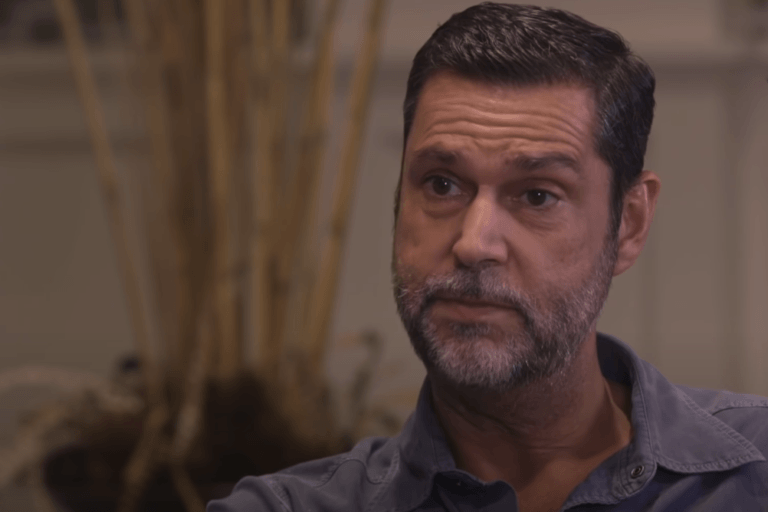

In a recent interview, former Goldman Sachs executive Raoul Pal talked about why is excited about certain altcoins, and in particular explained why he is bullish on Cardano ($ADA), Solana ($SOL), and XRP, all of which he currently owns.

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

Pal is bearish on fiat currencies, especially the U.S. dollar, because he believes that they are continuously depreciating against assets such as real estate, stocks, and crypto. Although some believe that we are currently witnessing an “everything bubble” that is about to burst, Pal remains bullish on both stocks and crypto. Nevertheless, he says that he has invested 100% of his liquid net worth in crypto because he believes that this asset class offers the greatest upside potential.

And within the crypto space, although he initially was much more bullish on Bitcoin than Ethereum, around the end of the first quarter of this year he started to believe that Ethereum is “the better asset allocation for performance” for now and over the next one year at least.

Pal’s comments about Cardano, Solana, and XRP were made during an interview (on August 31) with crypto analyst and influencer Ben Armstrong (better known as “BitBoy Crypto” on social media platforms). Below, we highlight Pal’s comments regarding these three cryptoassets.

On Cardano

“We’ve had Charles Hoskinson a few times on Real Vision. I like the project. I think it’s very interesting. We really need to see more network adoption. Yeah, so it’s early stage for me still. So yeah, the price is going up. It’s doing well. There’s a big community behind it; so that gives you one side of the network.

“We need to see more use cases outside of the Ethopia case that’s being talked about a lot. So, you know, I own some, and I’m just waiting to see really is it going to start getting a lot of attraction, people building stuff on it… Maybe it’s not the biggest outperformer this cycle, but, you know, if it survives this cycle and continues to get adoption, it’ll probably do very well in the next cycle…

“I own it because because there’s a lot of investors in it. And if the ecosystem builds out, it’s going to do incredibly well. And as you say, maybe it rallies into that…“

On Solana

“I think it’s the ETH of this cycle. Well, remember, the each of the last shot, you know, it was the one that became a big because [of] the pedigree of all the people involved in it. The speed of adoption is ridiculous. I mean it’s growing faster than ETH did at that point in the cycle.. The number of applications…

“Someone just sent me a chart of the ecosystem.There’s like 300 people already working with Solana… This is happening at a speed none of us can get our heads around…. Solana looks it’s going to win this cycle.“

On XRP

“XRP is a great risk reward, right? The lawsuit — we’ve seen every lawsuit — every single one — has been a fine, a slap on the wrist because everybody’s actually cleared up after the event anyway… So I think it’s gonna be a slap on the wrist that it could look like a security. There’ll be no admission of guilt on either side. There’ll be a payment of a fine. And then XRP is free to run. What’s interesting about XRP that it’s got quite a lot of use cases.

“Now, I know a bunch of Bitcoin people hate it. It’s not decentralized enough. I don’t care. Are people using it? Yes, a lot more than most people realize. And what’s amazing about this setup is you can’t buy it on any of the exchanges… So you’re setting up for a hell of a nice run if this clears up. Worse case, it doesn’t… Worst case is — let’s say — 50% downside. Bets case is 10X from here. So I’ll take a 50 to 1 risk reward for the next, you know, three to six months.“

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.