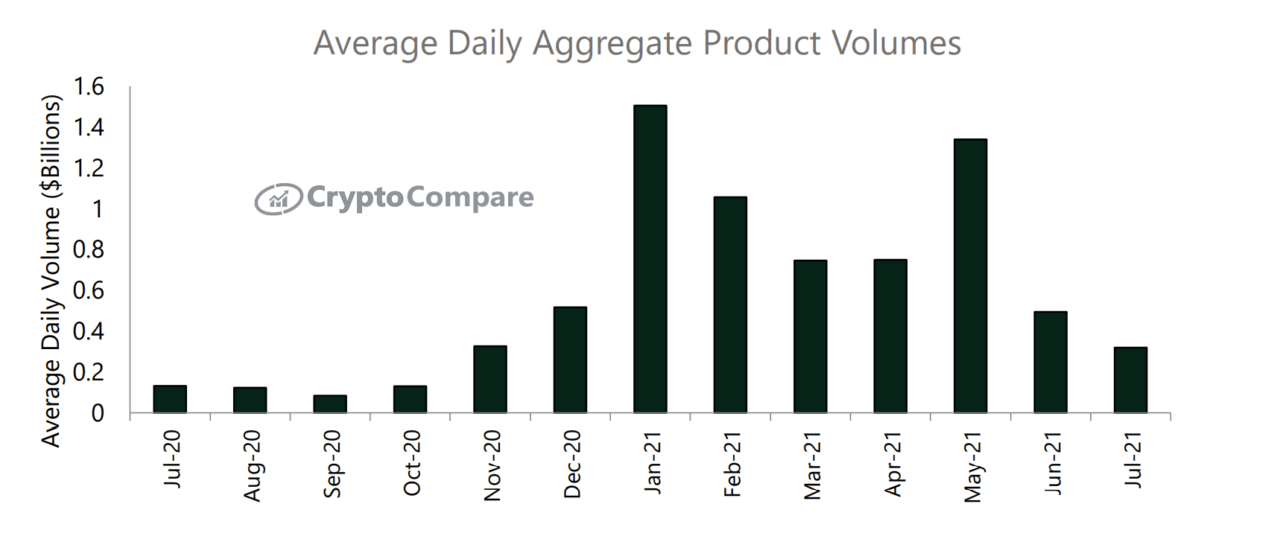

The aggregate trading volumes of cryptocurrency-related products have plunged by 35.4$ from June to July, while the total assets under management (AUM) of these products dropped 14% compared to the month before.

The average daily trading volumes are now at around $319 million, down over 35% from June to July. Average volumes across all exchange-traded notes (ETNs) and exchange-traded funds (ETFs) are down by an average of 50.4%.

That’s according to CryptoCompare’s Digital Asset Management Review report, which notes that despite these declines, average investment flows have been net positive so far this month. Bitcoin and Ethereum accounted for the majority of these inflows.

It’s notable that cryptocurrency products have seen positive inflows this month, as the price of BTC dropped below $30,000 for the first time in weeks, while Ethereum dipped below $2,000. Both cryptocurrencies have since recovered but market sentiment appears to be bearish.

Assets under management for Bitcoin-related products dropped 13.7% to $25.1 billion, but the flagship cryptocurrency’s products gained market share and now represent 72.1% of total assets under management. Ethereum’s AUM dropped 15.6% to $8 billion, while basks fell 14.6% to $1.4 billion.

Grayscale’s trust products saw their AUM drop 14.3% to $28.6 billion, to still represent 82.3% of the market’s total. Grayscale’s Bitcoin Trust (GBTC) still represents the majority of AUM for these products.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Pixabay