Bitcoin whales, defined as large investors who hold over 1,000 BTC, have been accumulating BTC while fearing fiat currency inflation may get out of control and after fueling the cryptocurrency’s renewed rally this year.

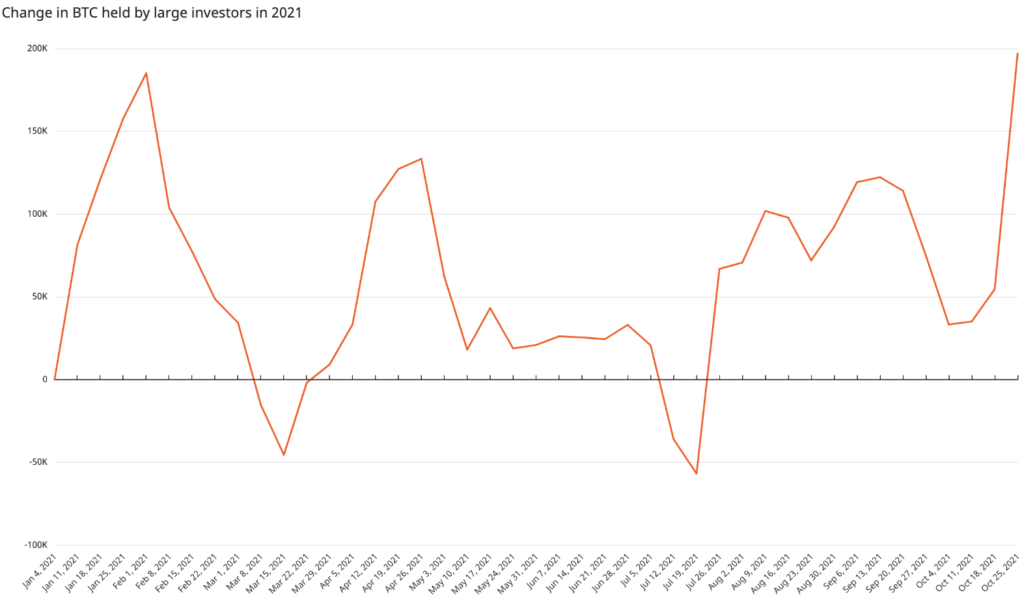

According to Chainalysis’ market intel report, first spotted by CoinDesk, bitcoin whales accumulated 142,000 BTC last week, moving their total holdings close to the 200,000 mark, a high that hadn’t been seen so far this year.

To Chainalysis, whale accumulating amid inflation fears appear to confirm BTC is seen as digital gold, but could also be a sign institutional investors are making a longer-term investment in the flagship cryptocurrency.

As CoinDesk reports, the U.S. 10-year breakeven rate, which represents how the market foresees long-term inflation, rose to a decade high of 2.64%. Bitcoin, meanwhile, reached an all-time high near $67,000 this year on the back of the launch of the first bitcoin futures exchange-traded fund (ETF) in the U.S. and as institutional interest grows.

Legendary investor Paul Tudor Jones has said bitcoin could be a “great hedge” against inflation, before adding cryptocurrency is “winning the race against gold at the moment.” Similarly, the CEO and chief investment officer of Soros Fund, Dawn Fitzpatrick, has revealed that the private investment firm with over $6 billion in assets under management holds “some” bitcoin, and sees it becoming mainstream.

To Chainalysis however, bitcoin needs to expand its usability to web 3.0 and decentralized finance to compete with Ethereum’s ether in the long run. The report adds:

Bitcoin usage has not reached the sophistication of Ethereum or other Layer 1 assets. A decentralized way of wrapping bitcoin is needed to unlock the use of bitcoin as high-quality capital in DeFi.

The firm added that if bitcoin can be used in web 3.0 it will have a future “as a scarce fungible asset and as a useful asset in the more innovative side of crypto.”According to Defi Llama, there are over $256 billion locked in the DeFi space.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured Image via Pixabay