Roughly three months ago today, the Avalanche Foundation announced “Avalanche Rush”, “a $180M liquidity mining incentive program” aimed at bringing more applications and assets to the DeFi ecosystem of smart contracts platform Avalanche ($AVAX).

What is Avalanche ($AVAX)?

Below is a brief description of Avalanche from its developer documentation:

“Avalanche is an open-source platform for launching decentralized applications and enterprise blockchain deployments in one interoperable, highly scalable ecosystem. Avalanche is the first decentralized smart contracts platform built for the scale of global finance, with near-instant transaction finality. Ethereum developers can quickly build on Avalanche as Solidity works out-of-the-box.

“A key difference between Avalanche and other decentralized networks is the consensus protocol. Over time, people have come to a false understanding that blockchains have to be slow and not scalable. The Avalanche protocol employs a novel approach to consensus to achieve its strong safety guarantees, quick finality, and high-throughput without compromising decentralization.

“AVAX is the native token of Avalanche. It’s a hard-capped, scarce asset that is used to pay for fees, secure the platform through staking, and provide a basic unit of account between the multiple subnets created on Avalanche. 1 nAVAX is equal to 0.000000001 AVAX.“

Avalanche is being developed by Ava Labs, a blockchain startup founded in Brooklyn, New York in 2018 by Professor Emin Gün Sirer (CEO), who does computer science research at Cornell University, Kevin Sekniqi (COO), and Ted Yin (Chief Protocol Architect).

The ‘Avalanche Rush’ DeFi Incentive Program

In a blog post published on August 18, the Avalanche Foundation introduced “Avalanche Rush”, a $180M liquidity mining incentive program, and explained that this program would bring two of the most popular DeFi projects to Avalanche:

“Avalanche Rush will bring Aave and Curve, two of the largest DeFi protocols by total value locked (TVL), to launch on Avalanche. Phase 1 of the Rush program will launch soon and provide the Avalanche native token, AVAX, as liquidity mining incentives for Aave and Curve users over a 3 month period. The Avalanche Foundation has allocated up to $20M AVAX for Aave users and $7M AVAX for Curve users, with additional allocations planned for Phase 2 in the coming months.“

This program follows in the footsteps of “Avalanche Bridge” (currently in beta), “a next-generation cross-chain bridging technology that transfers assets between blockchains.”

On November 3, Joseph Todaro, a Partner at Greymatter Capital, said that he feels there are going to be a lot more projects coming to Avalanche.

According to a tweet by Coin98 on November 9, at least 358 Avalanche-powered projects have been built in the past 13 months.

The following infographics gives an idea of how much the Avalanche ecosystem has grown since late April.

On November 10, Patrick Sutton, Director of Communications at Ava Labs, talked about the “exponential growth@ of transactions on the Avalanche blockchain:

Luigi D’Onorio DeMeo, Director of DeFi at Ava Labs said on Monday (November 15) that the number of daily active addresses (currently around 70,000) has gone up 20X in the past three months.

