Important information: This is a sponsored story. Please remember that the value of investments, and any income from them, can fall as well as rise, so you could get back less than you invest. If you are unsure of the suitability of your investment, please seek advice. Tax rules can change and the value of any benefits depends on individual circumstances.

Over the last few weeks, Bitcoin has seen its price increase by about $20,000 in the latest bull round. Do you also see a consolidated bull market coming?

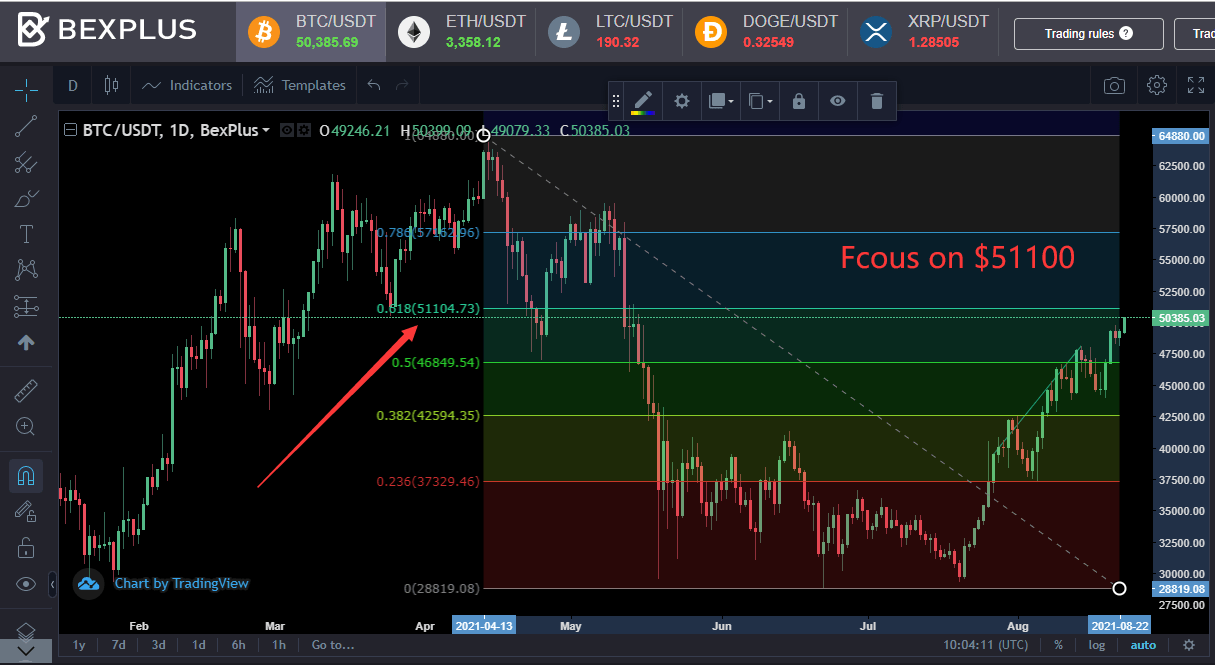

Undeniably, a lot of people share the view. On August 23rd, Bitcoin broke out above a key level at $50,000, reaching its highest price in recent months.

PayPal recently revealed that its U.K. customers will soon be able to buy Bitcoin, Ethereum, Bitcoin Cash, and Litecoin, as it expands a service that was launched in the U.S. late last year.

The company’s long-anticipated move into crypto was believed to be one of the main catalysts behind Bitcoin’s massive growth in the fourth quarter of 2020. As such, its influence cannot be ignored.

However, many bearish factors emerged at the same time.

Against the backdrop of spiking COVID-19 cases around the world and less-than-satisfactory economic data, investors are getting concerned with the Fed possibly removing stimulus and starting to shift their exposure to the U.S. dollar.

In addition, last Thursday, Japanese cryptocurrency exchange Liquid reported that a cyberattack has resulted in a loss of over $80 million worth of digital coins. Just 10 days ago, hackers stole over $600 million of digital coins from Poly Network.

These events have many traders, especially beginners, worried about the safety of exchanges and may cause them to halt trading for a while, which could impact the liquidity of exchanges and cause sell-offs.

