After Tesla reported its Q1 2021 Financial Results yesterday (April 26), many in the crypto community were shocked to hear Tesla had sold 10% of its recently acquired Bitcoin. Later, the Tesla CFO and the Tesla CEO made some clarifying remarks.

On February 8, the world discovered from Tesla’s latest annual report (Form 10-K), which had been filed with the U.S. Securities and Exchange Commission (SEC), that the electric car maker had invested $1.5 billion in Bitcoin.

The relevant section of the annual report read:

“We hold and may acquire digital assets that may be subject to volatile market prices, impairment and unique risks of loss.

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future.

“Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.“

Well, yesterday, Tesla reported its Q1 2021 results, and in the Shareholder Deck released by Tesla yesterday, the company had this to say about Bitcoin:

“Year over year, positive impacts from volume growth, regulatory credit revenue growth, gross margin improvement driven by further product cost reductions and sale of Bitcoin ($101M positive impact, net of related impairments, in “Restructuring & Other” line) were mainly offset by a lower ASP, increased SBC, additional supply chain costs, R&D investments and other items. Model S and Model X changeover costs negatively impacted both gross profit as well as R&D expenses.

“Quarter-end cash and cash equivalents decreased to $17.1B in Q1, driven mainly by a net cash outflow of $1.2B in cryptocurrency (Bitcoin) purchases, net debt and finance lease repayments of $1.2B, partially offset by free cash flow of $293M.“

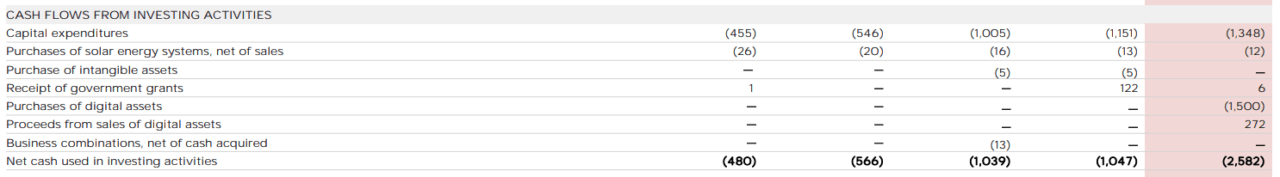

And in the “State of Cash Flows” section of the “Financial Statements”, you can see that Tesla received $272 million as the result of of selling parts of its Bitcoin holdings.

Many people in the crypto community were naturally shocked and disappointed to find out that Tesla had sold 10% of its BTC holdings in Q1 2021 (the period that end on 31 March 2021), i.e. after just a few weeks.

Here is one example:

Dave Portnoy, the founder and president of Barstool Sports, who yesterday claimed that he had once again become a Bitcoiner, criticized Tesla and Musk for conducting a “pump and dump” operation, but Musk corrected him, saying that he has not sold any of his own Bitcoin holdings and explained why Tesla had sold a small part of its Bitcoin holdings:

Interestingly, just a few minutes before Musk’s reply to Portnoy, Meltem Demirors, Chief Strategy Officer at CoinShares, had said:

Tesla CFO Zachary Kirkhorn also talked about Bitcoin during the company’s Q1 2021 earnings call (which took place at 5:30 p.m. ET on April 26). When Martin Viecha, the Head of Investor Relations at Tesla, asked “can you tell us anything about Tesla’s future plans in digital currency space or when any such major developments might be revealed”, Kirkhorn replied:

“So as I noted in our opening remarks and we’ve announced previously, so Tesla did invest $1.5 billion into bitcoin in Q1, and then we subsequently sold a 10% stake in that. We also allow customers to make vehicle deposits and final vehicle purchases using bitcoin.

“And so where our bitcoin story began, maybe just to share a little bit of context here. Elon and I were looking for a place to store cash that wasn’t being immediately used, trying to get some level of return on this, but also preserve liquidity. Particularly as we look forward to the launch of Austin and Berlin and uncertainty that’s happening with semiconductors and port capacity, being able to access our cash very quickly is super important to us right now. And there aren’t many traditional opportunities to do this or at least that we found and in talking to others that we could get good feedback on, particularly with yields being so low and without taking on additional risk or sacrificing liquidity.

“And bitcoin seemed at the time and so far has proven to be a good decision. A good place to place some of our cash that’s not immediately being used for daily operations or maybe not needed till the end of the year and be able to get some return on that. And I think one of the key points that I want to make about our experiences in the digital currency space is that there’s a lot of reasons to be optimistic here. We’re certainly watching it very closely at Tesla, watching how the market develops, listening to what our customers are saying.

“But thinking about it from a corporate treasury perspective, we’ve been quite pleased with how much liquidity there is in the bitcoin market. So our ability to build our first position happened quickly. When we did the sale later in March, we also were able to execute on that very quickly. And so as we think about kind of global liquidity for the business in risk management, being able to get cash in and out of the market is something that I think is exceptionally important for us.“

It is clear that Tesla needed to make its Q1 2021 earnings look better, and selling 10% of its BTC holdings was an easy way of doing that. However, as Nic Carter, a Co-Founder of Coin Metrics, points out, corporate treasurers sometimes need to rebalance their investment portfolios.

Carter went on to say:

- “so if you combine tendency 1 (volatility targeting) with tendency 2 (rebalancing) you get a suppressive effect on volatility as instits become a greater share of the market. less volatility begets larger allocations, which begets less vol, etc… we call that re•flex•iv•ity“

- “tldr, as these sorts of allocators become the marginal buyers (some evidence this is the case already) Bitcoin could well be entering a new more boring regime of lower vol and fewer face ripping rallies, and fewer gut wrenching selloffs. “this time different”? let’s watch.“