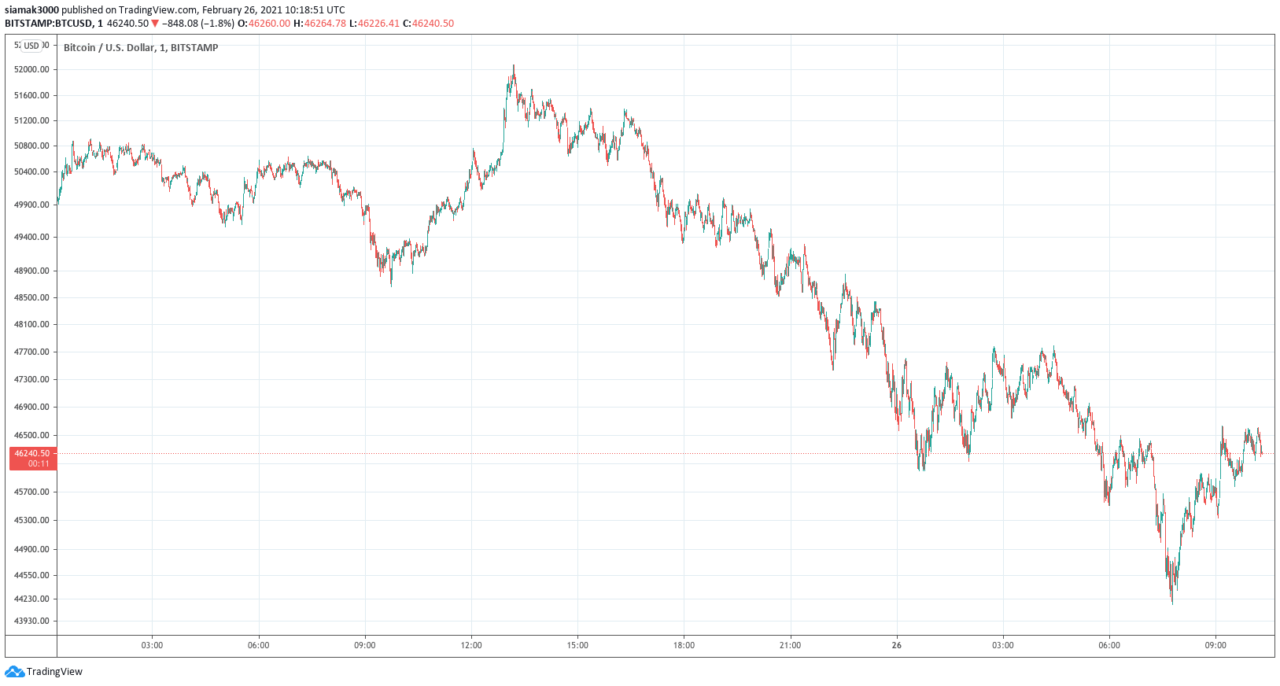

On Friday (February 26), the price of Bitcoin fell to as low as $44,188 (at 07:45 UTC) on crypto exchange Bitstamp after Thursday’s US Treasurys sell-off caused their yields to go up and stock and crypto prices to go down.

Currently (as of 10:26 UTC on February 26), according to CryptoCompare, Bitcoin is trading around $46,740, down 5.8% in the past 24-hour period, but still up 61.32% so far in 2021. The fact that the Bitcoin price is up more than $2,552 (or 5.77%) since its intraday low three hours ago is likely to be due to dip buying, especially after Ki Young Ju, the CEO of South Korean blockchain analytics startup, pointed out that institutional investors seem not have lost ay of their appetite for Bitcoin as evidenced by continuous large BTC outflows from Coinbase Pro wallets.

