On Tuesday (March 9), the Bitcoin price is back above the $54,000 level for the first time since February 23.

Data by TradingView tells us that, on crypto exchange Bitstamp, around 3:32 UTC, the Bitcoin price surged above the $54,000 level for the first time in two weeks. Roughly two and a half hours later (at 6:04 UTC to be exact), the Bitcoin price had reached $54,500, which is currently today’s intraday high.

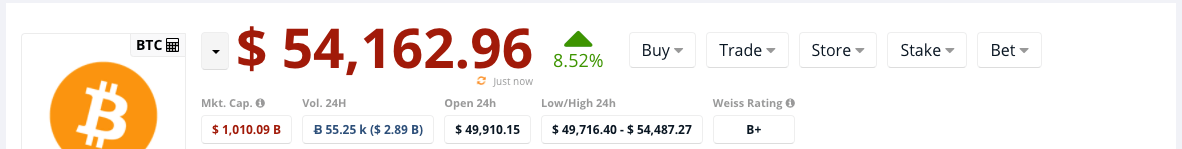

According to data by CryptoCompare, as of the time of writing (09:52 UTC), Bitcoin is trading around $54,162, up 8.52% in the past 24-hour period and up 86.94% since the start of 2021.

From a macroeconomic point of view, there are two explanations for Bitcoin’s strong performance today.

First, as you probably know already, on Saturday (March 6), the U.S. Senate passed a $1.9 trillion COVID-19 relief bill (“American Rescue Plan”).

Moments after this was announced, the Bitcoin price started rallying from around the $47,800 level and by 14:05 UTC on Sunday (March 7), on crypto exchange Bitstamp, the BTC price had reached $51,306.

Well, later today, it is expected that the U.S. House of Representatives, which is also controlled by the Democrats, will also pass this bill on Tuesday (March 9), after which it will be sent to U.S. President Joe Biden, so that he can sign it and make it into law.

This huge amount of fiscal stimulus, which will result in direct payments of up to $1,400 to most Americans within the next several days, basically devalues the U.S. dollar, and should result in higher prices for U.S. stocks and Bitcoin (and by extension, other cryptoassets since they tend to follow Bitcoin both on the way and on the way down).

In fact, according to data by MarketWatch, the U.S. Dollar Index (DXY) is currently (as of 10:01 UTC on March 9) at 91.97, down 0.37%.

Second, in the past 24-hour period, the prices of U.S. government bonds have been going up, thereby lowering yields, which is good news for risk assets such as stocks and crypto. For example, the U.S. 10 Year Treasury Note has come down from 1.602% at 20:50 UTC on March 8 to 1.543%, where it is as of 10:18 UTC on March 9.

As for Bitcoin, adoption is a stronger driver of its price. And yesterday, we had Aker ASA, a large Norwegian conglomerate, announce that it was establishing a subsidiary (Seetee AS) that would “keep all its liquid investable assets in bitcoin.”

In its letter to shareholders, Norwegian billionaire businessman Kjell Inge Røkke, who is the Chairman of Aker saidthat Aker had decided that not investing in Bitcoin would be the riskiest decision:

“Risk is not an obvious concept. What’s commonly considered risky is frequently not. And vice versa. We are used to thinking that cash is risk free. But it’s not. It’s implicitly taxed by inflation at a small rate every year. It adds up. Central bankers have magically agreed that they should target two percent inflation, which implies that one third of your money’s worth is taxed away every twenty years. If it was three percent, almost half of it would be gone in that time.“

He later added:

“Last year, bitcoin made significant progress towards becoming a mainstream investment. When investors with indisputable track records, like Paul Tudor Jones and Stanley Druckenmiller, disclose that they have significant positions, everybody with a curious brain should pay attention. Companies like Tesla, Mass Mutual, Microstrategy, and Square have flagged positions, while Fidelity, Blackrock, Morgan Stanley, and other asset management behemoths are working to launch investment products for cryptocurrencies, which would make it easier for investors.“

On-chain metrics also suggest a bullish outlook for Bitcoin, with both Bitcoin balances on exchanges and BTC miners’ rate of selling going down, as pointed out by crypto analyst Lark Davis earlier today:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.