Data from TradingView indicates that at 06:14 UTC on Wednesday (April 14), the Bitcoin ($BTC) price hit $64,895 on crypto exchange Bitstamp, thereby setting a new all-time high.

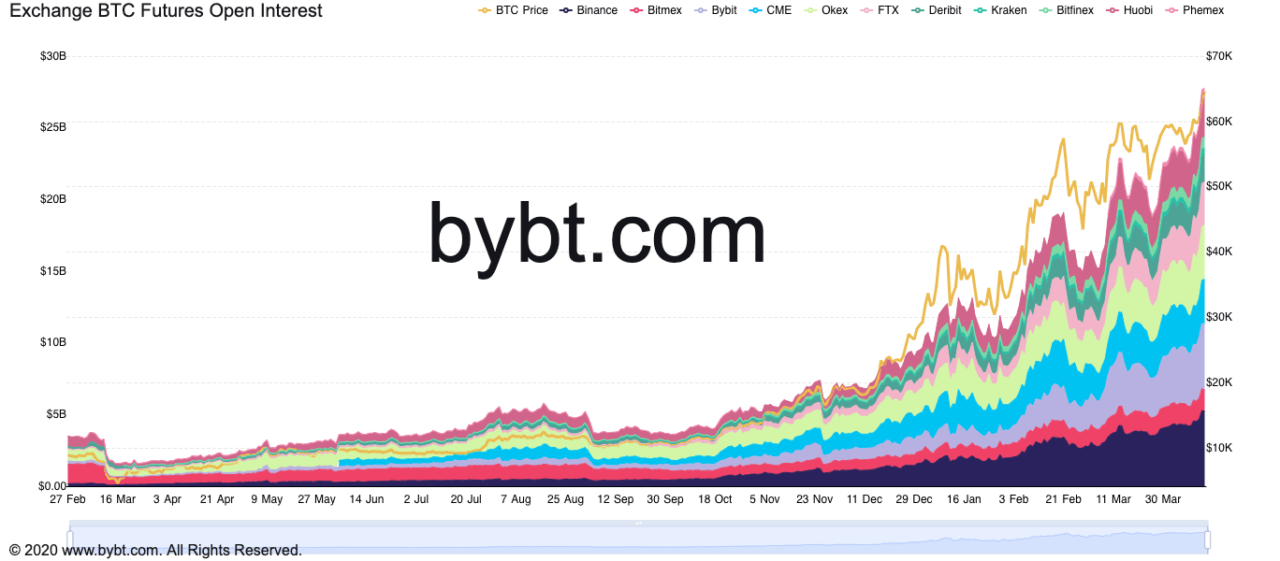

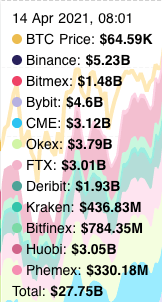

According to Bybt, Bitcoin futures open interest across major exchanges reached a record $27.75 billion at 07:01 UTC.

And here is the breakdown:

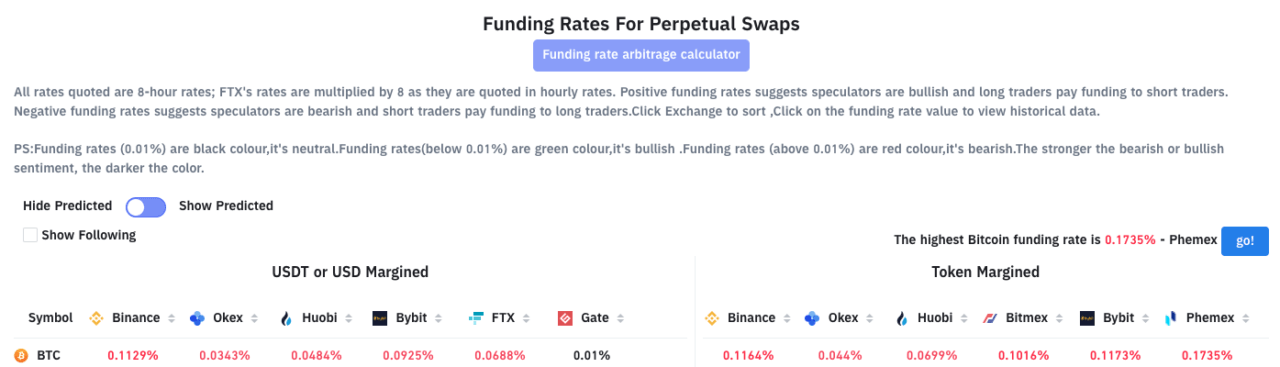

As of 07:10 UTC on April 14, funding rates for BTC perpetual swaps are positive. On Binance, the funding rate is 0.1164% and on OKEx it is 0.-44%.

Here is how Bybt says we should interpret these numbers:

“Positive funding rates suggests speculators are bullish and long traders pay funding to short traders. Negative funding rates suggests speculators are bearish and short traders pay funding to long traders.“

As you probably know, later today (at 09:30 ET or 13:30 UTC), Coinbase’s Class A common stock starts trading on the Nasdaq Global Select Market under the ticker symbol “COIN”. The excitement surrounding Coinbase’s Nasdaq debut has got everyone even more excited about crypto than they were before.

As crypto analyst and trader Michaël van de Poppe found a good way earlier today to describe how the crypto markets have been affected by Coinbase’s direct listing:

Among the top 10 cryptoassets by market cap, Ethereum ($ETH) and Dogecoin ($DOGE) also set new all-time highs today by reaching $2,384 and $0.133 respectively.

Featured Image by “vjkombajn” via Pixabay.com

The views and opinions expressed by the author, or any people mentioned in this article, are for informational purposes only, and they do not constitute financial, investment, or other advice. Investing in or trading cryptoassets comes with a risk of financial loss.