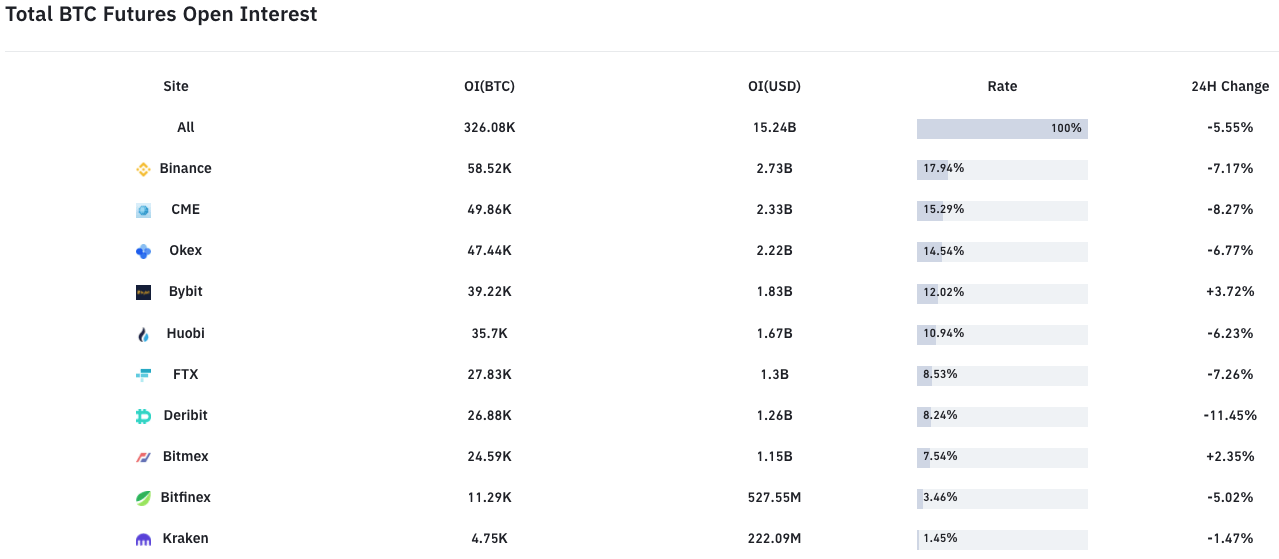

According to Bybt, in the past 24-hour period, Bitcoin’s total futures’ open interest has gone down 5.55%.

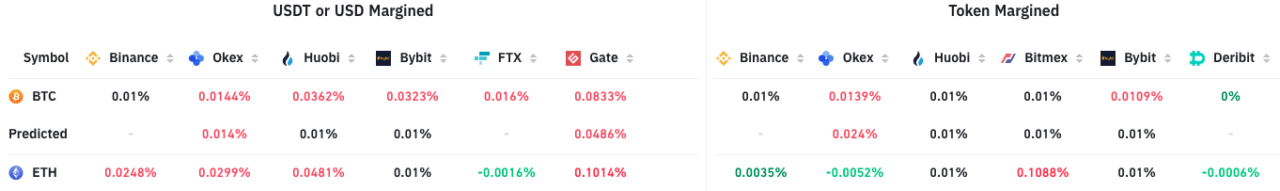

The jitteriness in the crypto market is also reflected in funding rates for perpetual swaps, which have come down to neutral (i.e. 0.01%) levels. Positive funding rates tell us that “speculators are bullish and long traders pay funding to short traders,” while “negative funding rates suggests speculators are bearish and short traders pay funding to long traders.”

The CryptoQuant CEO agrees with Alex Krüger, one of Crypto Twitter’s most popular macroeconomists, who also blames rising yields for US government bonds for the downturn in the crypto market and the fall of Bitcoin to sub-$50K levels. On Wednesday (February 24), he wrote about reflation is hurting stock prices (especially tech/growth stocks) and Bitcoin, which has benefited hugely in the negative yield environment brought on by the economic impact of the COVID-19 pandemic.

He went on to say:

- “With bitcoin there’s the chance it does its own thing as institutional penetration remains very low, and thus inflows may continue regardless. Retail will definitively continue stacking regardless. Corporates may as well, more focused on inflation or digitalization than rates.“

- “If you wonder about today’s weakness in stocks, which moved on to crypto, real rates are the root cause.“

And earlier today, with regard to yesterday’s U.S. Treasurys sell-off, he wrote that he believes that these bonds may have bottomed for now.

As CNBC reported yesterday, as economies around the world start to slowly recover (thanks to COVID-19 vaccination efforts), there is growing concern in the bond market about the possibility of higher inflation:

“The bond market has been sensitive to the fact that a strengthening economy could also lead to some inflation. As yields go higher, the bond market’s inflation expectations have also been rising and one market metric is pricing in average inflation at 2.32% over the next five years. Inflation has barely been able to crack the Fed’s 2% target for years, and while volatile, economists do not expect it to become runaway.

“Still, it is making markets nervous and yields have been rising all around the world, as commodities prices surge. Oil is up about 18% just in the past month, and copper is up 17%.“

Binance Co-Founder and CEO Changpeng Zhao (“CZ”) made this interesting observation earlier today:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.