Vast Bank says that it has become “the first nationally chartered U.S. bank that allows you to buy, sell, and hold cryptocurrency assets directly with your bank account.”

Vast Bank is an independent bank (wholly owned by the Biolchini family) based in Tulsa, Oklahoma. According to a press release issued by Vast Bank on August 25, the bank’s new Crypto Banking service is “available via a user-friendly mobile application which simplifies the buying and selling of cryptocurrencies directly with bank accounts.”

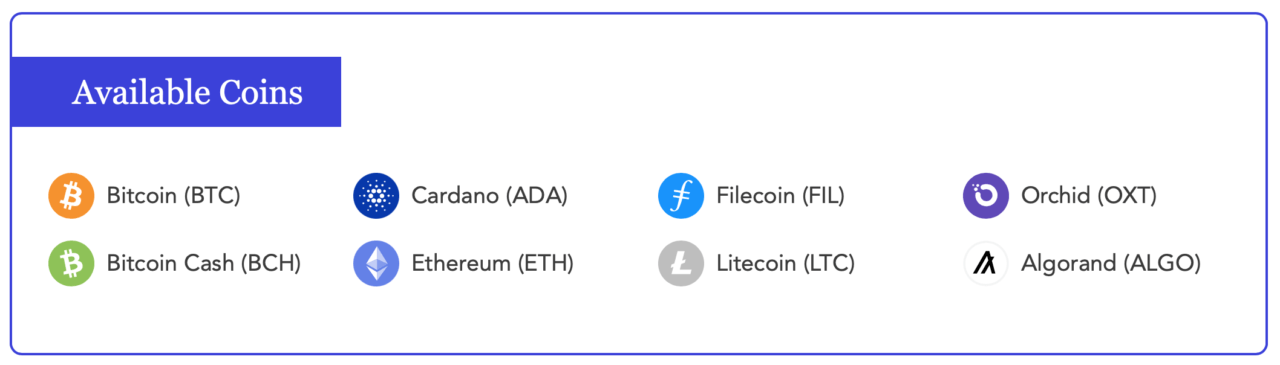

Besides Bitcoin, Vast Bank currently supports seven other cryptoassets:

Brad Scrivner, CEO of Vast Bank, stated:

“We take pride in getting to know our customers, and that starts with listening. At the heart of many of these conversations is crypto. For quite some time, our customers have been asking why they cannot securely purchase the likes of Bitcoin using their bank account, citing concerns over trustworthiness, safety, and the security of other platforms—all issues which have kept many consumers parked on the sidelines of the crypto phenomenon.

“We took this challenge head on, and devoted significant resources to answer this unmet need. We’re excited to bring this service online, and give all consumers the opportunity to explore the world of cryptocurrencies in a way that brings peace of mind that only a bank like Vast can provide.“

Here are a few of the main benefits of Vast Bank’s Crypto Banking service:

- Safety / Security (since Vast Bank has custody of customers’ cryptocurrencies)

- Insurance (Vast Bank’s checking accounts are” insured by the FDIC for up to $250,000; their crypto accounts are “protected through pooled insurance provided by Coinbase”)

- No Transfer Delays (“funds move instantly between cryptocurrency in customers’ Vast Bank crypto accounts and U.S. dollars in their Vast Bank checking accounts”)

During an interview with Forbes’ journalist Jason Brett, the Vast Bank CEO had this to say about how the Crypto Banking service works:

“We have launched crypto services for individuals as a ‘self service’ capability. When customers fund a normal bank account, you have the ability to purchase eight cryptocurrencies, just by signing up for that account. When you ask about custody and exchange, you can buy, you can sell, and you can store those eight crypto currencies by opening a single bank account.

“Now, technically behind the scenes, each one of those cryptocurrencies is in another account, but it is shown on your mobile device so that you understand what you have in each one of those coins – but it is settling and coming directly out of your bank account. So there’s instant settlement into your checking account when you sell the cryptocurrencies or instant settlement to purchase the cryptocurrency as well.“

As for the bank’s strategic partnership with SAP and Coinbase, he said:

“As you can imagine, implementing this technology is not easy for a relatively small bank. SAP is historically at least thought of as one of the largest companies in the world who services the financial services industry. They believed in what we’re doing and have been tremendous partners.

“With Coinbase, that was an introduction from one of our FinTech partners. Coinbase thought it was a really good opportunity for a bank to serve segments of their clients and different types of clients. And they have continued to be a really good partner in terms of referrals in terms of encouraging folks to talk with us about the custody opportunity.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.