Cardano (ADA) has seen its price grow exponentially over the last few months, managing to break through the psychological $1 barrier to hit a new all-time high close to $1.5. Its massive 690% rally year-to-date has been partly fueled by retail investors drawn by the bull market and upgrades to the network.

Cardano has become a multi-asset network, similar to Ethereum, thanks to its long-awaited “Mary” protocol upgrade that also improved its security. ADA is now often being pared to ether, as it’s the native token of a network that allows for the development of decentralized applications.

The price of ADA surged from $0.187 at the beginning of the year to over $1.25 at press time, after falling from a renewed push to $1.5 that came after Coinbase Pro, Coinbase’s platform for experienced and professional traders, announced it was listing ADA.

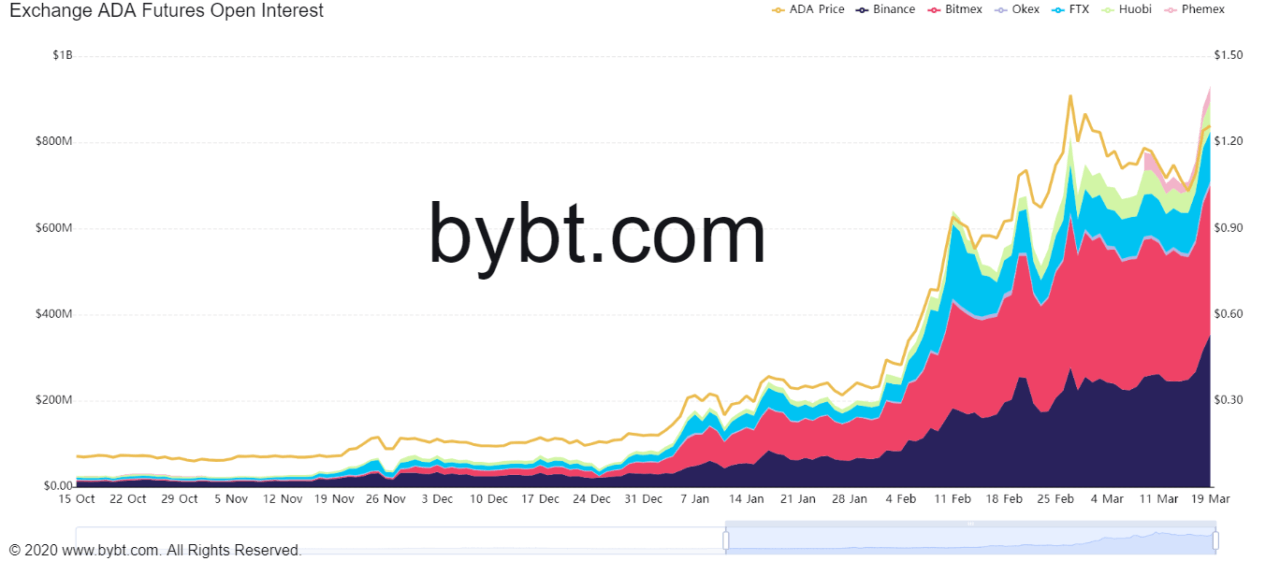

Its price rise, as Cointelegraph reports, was accompanied by growth across several metrics, including its spot trading volume and on-chain transactions. Open interest, according to Bybt, broke the $1 billion barriers, becoming the only other cryptocurrency to do this after BTC and ETH.

Major cryptocurrency exchanges where ADA futures are traded include Binance, BitMEX, and FTX.

Interest in the cryptocurrency surged after whales started buying it. As CryptoGlobe reported, Dubai-based cryptocurrency investment fund FD7 Ventures has announced it’s selling $750 million worth of bitcoin to increase its positions in Cardano and Polkadot.

Last month Gene Simmons, the iconic bass player of the popular rock bank Kiss, has announced he has invested $300,000 into Cardano (ADA), shortly after announcing positions in other cryptocurrencies including BTC, ETH, and DOGE.

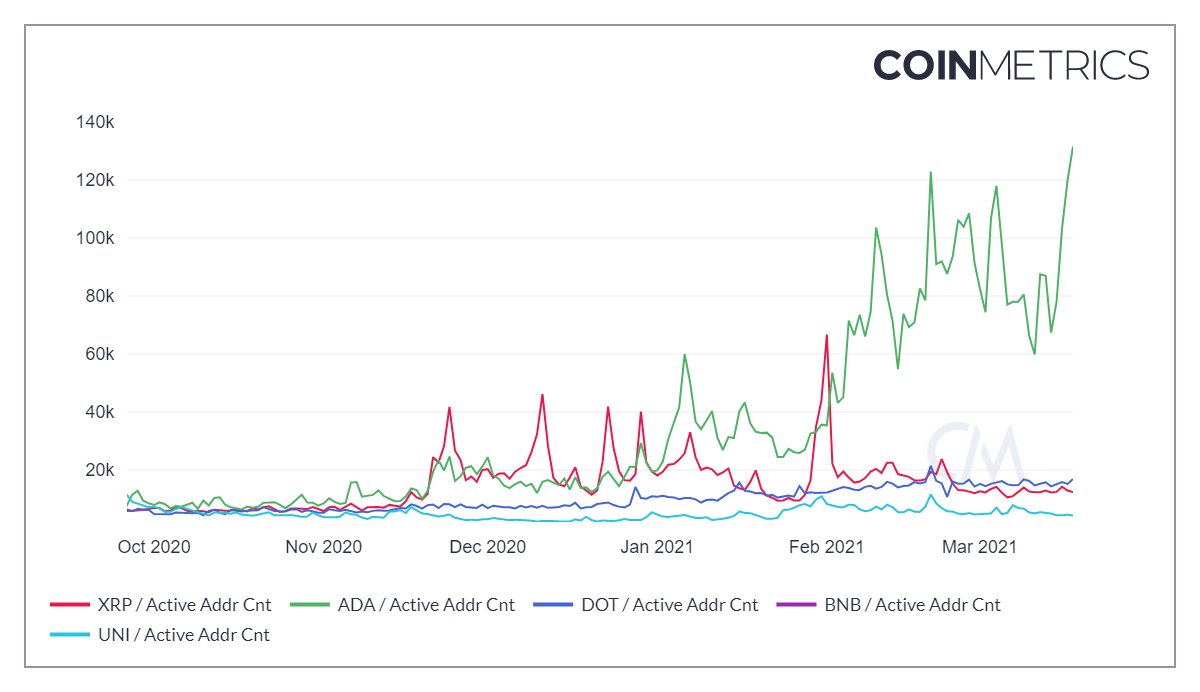

Looking at on-chain data it’s possible to see that there are real uses behind the price surge, and not just retail interest associated with a larger amount of Google searches for the cryptocurrency. CoinMetrics data shows that daily active addresses on the Cardano network have been steadily growing and are now consistently above 100,000.

In comparison, other top altcoins like XRP and DOT have over 15,000 daily active addresses.

Data shows that daily transactions on the Cardano network average $4.5 billion per day, a figure significantly above that of other altcoins. CryptoCompare data shows that ADA’s trading volume on Top-Tier exchanges surpassed $4 billion over the last 24 hours.

Featured image via Pixabay.