Traditional financial institutions including JPMorgan and Goldman Sachs have bought shares in the first exchange-traded product (ETP) that offers investors exposure to Polkadot’s DOT cryptocurrency for clients.

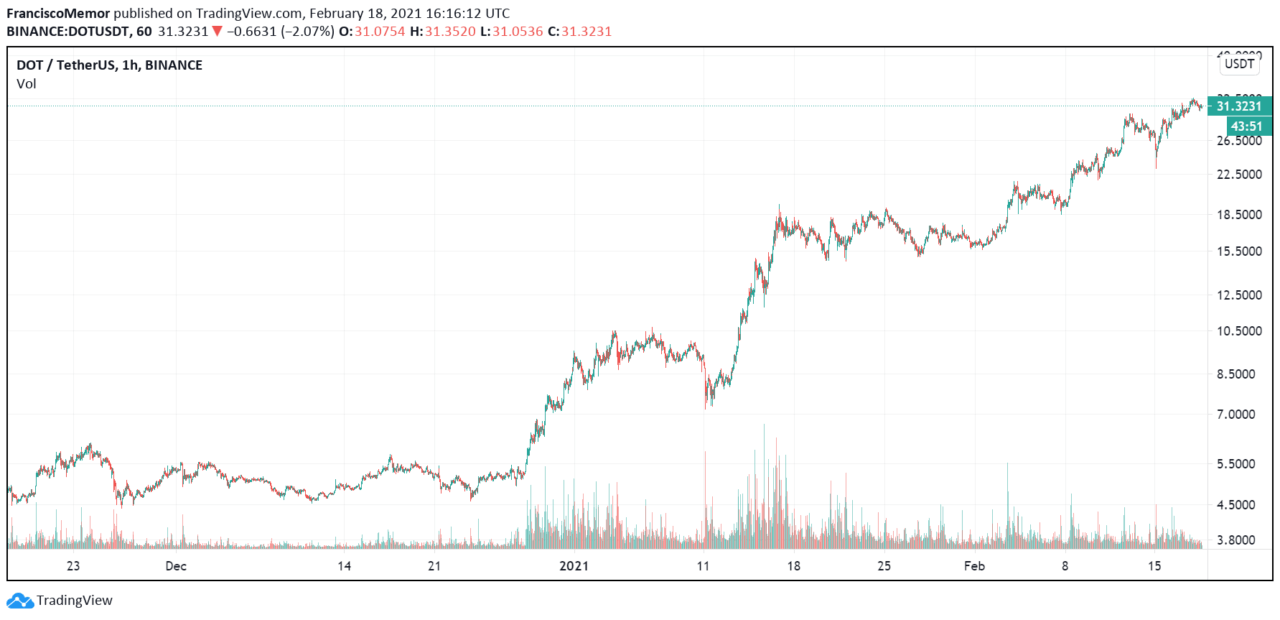

According to CoinDesk, citing data reviewed from a Bloomberg terminal, Goldman Sachs, ICAP, JPMorgan, UBS, Kepler Securities, Instinet, and others have bought shares in the Switzerland-based 21Shares’ ETP. The product debuted earlier this month on the SIX Swiss Exchange at $22-23 and has since climbed past $30.

The news outlet reports the purchases suggest institutional investors’ appetite for cryptocurrency exposure in the current bull market goes beyond bitcoin and ether. Investing in the ETP means the firms’ clients are not investing in DOT itself, but instead in a security tracking its performance.

Polkadot was created by Ethereum co-founder Gavin Wood and is a blockchain that supports various interconnected sub-chains called parachains. DOT is up 86.2% in the last 30 days and is quickly becoming one of the largest cryptocurrencies by market capitalization.

Investing in the ETP means clients do not have to download specific software to run a wallet, nor do they have to understand how to use the cryptocurrency. Goldman Sachs reportedly purchases three lots of shares on behald of a client, while UBS purchased 2,770 shares.

JPMogan is said to have purchased 500 shares, ICAP 1,000shares, and Bank of America’s Merril Lunch purchased 2,200 shares. Kepler Securities purchased 550, and Instinet purchased 9,280. Flow Traders purchased 6,897.

The ETP, CoinDesk reports, has grown to have over $15 million in assets under management. Michael Lie, head of digital asset trading at crypto ETP market maker Flow Traders, said interest in trading cryptoassets has increased “mardekly” as these products “are an easy way to gain exposure to cryptocurrencies, without having to worry about custody.”

Featured image via Pixabay.