On Monday (March 15), Billionaire investor Mike Novogratz shared his latest thoughts on Bitcoin.

Former hedge fund manager Novogratz is the Founder and CEO of Galaxy Digital, “a diversified financial services and investment management innovator in the digital asset, cryptocurrency, and blockchain technology sector.”

His comments about Bitcoin during an interview on CNBC’s “Squawk Box” at a time when Bitcoin was trading around $57,000.

When the show’s co-anchor Andrew Ross Sorkin asked him if there is a point that Bitcoin’s price will reach after which it won’t be able to continue going up by huge percentages like it could when the price was under $5,000.

Novogratz replied:

“Listen, the law of large numbers kicks in and it gets harder for it to go higher. Listen, in the long run, we’re in this once in a lifetime secular shift, where we had something that wasn’t an asset class that’s becoming an asset class. So, every insurance company and pension fund and endowment money manager needs to get something on the books, and so that’s why we’re having this kind of one-off secular shift.

“I think after that Bitcoin will literally be like a report card for how citizens think the government is doing managing their finances…

“Bitcoin is a digital store of wealth, and so in some ways if people think Powell and Yellen really have got it together and they’re gonna be able to land this giant supertanker — grow us at full employment and not have high high inflation, people will stop moving into Bitcoin, but right now people are saying ‘hey there’s a chance that this supertanker crashes.’“

According to data by TradingView, on crypto exchange Bitstamp, today, during a span of less than six hours, the Bitcoin price fell from $60,559 (at 04:00 UTC) to $55,035 (at 09:45 UTC), which is a drop of 9.12%.

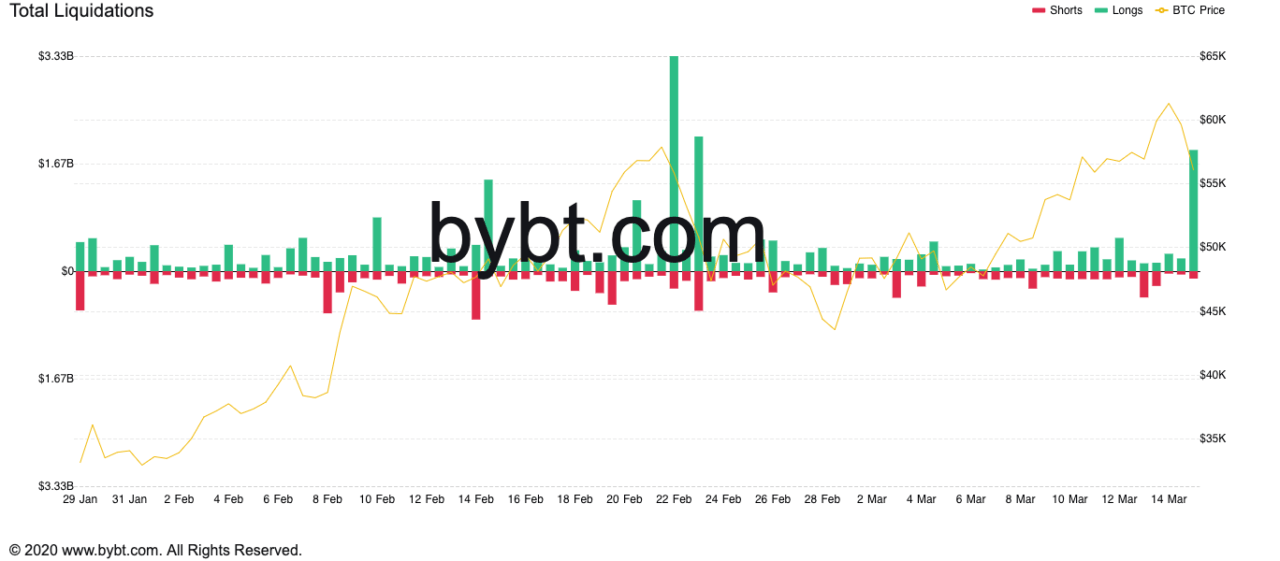

As usual, the reason for such a large sudden drop was because most highly leveraged futures traders were long Bitcoin — meaning that funding rates for perpetual swaps across derivatives exchanges was greater than 0.1 — and then some bad news came out of India, which made some traders sell in a panic, thereby pushing the Bitcoin price lower and causing these long positions to get liquidated.

According to data by Bybt, at 04:00 UTC, $1.88 billion worth of long positions were liquidated.

As Reuters reported earlier today, according to an unnamed senior government official, India will “propose a law banning cryptocurrencies, fining anyone trading in the country or even holding such digital assets.”

Macroeconomist and crypto analyst Alex Krüger had this to say about Bitcoin’s price action:

As for on-chain Bitcoin analyst Willy Woo, he believes that today’s sell-off was due to “bogus data saying $1b of BTC flowing into Gemini.”

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.