On Monday (September 20), Wilshire, which provides several market leading indexes (such as the FT Wilshire 5000), announced that it has launched several new crypto indexes with the help of leading cryptoasset market data provider CryptoCompare and UK-based financial news organization Financial Times (FT).

Presumably, Wilshire chose CryptoCompare as a partner based on the latter’s reputation for the high quality of its market data as well as its highly respected unique and comprehensive methodology for ranking crypto exchanges.

The 13 new FT Wilshire indexes listed below — 10 single asset indexes and three multi-asset indexes — serve to aggregate the prices of digital assets from the most highly rated crypto exchanges:

- FT Wilshire Bitcoin Blended Price Index

- FT Wilshire Ethereum Blended Price Index

- FT Wilshire Cardano Blended Price Index

- FT Wilshire Dogecoin Blended Price Index

- FT Wilshire Chainlink Blended Price Index

- FT Wilshire Uniswap Protocol Blended Price Index

- FT Wilshire Bitcoin Cash Blended Price Index

- FT Wilshire Uniswap Protocol Blended Price Index

- FT Wilshire Solana Blended Price Index

- FT Wilshire Litecoin Blended Price Index

- FT Wilshire Top5 Digital Assets

- FT Wilshire Top5 Digital Assets ex Bitcoin

- FT Wilshire Bitcoin & Ethereum Inde

Initially, the pricing data will come from the top seven highest ranked crypto exchanges.

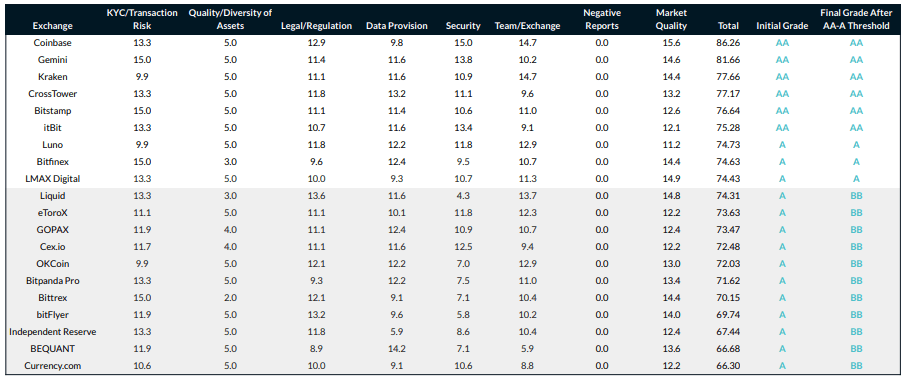

All of these exchanges must be rated “A” or “AA’ by CryptoCompare and must have been awarded overall scores of at least 70 over the previous 12 months, which means these exchanges must have “robust Know Your Customer (KYC) and Anti-Money Laundering (AML) policies, as well as legal and regulatory compliance and due diligence processes.”

Based on the August 2021 edition of CryptoCompare’s Exchange Benchmark Report, currently, the top seven crypto exchanges (by total score) are Coinbase, Gemini, Kraken, CrossTower, Bitstamp, itBit, and Luno.

Also, according to the press release, these new indexes will be published in real-time and feature among the FT’s markets data.

Mark Makepeace, CEO of Wilshire, stated:

“Our role is to provide the tools and strategy necessary for safe access to new markets for investors. As new digital forms of investment and the adoption of blockchain technologies take shape, the financial services will need help to ensure institutional investors gain safe access and understand the drivers of performance and risk associated with digital assets.“

Charles Hayter, Co-Founder and CEO of CryptoCompare had this to say:

“We are seeing a substantial and increasing interest in digital assets from institutional investors. Since 2014,we have worked to develop an extensive and reliable suite of market data to offer access and transparency to this rapidly growing asset class. We look forward to working closely with the Financial Times and Wilshire to provide our trusted digital asset data to build these innovative products offering institutional investors new avenues for digital asset exposure.“

And finally, John Ridding, CEO of The Financial Times, said:

“Digital assets are a dynamic and fast moving sector with the potential to have considerable impact on financial services and the investment industry. They are drawing the attention of a wider pool of investors and regulators. There is a need and an opportunity to provide investors and readers with authoritative metrics, news and analysis. As a globally trusted source on market trends and innovations, the FT is supportive of enhanced data that helps readers understand the risks as well as the opportunities and informs their perspectives.“