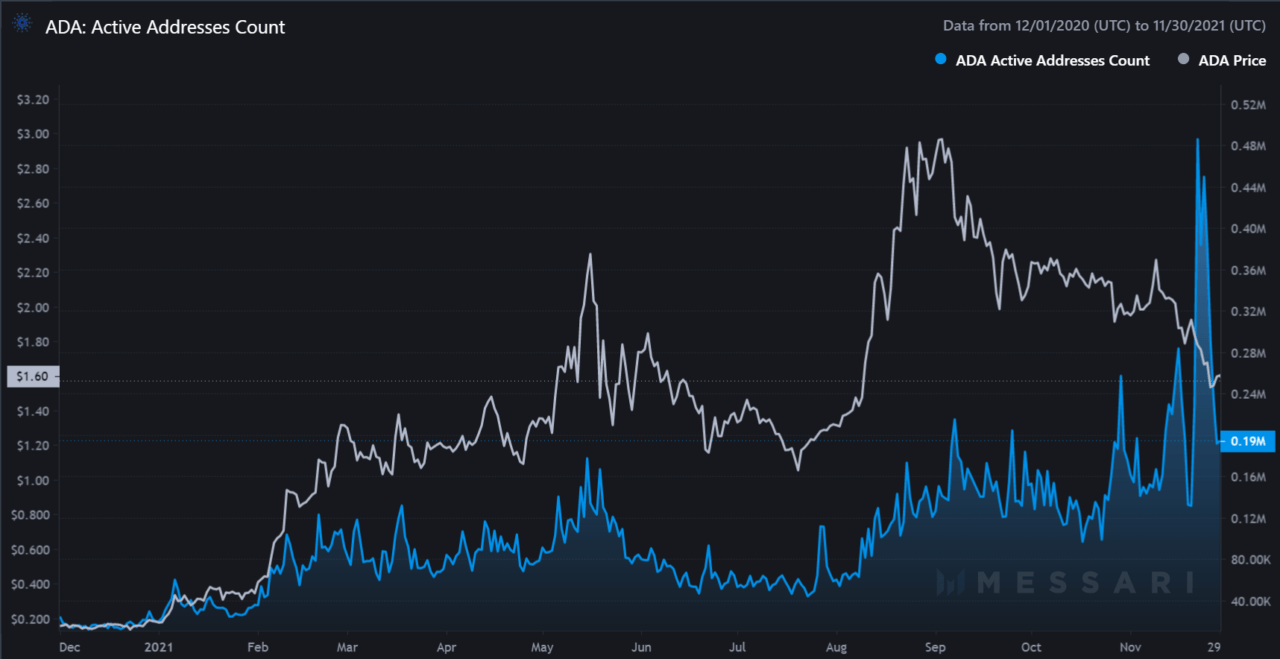

The number of active addresses on the Cardano ($ADA) network has recently jumped from around 150,000 per day to over 480000, before plunging back to 200,000, according to available on-chain data.

The data, provided by Messari and first spotted by BeInCrypto, reveals that as the price of the native token of the Cardano network, ADA, went down, the number of active addresses suddenly surged.

As reported earlier, the number of Cardano addresses staking the cryptocurrency grew by over 100,000 in just two months as more investors are betting on the cryptocurrency and its ecosystem. Data shows there are $54.07 billion worth of the cryptocurrency staked across 2,931 active pools, representing over 72% of the ADA’s supply.

Earlier this year the price of ADA exploded ahead of the rollout of the widely anticipated Alonzo hard fork, which brings smart contracts into the network and allows it to compete with the Binance Smart Chain (BSC), Ethereum (ETH), and Solana (SOL).

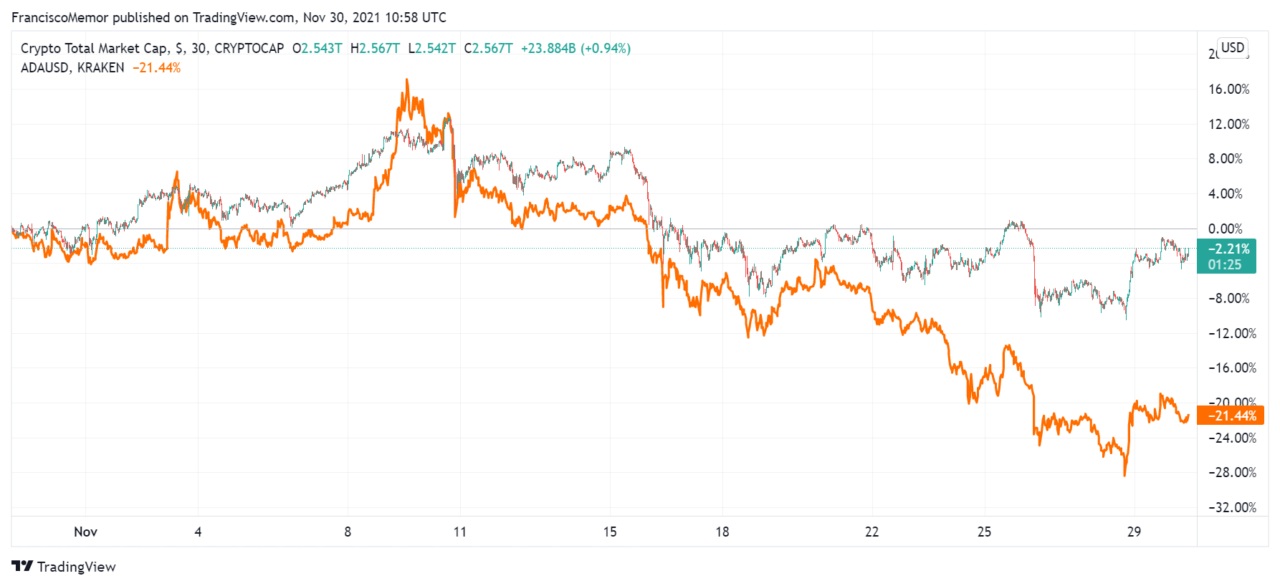

ADA’s price recently started dropping amid a wider cryptocurrency market correction. ADA’s drop continued after eToro announced on its website that due to regulatory concerns it would be “limiting ADA and TRX” for users based in the U.S. and that these users would “no longer be able to open new positions in, or receive staking rewards for, Cardano (ADA) and TRON (TRX)” but would be “able to close existing positions.”

Cardano’s Charles Hoskinson has commented on eToro’s move, saying that neither the Cardano Foundation nor Input Output Hong Kong (IOHK) had been contacted by any financial regulators about $ADA. Hoskinson added that although it’s unfortunate eToro felt it had to delist the token from its platform in the U.S., the move will have no meaningful impact on $ADA’s liquidity as it did not handle a large trading volume.

Meanwhile Bitstamp, one of the world’s longest-running cryptocurrency exchanges and Europe’s largest exchange by trading volume, announced it is listing ADA. As reported, the founder of Crypto Capital Venture, Dan Gambardello, has criticized the cryptocurrency community’s focus on Cardano getting delisted from eToro instead of focusing on the listing.

The active address rise may be related to the native token of COTI, the Cardano Foundation-backed enterprise-grade fintech platform, being added to Coinbase Custody.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash