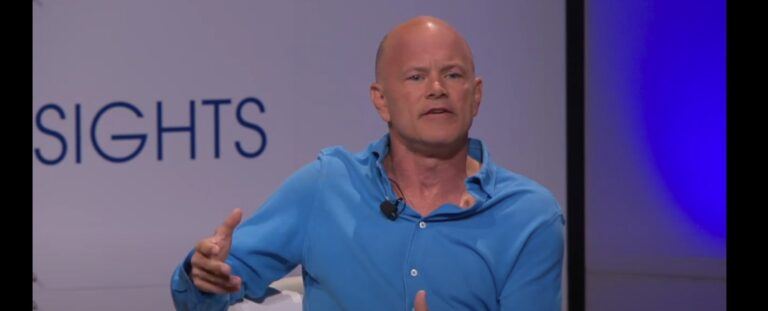

On Tuesday (June 22), the day that the Bitcoin price briefly fell below the psychologically-important $30K level, billionaire investor Mike Novogratz explained why his long-term bullishness on Bitcoin is justified.

Former hedge fund manager Novogratz is the Founder and CEO of Galaxy Digital, “a diversified financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sector.”

Novogratz’s comments about Bitcoin were made during an interview with Joe Kernen on CNBC’s “Squawk Box” at a time when Bitcoin was trading around the $30,000 level

Novogratz had this to say about Bitcoin’s recent price action:

“We had China really be much more forceful in their idea to ban cryptocurrency. That’s created a retail deleveraging, a run on the banks if you would with retail accounts. A lot of crypto happens in Asia, a lot of it is Chinese focused… We’re seeing big liquidations. So, it’s hard to call a bottom.

“$30,000 — we’ll see if it holds on the day. We might plunge below it for a while and close above it. If it’s really breached, $25,000 is the next big level of support. Listen, I’m less happy than I was at $60,000, but I’m not nervous.

“We continue to see talent come into this space. I was with some of the big pension funds in America. They’re getting close to making their first investments in Bitcoin. And so I think we’re gonna see really a shift away from Asia and more to the developed world…“

As for the concern over future regulatory actions against Bitcoin in the Europe or U.S., he said:

“The answer really is no. We vote for our politicians. Our politicians would be very very leery to do something like China.“

And when Kernen asked him if there was a chance of Bitcoin’s price falling much more than 50% from its 2021 high, Novogratz replied:

“The ecosystem is so much more mature. The amount of players that are moving in are so much more mature. Every single bank is working on their own crypto project, how they can get Bitcoin to their wealth clients, and I think a lot of clients that didn’t buy it the first time will see this as an opportunity to buy it and get involved.“

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.