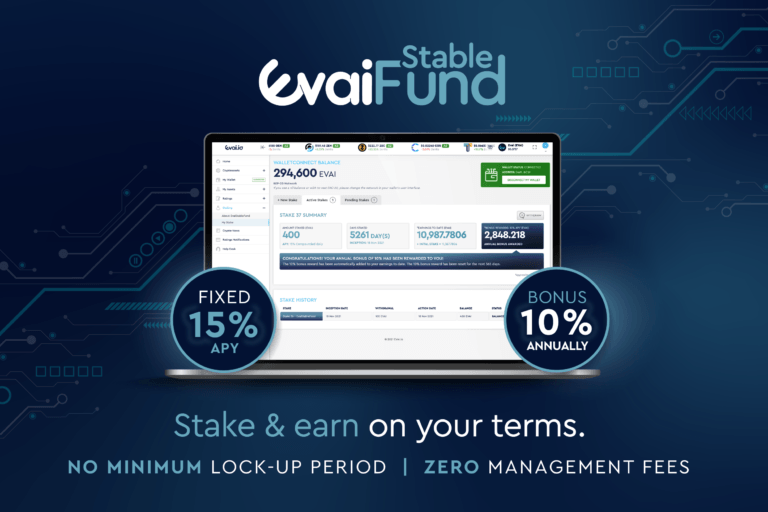

London, UK – The British company behind the innovative crypto ratings platform, evai.io, has announced that over one million dollars worth of ERC-20 and BEP-20 compatible EVAI tokens were staked into the new EvaiStableFund within hours of it going live. The fund gives investors the opportunity to yield a fixed 15% APY with an additional 10% per annum bonus. Unlike many staking options in the crypto market, EvaiStableFund does not lock investors in for a minimum term, nor charges any management fees.

The fund avoids the usual volatility associated with the crypto space and offers a way for investors to get exposure to the market with minimal risk. The interest is compounded daily, and with the additional per annum bonus, investors will earn a 26.5% yield on every stake held for a total period of 365 days, with no limit to how many stakes investors can run consecutively. To open a new stake, users need to sign up to evai.io, have a balance of 500 EVAI or more in their Trust Wallet or MetaMask and connect to the Evai staking platform through WalletConnect. Investor appetite for the EvaiStableFund has also seen the EVAI price climb over 25% within a single day, in contrast to the wider market decline.

Earlier this year Evai launched evai.io, a crypto ratings platform through which live crypto asset data is evaluated daily against several key economic factors by AI and machine learning, before awarding each asset one of eleven possible ratings, from A1 to U. Professor Andros Gregoriou of The University of Brighton, Co-Founder and Chief Research Officer at Evai, explains how the evai.io rating platform works, “The Evai platform combines peer-reviewed academic research and Artificial Intelligence with a machine learning, self-correcting and autonomous rating protocol, removing human bias. Evai continuously learns, maintains and remains decentralised to produce unbiased ratings.”

The British FinTech company has offices in London and Singapore, with their main HQ now set up in the cutting-edge CV Labs office within the DMCC Crypto Centre Dubai, located on the 48th floor of the iconic Almas Tower. Swiss Crypto Valley ecosystem company CV Labs supports over 960 blockchain projects within Crypto Valley alone and saw something unique in Evai, making the British technology company Global Platinum Partners earlier this year. Ralf Glabischnig, founder of CV Labs, said of the partnership, “The convergence of innovation, regulation and education is at the heart of CV Labs and the global partnership with Evai was a natural first step. Evai has developed a platform that will help to democratise the financial ratings sector.”

Peer-reviewed, academic research is at the heart of the Evai ethos and as such, the company have partnered with both Peking University and Brighton University, with the former recently having taken on its first PhD student, dedicated to the development and research of the Evai ratings platform while supporting the wider Evai research team.

The innovative crypto ratings platform is free for everyone to use and can be viewed at www.evai.io. The company describe the platform as a democratisation of the crypto market with over 1,000 assets listed and rated, and thousands more assets due to be added over the coming months. Evai co-founder and CEO Matthew Dixon explains, “The appeal of the EvaiStableFund is universal and has immediately captured the attention of retail crypto investors, family funds and institutions. It has been designed to utilise our proven Evai ratings technology, powered by AI and machine learning, to provide competitive returns for investors with minimal risk. We are excited to offer investors of all levels and budgets a gateway into cryptoasset investment.”

To find out more about Evai’s unbiased, AI and machine learning powered crypto ratings or how to buy the EVAI token and stake into the new EvaiStableFund, head to www.evai.io or join their telegram at https://t.me/EVAIofficial.

Media Contact

Company: Evai

Contact: Media Team

E-mail: [email protected]

Website: www.evai.io

Telegram: https://t.me/EVAIofficial