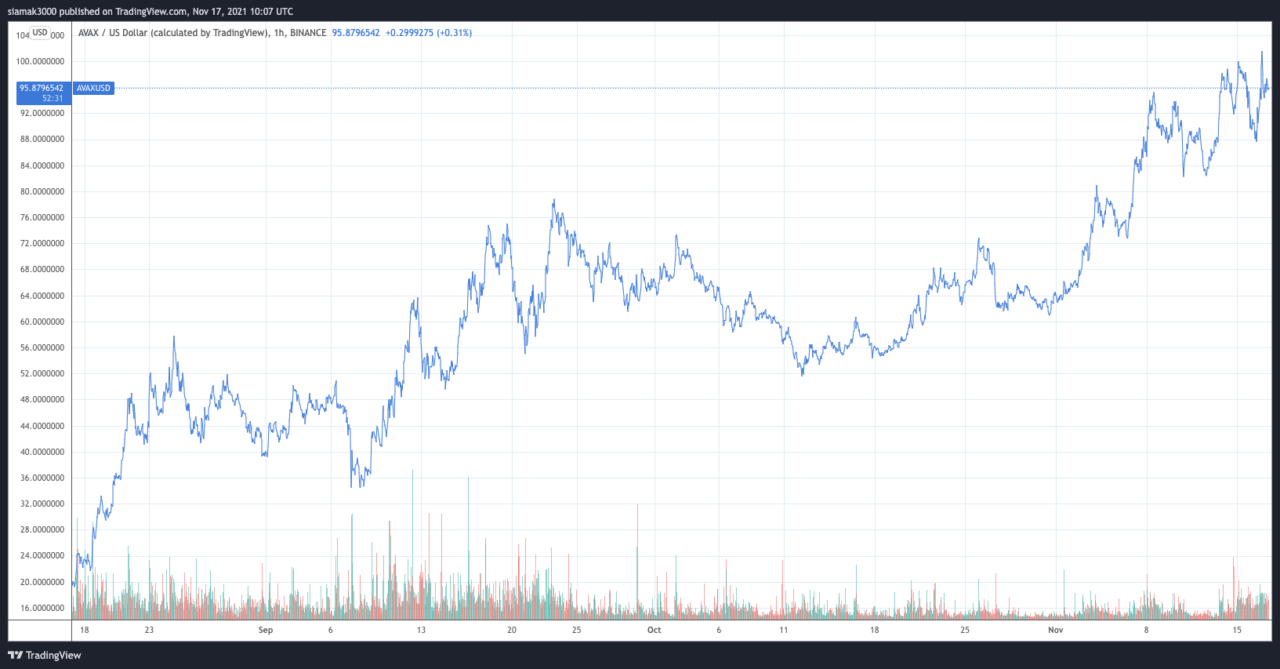

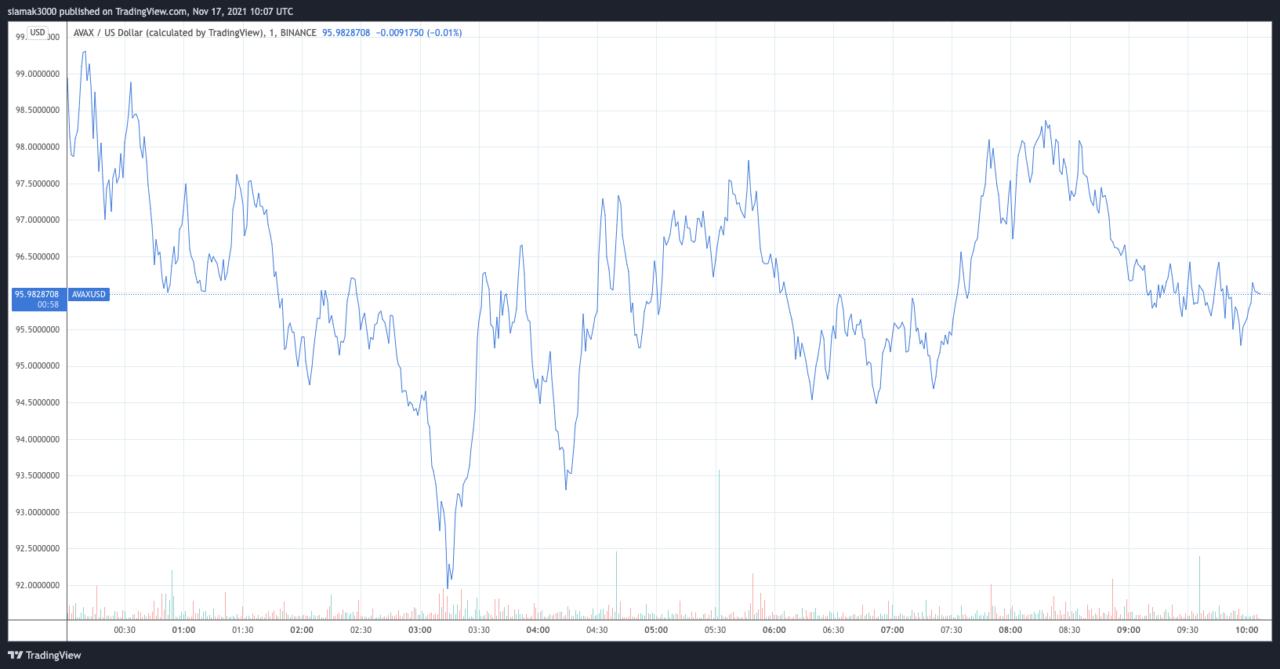

$AVAX’s Price Action

According to data by TradingView, on crypto exchange Binance, currently (as of 10:05 UTC on November 17), $AVAX is trading around $96.01, up 11.21% in the past 24-hour period.

Interestingly, in the three-month period since the Avalanche Rush program was announced, $AVAX has gone up nearly 300% (or 297.06% to be more precise).

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.