On Wednesday (September 22), Bitcoin and altcoins seemingly shook off the cold brought on by the “Evergrande” virus and bounced back strongly, rewarding the faithful who continued HOLDing and/or took advantage of the dip buying opportunities.

According to a report published by CNBC on September 16, toward the end of last week, analysts were telling investors that Chinese real estate developer Evergrande’s $300 billion debt crisis could cause huge problems not just within China, but outside China as well (e.g. for foreign companies holding its bonds) after the firm warned twice that it could default on its debts (i.e. be unable to make the interest payments).

Mark Williams, Chief Asia economist at Capital Economics told CNBC:

“Evergrande’s collapse would be the biggest test that China’s financial system has faced in years.“

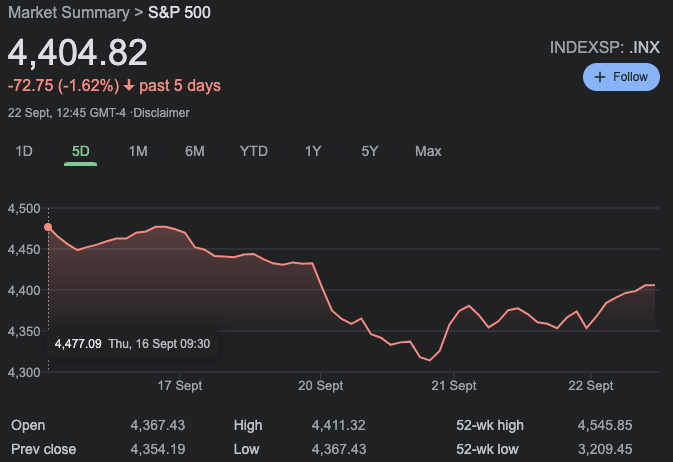

As you can see in the five-day S&P 500 chart from Google Finance, on September 16, the S&P 500 closed at 4,474.05. And yesterday (September 21), it closed at 4,353.61.

The risk-off mood naturally also negatively affected the crypto market with both Bitcoin and altcoins suffering double-digit percentage losses vs USD. As the five-day BTC-USD price chart below shows, on crypto exchange Bitstamp, Bitcoin was trading as high as $48,711 on September 18; however, by September 21, the Bitcoin price had fallen as low as $39,708, which means that it had lost 18.48% of its value.

However, in the early hours of today (September 22), good news started flowing outside China, which managed to stablize the prices of equities and cryptoassets.

Then, a couple of hours later, Bloomberg reported that China’s central bank had injected 120 billion yuan ($18.6 billion) into the banking system, which helped to calm investors’ nerves even further.

Later in the day, there was further good news regarding Evergrande, with Asia Markets reporting that according to cources close to the Chinese government have told it that “a deal that will see China Evergrande restructured into three seperate entities is currently being finalised by the Chinese Communist Party and could be announced within days.”

At the time of writing (17:05 UTC on September 22), Bitcoin is trading around $43,214, up 1.87% in the past 24-hour period.

As for the altcoins, they are rallying even harder than Bitcoin, with Ethereum (ETH), Cardano (ADA), and Solana (SOL) currently seeing gains of +4.57%, 6.52%, and 9.02% in the past 24-hour period.

Finally, it is worth remembering that despite the recent crash in the crypto market, cryptoasset prices are generally a lot higher today than just a year ago. For example, as New Zealand based crypto analyst Lark Davis pointed out, one year ago, Bitcoin was trading around $10,000.

Disclaimer

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.