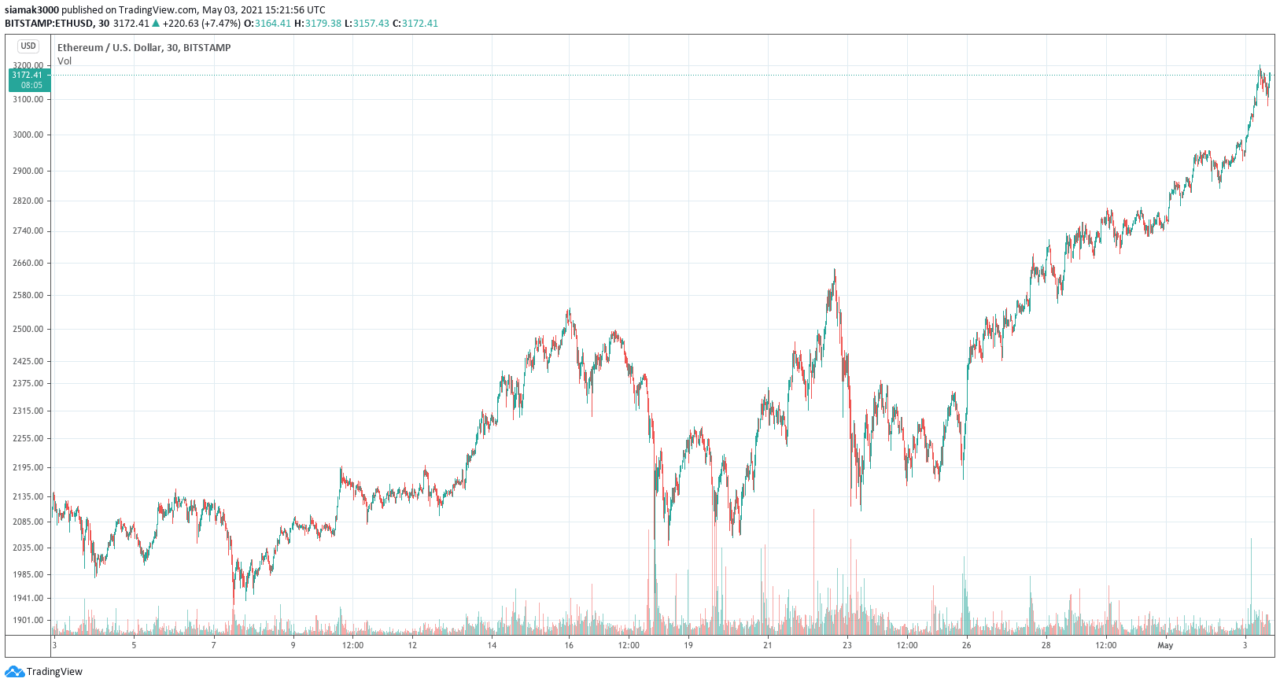

Earlier today (01:38 UTC), on Bitstamp, the Ethereum ($ETH) price broke through the $3,000 level for the first time ever. And just seven hours later, $ETH went above $3,200 and got as high as $3,203, setting a new all-time high.

Currently (as of 15:18 UTC on May 3), $ETH is trading around $3173.01, which means that it is up 8.75 (vs USD) in the past 24-hour period. Even more interestingly, $ETH is up 53.28% in the past one-month period and up 330.23% in the year-to-date period.

Earlier today, shortly after $ETH broke $3,000, popular New Zealand-based crypto analyst Lark Davis (@TheCryptoLark on Twitter) re-iterated his $10K price target for Ethereum:

Jason Yanowitz, Co-Founder of Blockworks, pointed out that Ethereum’s market cap (which is currently around $368 billion) is now higher than every bank in the world except JPMorgan Chase:

Behavior analytics startup Santiment used its Social Dominance Chart to make this interesting observation:

Ki Young Ju, the CEO of South Korean crypto analytics startup CryptoQuant believes that Ethereum’s impressive price action is due to large purchases of $ETH by institutional investors.

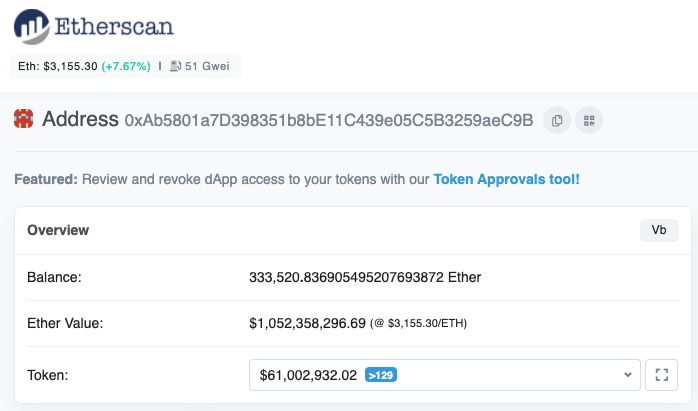

One final comment about Ethereum breaking the psychologically important $3,000 resistance level: it allowed Russian-Canadian programmer Vitaly Dmitriyevich Buterin (better known as “Vitalik Buterin”) who wrote the original Ethereum white paper (titled: “Ethereum White Paper: A next-generation smart contract and decentralized application platform”) and published it on his blog in December 2013, to become the youngest crypto billionaire.

According to data by Etherscan, Vitalik’s main Ether wallet, the address of which he revealed on 10 October 2018, holds around 333,520 ETH, which means that (at $3,155.30 per ETH), his ETH holdings are now worth around $1.05 billion.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.