On Thursday (May 6), CryptoCompare, a leading cryptoasset market data provider, released the April 2021 edition of CryptoCompare Research’s “Exchange Review” report.

The April 2021 report, which was sponsored by AAX, the world’s first crypto exchange powered by London Stock Exchange Group’s LSEG Technology, provides many interesting insights, a few of which are highlighted in this article.

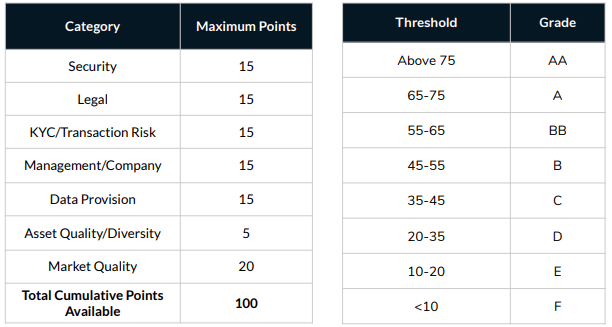

Before we start, it is important to point out that CryptoCompare Research makes a distinction between “Top Tier” and “Lower Tier” exchanges.

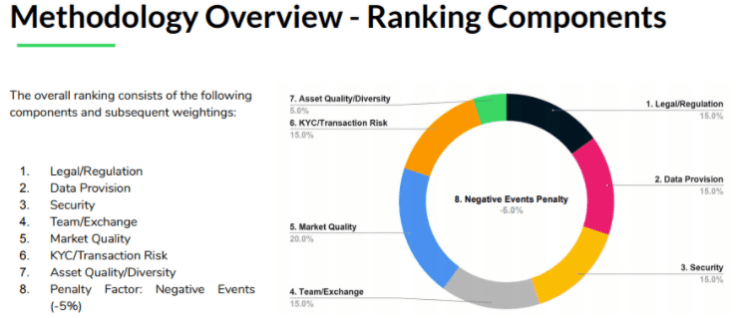

CryptoCompare’s Exchange Benchmark Methodology currently uses a combination of 68 qualitative and quantitative metrics to assign a grade to over 160 active spot exchanges. Each metric is converted into a series of points based on clearly defined criteria. Metrics are categorised into several buckets, and distributed fairly to arrive at a final robust score, ensuring that no one metric overly influences the overall exchange ranking.

A grading system was implemented to assign each exchange a grade (AA, A, BB, B, C, D, E, F) based on its total cumulative score out of 100. Top-Tier exchanges refer to those that have scored at least 45 points (B and above).

Now, going back to the April 2021 issue of the Exchange Review report, below, we take a look at a few of the many interesting findings of the CryptoCompare Research team.

Trading Activity Across Spot Markets

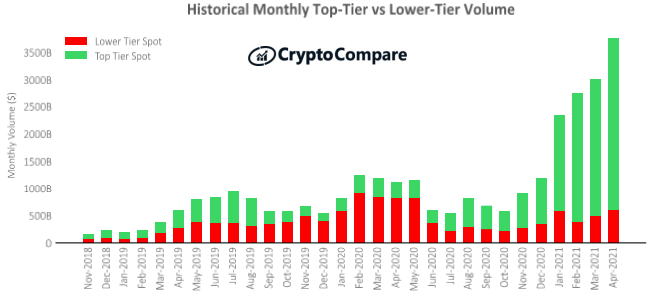

Trading activity across all spot markets throughout April increased steadily compared to March. In April, volume from the 15 largest Top-Tier exchanges increased 40% on average (vs. March).

Also, Top-Tier spot volumes increased 28.6% to $3.22 trillion while Lower-Tier spot volumes increased 26.7% to $618 billion. Top-Tier exchanges now represent 83.9% of total volume.

Binance (Grade A) was the largest Top-Tier spot exchange by volume in April, trading $1 trillion (up 32.3%). This was followed by Huobi Global (Grade A) trading $288 billion (up 36.9%), and OKEx (Grade BB) trading $282 billion (up 63.2%).

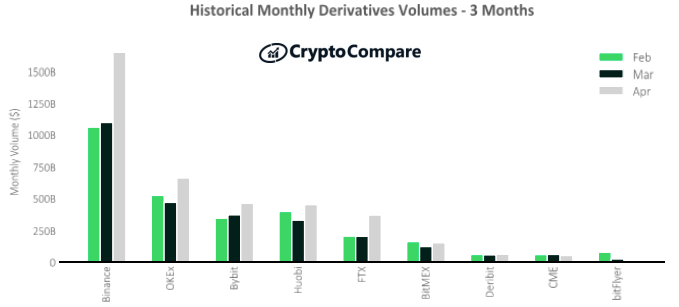

Trading Activity Across Derivatives Exchanges

Binance was the largest derivatives exchange in April by monthly trading volume with $1.65 trillion (up 50% vs. March) followed by OKEx ($663 billion, up 41%), Bybit ($463 billion, up 24%), and Huobi ($453 billion, up 37%).

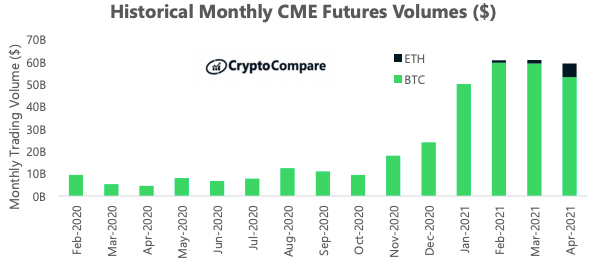

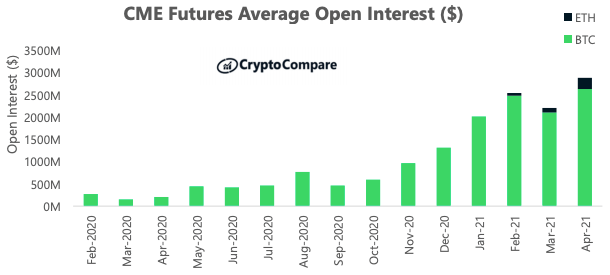

CME BTC and ETH Futures

In terms of total USD trading volume, CME’s ETH futures reached $6.1 billion in April (up 302% vs. March). Meanwhile, CME’s BTC futures volumes decreased by 10.3% to $53.3 billion. On aggregate (ETH + BTC futures), volumes reached $59.4 billion (down 2.6%)

CME’s average open interest figures for BTC futures increased by 25% to $2.6 billion in April. Meanwhile, ETH open interest averaged $250 million (up 146%).

IMAGE CREDIT

Featured Image by “WorldSpectrum” via Pixabay.com