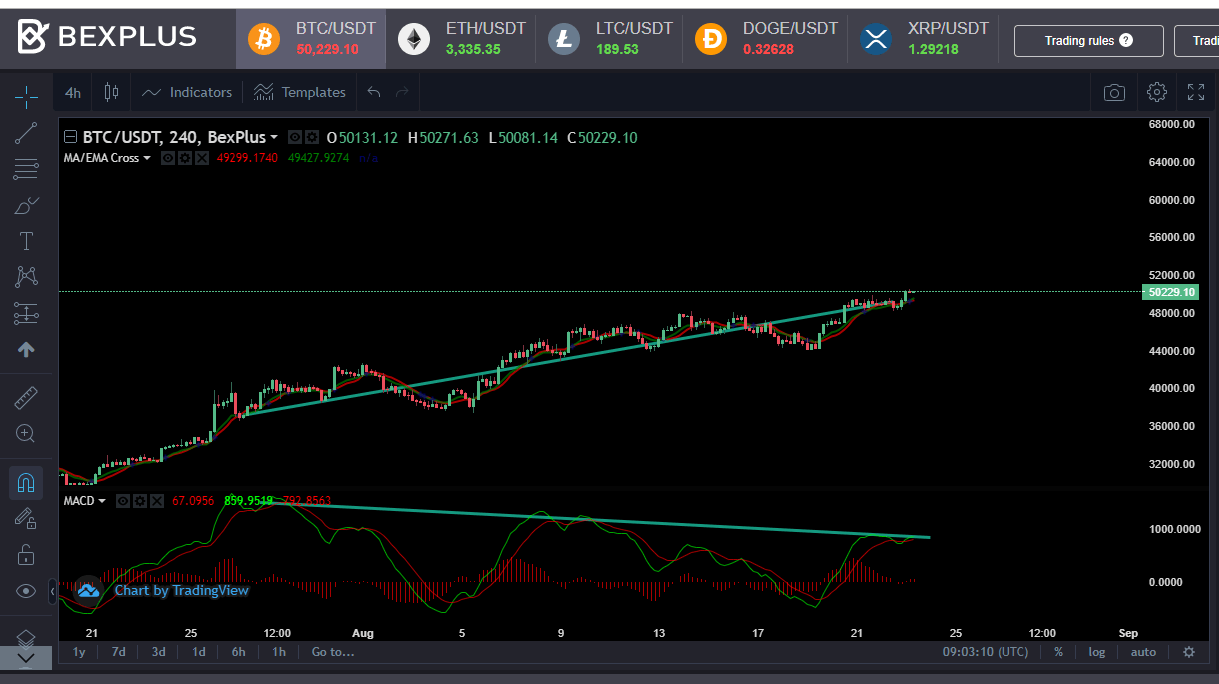

The MACD indicator from late July showed deviation from previous price movements, which is a sign that the bullish momentum is weak, or even becoming bearish.

What’s more, the 0.618 Fib line indicated that $51,100 will be a key position. It is notable that the correction is accurately predicted in this really.

If the key resistance level manages to defeat the ongoing rally, how can traders make a profit in a downtrend? One option is to turn to 100x leverage provided by exchanges like Bexplus.

How 100x leverage works

With 100x leverage applied, traders can use 1 BTC to open a position of 100 BTC by going long (predicting BTC price will be up) or going short (predicting BTC price will be down).

For example, in spot trading, if you buy 1 Bitcoin at the price of $50,000, and when it drops up to $49,900, you’ll gain only $100 in profit. On Bexplus, if you invest in 1 BTC at the same price with 100x leverage, and the Bitcoin price rises to $40,500, you have a chance to get profits of $10,000 ((50,000-49,900)* 100 = $10,000)

Leverage uses borrowed funds to increase your position, which both means profits can soar and that the risk of liquidation increases heavily.

About Bexplus

Bexplus is a crypto futures trading platform offering 100x leverage for trading pairs like BTC, ETH, LTC, Dogecoin, XRP, etc. With headquarters in Hong Kong, it now has branches in Singapore, Japan, the United States, and Brazil. Bexplus doesn’t require KYC and is accredited by MSB (Money Services Business), being trusted by over 800k traders from over 200 countries/regions.

Bexplus’ Features

- Privacy – Registration needs an email confirmation only

- Demo account– 10 BTC is provided on the stimulator account for traders to practice their trading skills.

- Deposit bonus – Get a 100% bonus every time you deposit.

- BTC wallet: up to 21% annualized interest with reduced risk

- Flexibility – Profit from the market’s ups and downs.

- Support – Customer service is available 24/7.

Join bexplus to maximize your gains.

Bexplus offers Ethereum Classic and other price predictions to help users keep up-to-date with the cryptocurrency industry.