The mysterious Dogecoin whale that holds around 28% of the cryptocurrency’s supply has seen the value of its DOGE fortuned crumble over the last few weeks, from an $8.2 billion high before the cryptocurrency’s price started dropping.

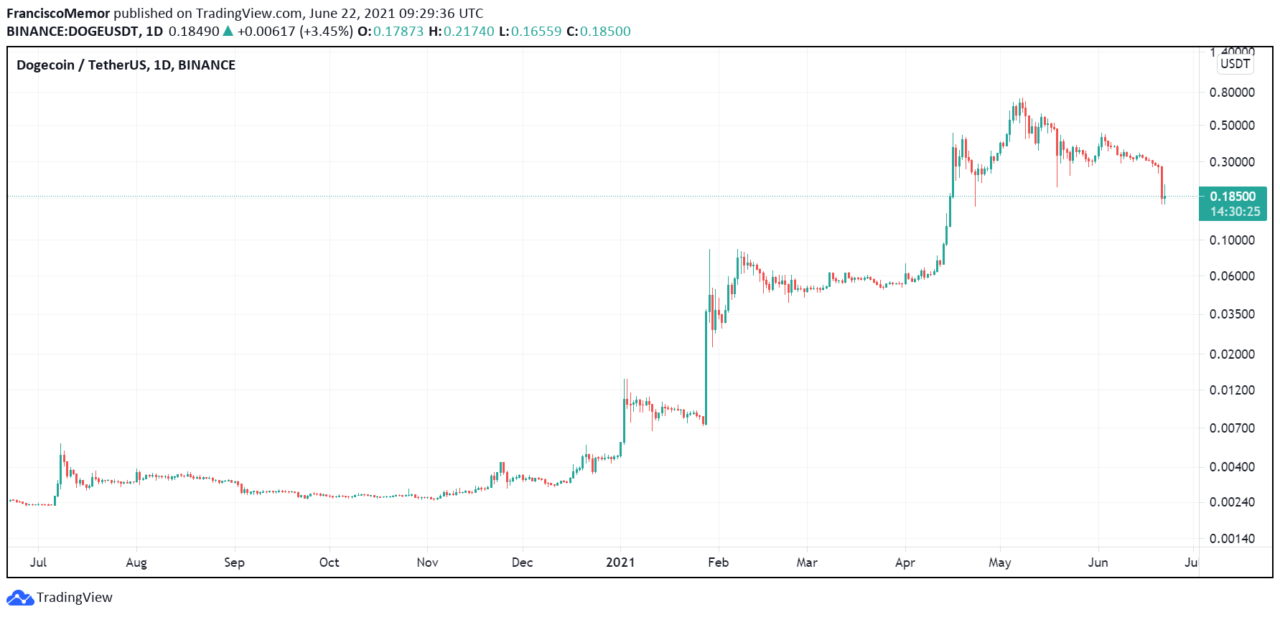

The whale’s address, as Markets Insider reports, owns nearly 37 billion DOGE, which in early May were worth over $24 billion when each token was trading at an all-time high above $0.70. Interest for the cryptocurrency peaked shortly after Tesla CEO Elon Musk – a vocal Dogecoin proponent – hosted “Saturday Night Live” and admitted the cryptocurrency “is a hustle.”

The value of Dogecoin has since then dropped along with the rest of the cryptocurrency space. Each DOGE is now trading at around $0.186 as demand has been steadily dropping, while around 5 billion DOGE are mined every year and enter the market.

The mysterious Dogecoin whale has notably not sold a significant portion of its holdings when DOGE surged to surpass $0.70 per coin, and has in fact been consistently adding more coins in small increments. Most of these increments appear to be in “meme” amounts of 4.40 DOGE or 6.9 DOGE.

The figures are small which could also mean external addresses are trying to send dust to the whale address in a bid to identify who owns it if they move the funds over time. The strategy is known as a dusting attack and could compromise the whale’s pseudonymity by linking addresses it owns.

Some have speculated the whale address belongs to a cryptocurrency exchange such as Robinhood. Despite the high DOGE concentration in a single address, many still see utility in the cryptocurrency as a payment method, with several businesses including the NBA’s Dallas Mavericks and the MLB’s Oakland Athletics accepting dogecoin payments.

Elon Musk has called for improvements to the cryptocurrency as a payment method, something that Cardano creator Charles Hoskin said could help DOGE have real-world use and become “an interesting cryptocurrency.”

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.

IMAGE CREDIT

Featured image via Unsplash