It is crucial for DeFi projects to continually bring value to investors and expand the appeal of their solutions. TeraBlock, the machine-learning-driven automated portfolio management tool, has become part of UniFarm’s 12th Cohort. TBC token hodlers can use their token for farming four other compelling DeFi assets and achieving a relatively high APY.

Bringing Value To TeraBlock’s Token Holders

Since its launch, TeraBlock has attracted a lot of attention from DeFi enthusiasts. Not only is it an automated cryptocurrency portfolio management solution, but the platform also has native credit and debit card support to buy crypto assets. Attracting mainstream users remains one of the biggest issues in the crypto world today, yet TeraBlock offers a compelling suite of tools to onboard thousands, if not millions of users.

It is also worth noting TeraBlock has Binance as a technology partner to ensure a smooth user experience. Binance will provide security, technology, and liquidity solutions for all TeraBlock users. Furthermore, the project is accelerated by the Scalex Venture program to facilitate future business growth. Finally, its native features – including trade automation, secured wallets, and insured user funds – all make it a very approachable and convenient DeFi solution.

The native token of TeraBlock – called TBC – removes the fund management fees for automated portfolio management and index automation. It also offers discounted trading fees when covering the cost in TBC. Last but not least, there are tiered perks for staking and holding TBC. While those incentives attribute value to the token, it has now gained a different use case as “collateral” for staking through UniFarm’s 12th Cohort.

Using TBC To Farm Other DeFi Tokens

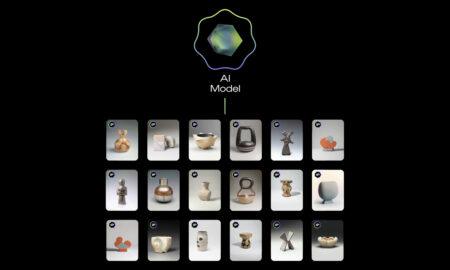

Composability and cross-platform support are an integral part of the decentralized finance ecosystem. For example, users who hold TeraBlock’s TBC token can now leverage it to farm four other prominent DeFi tokens with the help of UniFarm. TeraBlock is one of the five outstanding DeFi projects selected for this staking venture, highlighting the appeal of this service.

Through the UniFarm Cohort 12, users need to stake one of the five supported tokens to farm all supported assets. For example, a TBC holder can stake the asset and earn TBC, UFARM, NTVRK, STACK, and RAZOR. These tokens belong to UniFarm, Netvrk, StackOS, and Razor Network, respectively. Having the option to diversify one’s portfolio by staking a token one already owns brings extra value to the holders of that particular asset.

Participating in this offering is possible for 90 days, yielding an APY between 36% and 250%. The longer one stakes, the better the rewards will become. Users can unstake at any time if they desire to exert that option. It is interesting to see a staking solution that automatically diversifies rewards like this. Moreover, with TeraBlock’s native management and diversification solutions, it becomes even easier to make the most of cryptocurrency trading.

Featured image via Pixabay.