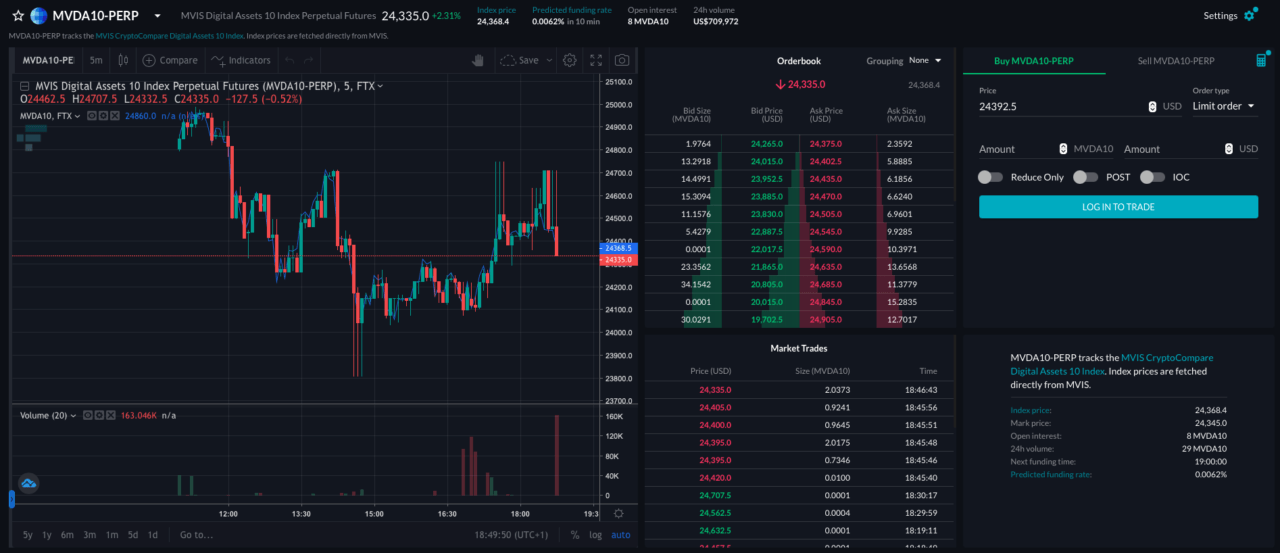

On Thursday (June 3), crypto exchange FTX launched continued demonstrating word-class execution by launching two exciting new perpetual futures products: “MVDA10-PERP” and “MVDA25-PERP“.

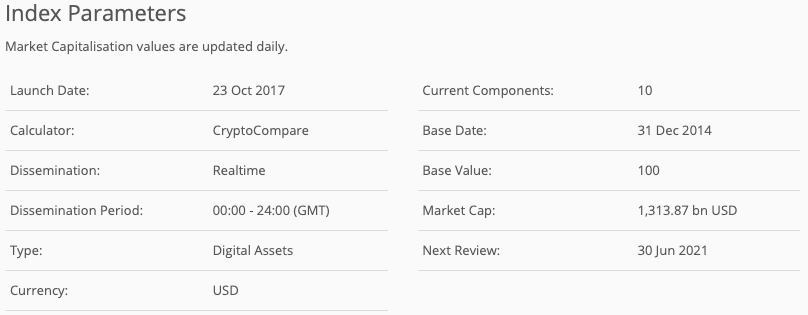

These two products are based on the MVIS CryptoCompare Digital Assets 10 Index (ticker: MVDA10) and MVIS CryptoCompare Digital Assets 25 Index (ticker: MVDA25) respectively, which were licensed from VanEck subsidiary MV Index Solutions GmbH (MVIS®) and CryptoCompare. MVDA10 and MVDA25 are powered by institutional-grade cryptoasset pricing data from CryptoCompare.

The MVIS CryptoCompare Digital Assets 10 Index is a modified market cap-weighted index which tracks the performance of the 10 largest and most liquid digital assets. Most demanding size and liquidity screenings are applied to potential index components to ensure investability.

The MVIS CryptoCompare Digital Assets 25 Index is very similar to the MVIS CryptoCompare Digital Assets 10 Index except that it tracks the performance of the 25 largest and most liquid digital assets.

According to a joint press release by MVIS and CryptoCompare, Sam Bankman-Fried, CEO at FTX, had this to say:

We’re really excited to launch products on FTX with MVIS indices. This is one small step towards bridging the gap between crypto and traditional finance; hopefully there will be many more to come.

And Charles Hayter, Co-Founder and CEO of CryptoCompare, stated:

We are delighted that MVDA10 and MVDA25, powered by CryptoCompare’s premium market data, will support FTX’s newest perpetual futures products. This exciting partnership offers an innovative application for our trusted suite of MVIS CryptoCompare indices, and provides investors with new vehicles to gain exposure to digital assets.

Following the launch, Gabor Gurbacs, Director of Digital Asset Strategy at VanEck/MVIS, tweeted: