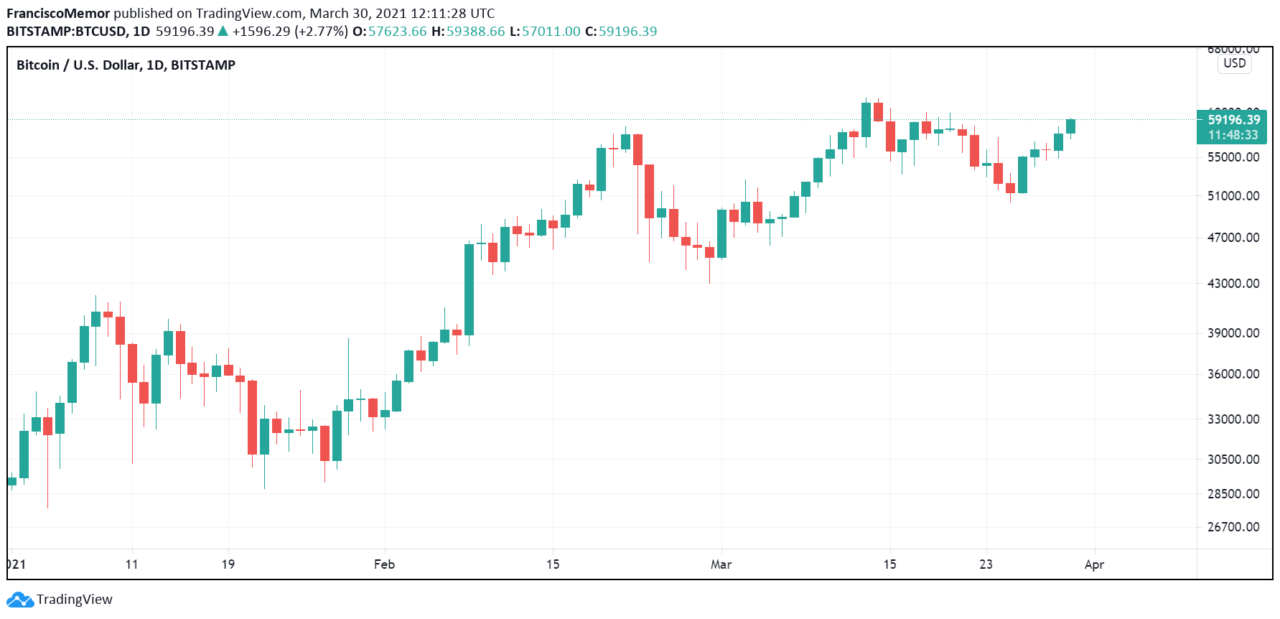

The price of bitcoin has moved from around $29,000 at the beginning of the year to a new all-time high near $62,000 before enduring a correction that saw it drop back under the $60,000 mark. Despite its performance, one ultra-rare metal has outperformed the cryptocurrency.

According to Bloomberg the metal, called Iridium, has seen its price surge over 131% since the beginning of the year, surpassing BTC’s 85% surge year-to-date. Iridium is mined as a byproduct of platinum and palladium and rallied on supply disruptions, demand growth, and low liquidity.

Its market is much smaller than that of other precious metals and betting on it may be hard as demand is dominated by industrial players and it isn’t traded on an exchange. Investors can’t even gain exposure to it through exchange-traded funds, and limited buyers are limited to ingots from a few dealers.

Jay Tatum, a portfolio manager at Valent Asset Management, was quoted saying:

The lead time on the supply side is too long to increase supply in a timely fashion. The only near-term solution is higher prices to get people to sell their existing holdings.

Iridium is, at press time, reportedly trading at $6,000 an ounce, making it three times more expensive than gold. A fall in demand for platinum, which iridium is mined with, also contributed to its sharp price rise. Refiner Heraeus said that the market for it is “not very liquid so its price can shoot up if there are no sellers.”

SFA Oxford, the world’s leading authority on platinum-group metals (PGMS), reportedly said that metals such as iridium will see their average price performance “be on the top” in 2022. Other platinum-group metals, SFA Oxford said, will see similar price performances. These include palladium and rhodium, which have been rallying over the last few months.

Featured image via Pexels.