On Saturday (May 8), with Ethereum ($ETH) trading above the $3,800 level, former Goldman Sachs executive Raoul Pal said that “every single investor I have spoken to is shifting allocation to ETH over BTC.”

Prior to founding macro economic and investment strategy research service Global Macro Investor (GMI) in 2005, Pal co-managed the GLG Global Macro Fund in London for global asset management firm GLG Partners (which is now called “Man GLG”). Before that, Pal worked at Goldman Sachs, where he co-managed the European hedge fund sales business in Equities and Equity Derivatives. Currently, he is the CEO of finance and business video channel Real Vision, which he co-founded in 2014.

On 30 November 2020, Pal revealed that he was about to sell his entire gold holdings and use the money to invest in Bitcoin and Ether.

“I have a sell order in tomorrow to sell all my gold and to scale in to buy BTC and ETH (80/20). I dont own anything else (except some bond calls and some $’s). 98% of my liquid net worth.“

Then, on Janaury 18, Pal provided this update on his crypto portfolio allocation:

“#irresponsiblylong BTC and ETH. My split is now 70/30.“

Yesterday, Pal took to Twitter again, this time to explain why he is much more bullish on Bitcoin at the moment:

He then went on to say:

- “When you price anything up in DeFi, NFT, community tokens or even metaverse worlds, everything is basically priced in ETH, including designers time etc. ETH is rapidly becoming the currency of the digital world and BTC is the pristine collateral and base layer.“

- “The ETH space is growing at 100% YoY (vs 50% YOY for BTC) and it is attracting a massive proportion of the developer talent and applications too.“

- “At this point in the risk cycle and with ETH 2.0 coming (cheaper fees and less supply), I’m struggling to not sell all my BTC to move my entire core position to ETH. To be clear – I’m a massive BTC bull, but I think ETH is the better asset allocation for performance right now.“

Interestingly, Peter L. Brandt, who is one of the world’ most respected classical chartists and commodity traders, agreed with Pal’s assessment. His reply to Pal read: “Raoul, I see it the same way”.

Well, around 14:21 UTC on May 8, Pal sent out the following reply to his over 484K followers when Jonathan Cheesman, Head of over-the-counter (OTC) and institutional sales at FTX, asked who is doing all the buying that has helped the Ethereum price go over $3,800 today:

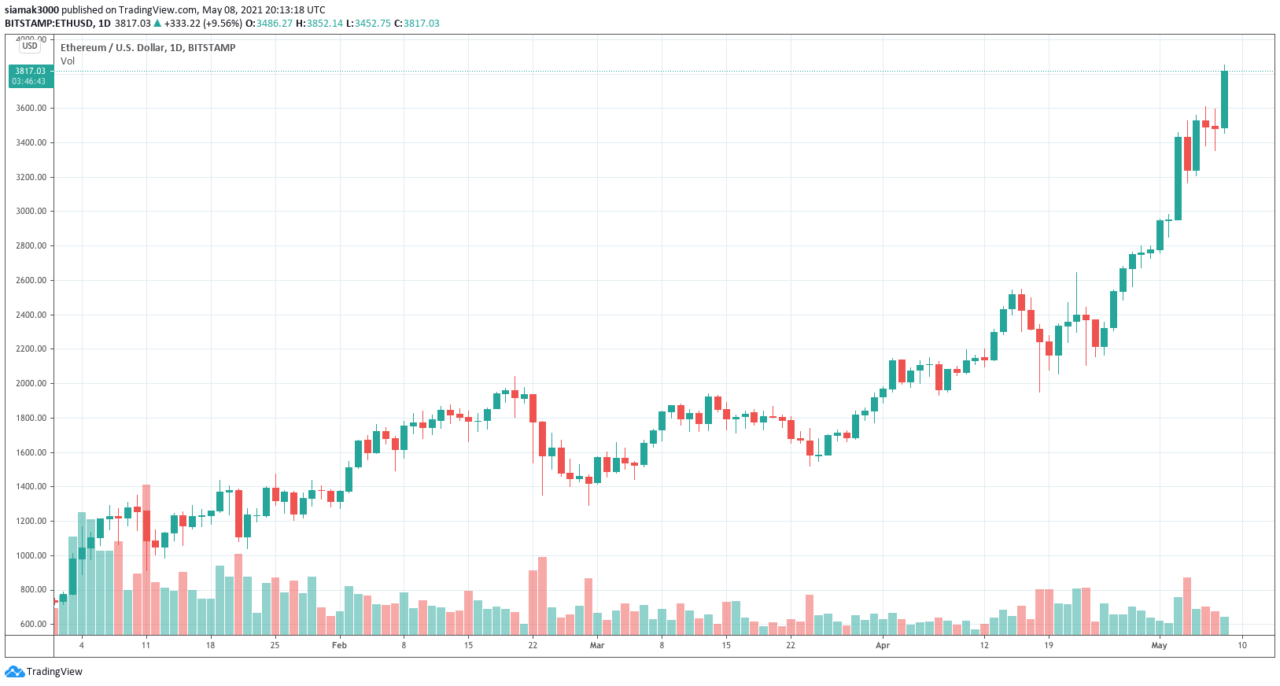

Data by TradingView indicates that at 18:00 UTC on crypto exchange Bitstamp the Etheruem price got as high as $3,852, setting a new all-time high.

Currently (as of 20:10 UTC on May 8), Etheruem is trading around $3,807, which means in the past 24-hour period, ETH-USD is up 8.15%. As for the year-to-date period, ETH-USD is up 416.55%.

DISCLAIMER

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.