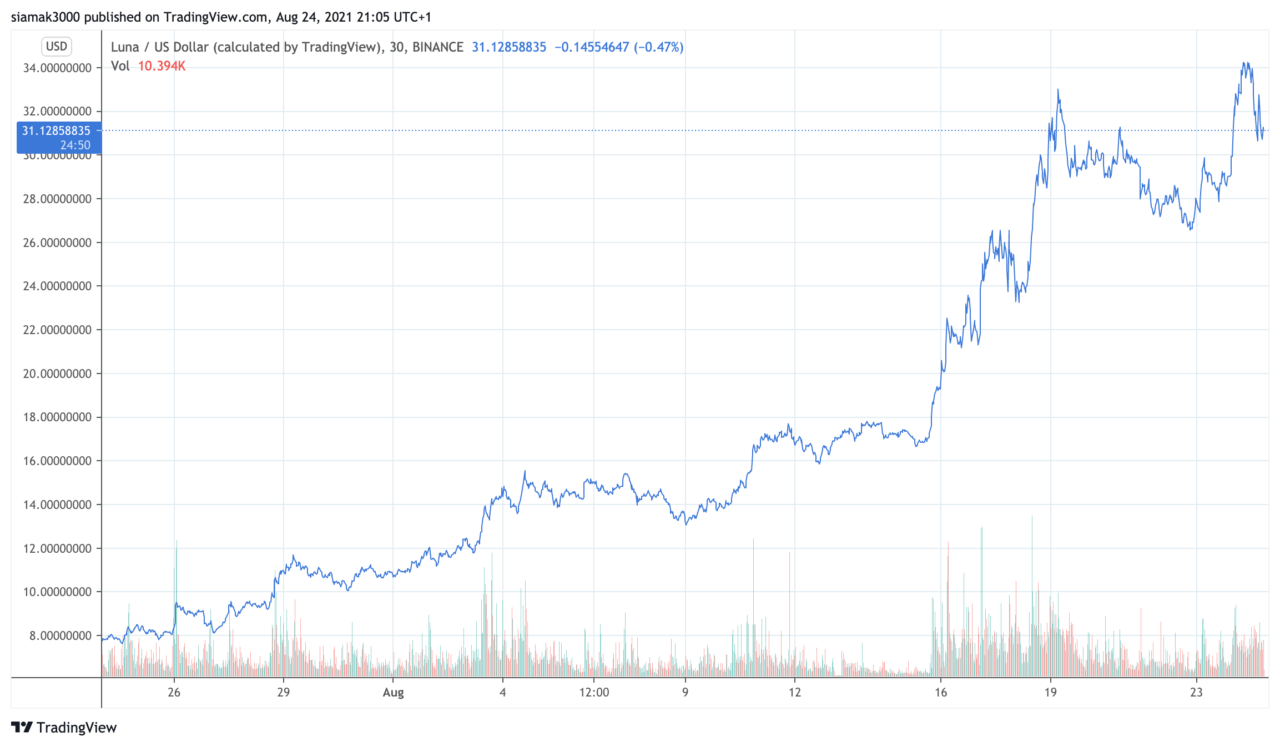

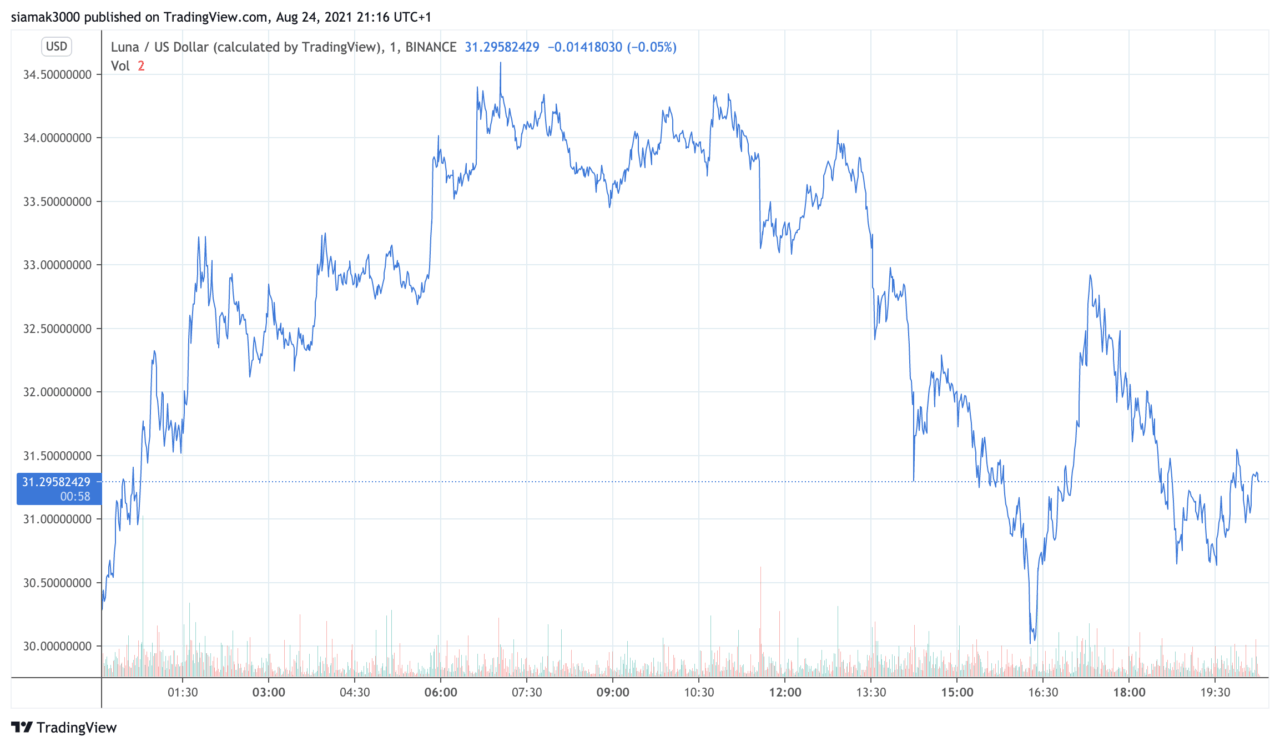

On Tuesday (August 24), as the price of $LUNA, the native token of algorithmic stablecoin platform Terra, surged to a new all-time high of $34.2434, one popular crypto analyst said that $LUNA is “carrying the team right now.”

According to Binance Research, Terra is a Proof of Stake (PoS) blockchain. They also say that $LUNA is “used in the issuance of stablecoins (TerraSDRs), as a price stability mechanism, as well as for staking and network governance.”

Work on Terra, which was developed by South Korean blockchain company Terraform Labs (founded in January 2018 by Daniel Shin and Do Kwon), started in January 2018, and the Terra mainnet launched on 23 April 2019.

In a video released on his very popular YouTube channel on March 1, Coin Bureau had this to say about Terra:

“Terra has found a unique way to mint stablecoins that are pegged to various fiat currencies in a decentralized manner. The circulating supply of Terra’s US dollar stablecoin, UST, has doubled over the last month and has consequently become one of the largest stablecoins by market cap.“

He went on to say:

“I think this is one of the most exciting cryptocurrency projects I’ve seen in some time and part of me regrets not covering Terra sooner. The founders are legit – Terraform Labs is constantly innovating, and a lot of progress has been made since the Terra mainnet went live in 2019.“

More recently, in a video released on August 10, Coin Bureau told his YouTube channel’s more than 1.23 million subscribers:

- Although he does not have any $LUNA holdings at the moment, he is “seriously considering” putting money into $LUNA.

- Terra’s TerraUSD (UST) stablecoin is currently “the fastest growing stablecoin” with a market cap that has grown ten-fold so far this year.

- $LUNA is used for collateralising UST, with $1 worth of $LUNA being “always convertible to 1 UST.”

- One of the main reasons for UST’s popularity is the huge popularity of the the following two Terra-powered applications: Mirror and Anchor.

- Demand for UST drives demand for $LUNA and since the latter is burned every time that the former is minted, this has a “deflationary effect”.

As for his year-end price target for $LUNA, he said:

“Now call me crazy but I could easily see LUNA hit $100 by the end of the year if its adoption and innovation continues... The only reason why I am reluctant to invest in LUNA is because all of Terra’s protocols have not been sufficiently battle-tested and it seems to be relatively centralized compared to similar projects. This means that Terra could be vulnerable to regulatory crackdowns…“

As for today’s price action, currently (as of 20:10 UTC on August 24), on crypto exchange Binance, $LUNA is trading at $31.3537, up nearly 10% in the past 24-hour period.

The pseudonymous crypto analyst who suggested earlier today that $LUNA is vastly outperforming the vast majority of cryptoassets is “The Crypto Dog”, who told his over 583K followers on Twitter:

And with Terra’s Columbus-5 upgrade expected to go live on September 9 (i.e. in just over two weeks), it is perhaps not surprising that $LUNA’s rapidly growing army of fans believes that the current bull run is far from over and that could partially explain why $LUNA is currently ranked #1 by “combined social + market activity”.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Image by “rkarkowski” via Pixabay