At 18:30 UTC on Wednesday (March 17), Federal Reserve Chair Jerome Powell delivered his remarks about the Fed’s monetary policy at a press conference following the conclusion of a two-day meeting of the Federal Open Market Committee (FOMC).

FOMC press conference itself, it started with Fed Chair Powell delivering some prepared remarks, a few interesting highlights of which are listed below:

- “Today, the FOMC kept interest rates near zero and maintained our sizable asset purchases.“

- “… indicators of economic activity and employment have turned up recently, although the sectors of the economy most adversely affected by the resurgence of the virus and by greater social distancing remain weak.“

- “Overall inflation remains below our 2% longer-run objective. Over the next few months, 12-month measures of inflation will move up as the very low readings from March into April of last year fall out of the calculation.“

- “Beyond these base effects, we could also see upward pressure on prices if spending rebounds quickly as the economy continues to reopen, particularly if supply belt bottlenecks limit how quickly production can respond in the near term. However, these one-time increases in prices are likely to have only transient effects on inflation.“

- “As the committee reiterated in today’s policy statement, with inflation running persistently below 2%, we will aim to achieve inflation moderately above 2% for some time so that inflation averages 2% over time and longer-term inflation expectations remain well-anchored at 2%.“

- “With regard to interest rates, we continue to expect it will be appropriate to maintain the current 0 to .25% target range for the federal funds rate until labor market conditions have reached levels consistent with the committee’s assessment of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.“

- “In addition, we will continue to increase our holdings of treasury securities by at least $80 billion per month, and of agency mortgage-backed securities by at least $40 billion per month until substantial further progress has been made toward our maximum employment and price stability goals.“

Powell then started to take questions from reporters. Below, we look at some of the most interesting comments made by Powell whilst answering these questions:

- “... what we’d really like to do, is to get inflation moderately above 2%. I don’t want to be too specific about what that means, because I think it’s hard to do that and we haven’t done it yet.“

- “There was a time when inflation went up, it would stay up. And that time is not now. That hasn’t been the case for some decades. We won’t suddenly change to another regime. These things tend to change over time, and they tend to change when the central bank doesn’t understand that having inflation expectations anchored at 2% is the key to it all.“

- “If we saw inflation expectations moving materially above 2%, of course we would conduct policy in a way that would make sure that that didn’t happen.“

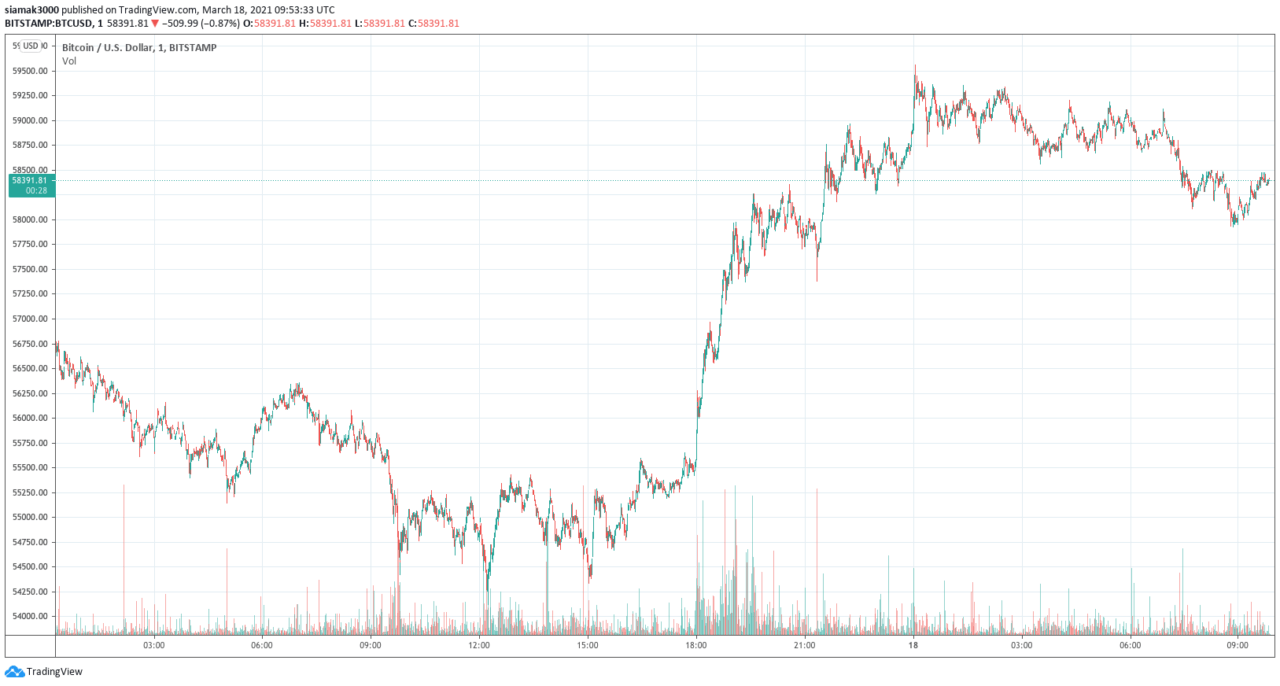

As you can imagine, the Fed’s dovish stance and seemingly lack of concern over short-term rises in inflation help U.S. stocks and Bitcoin go higher as Powell was speaking at the FOMC press conference.

The main U.S. stock indices, i.e. the Dow Jones Industrial Average, the S&P 500, and the Nasdaq Composite, all ended higher on Wednesday (0.58%, 0.29%, and 0.40% respectively).

As for Bitcoin, on crypto exchange Bitstamp, BTC-USD went from $56,701 at the start of the Powell’s press conference (which was at 18:30 UTC on March 17) to $59,559 approximately 5.5 hours later.

Per data by CryptoCompare, currently (as of 10:57 UTC on March 18), Bitcoin is trading around $58,592 up 6.40% in the past 24-hour period; for the year-to-date (YTD) period, Bitcoin’s return on investment (ROI) is +102.23%.

This is what macro-economist and crypto analyst Alex Krüger abut the markets’ reaction to Fed Chair Powell’s comments:

On Monday (March 15), the U.S. Securities and Exchange Commission (SEC) acknowledged on its website that it had received “Notice of Filing of a Proposed Rule Change to List and Trade Shares of the VanEck Bitcoin Trust, under BZX.”

Within the next 45 days, the SEC needs to approve this proposal, reject it, or ask for more time to study it further.

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.