As the prices of most cryptocurrencies plunge, former Goldman Sachs executive and Real Vision CEO Raoul Pal revealed he feels relief when prices drop as he switches into “buy the dip mode.” March, he said, is a historically weak month for cryptoassets.

On Twitter, Raoul Pal revealed, however, he is not sure whether this is a larger correction associated with historical March sell-offs, or whether it’s “just another cheeky shakeout.”

The analyst’s words come as the prices of most cryptoassets plunge. CryptoCompare data shows that bitcoin has moved from $54,000 to $46,800 in the last 24-hour period, while Ethereum’s ether dropped from over $1,800 to $1,450 at press time.

Most other cryptoassets are also in the red, with Binance’s BNB, which rallied more than 500% in the last 30 days, being down 20% in the last 24 hours. From an all-time high above $340 seen late last week, it has dropped to $200.

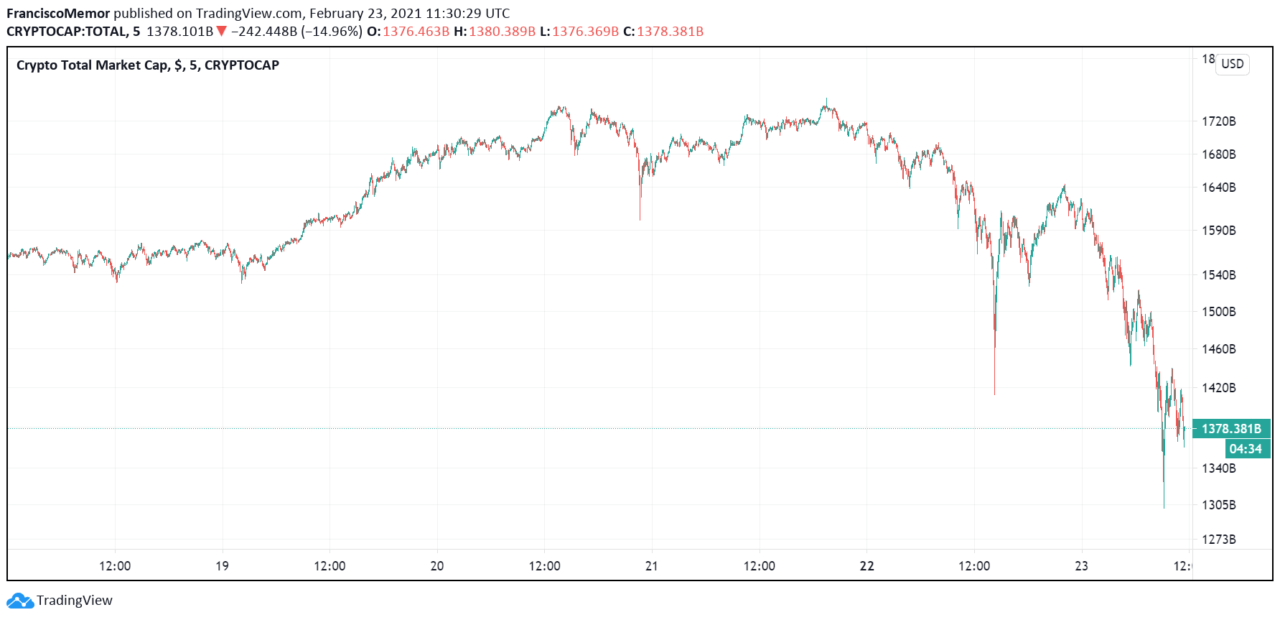

TradingView data shows that the cryptocurrency space has already shed over $300 billion during the massive sell-off, going from a market capitalization above $1.7 trillion to $1.37 trillion at press time.

In other tweets, Raoul Pal revealed he has a bullish stance on cryptocurrencies in general. Before the crypto market sell-off, Pal said there is a “bitcoin revolution but there is a digital asset revolution going on that is beyond incredible.”

Per his words, the cryptoasset revolution is in “very early days, like BTC in 2013,” but is indeed happening with exciting opportunities across a range of products. The revolution, he added is the “next and biggest part of the internet revolution and it only just started.” The analyst also cautioned there will be boom and bust cycles in it.

Pal has in the past argued that the price of ETH could go to $20,000 this cycle based on Metcalfe’s Law. He said that “ETH = BTC” whether investors like it or not. He started pointing towards a model his team created to demonstrate Metcalfe’s Law on the BTC network using active addresses and the cryptocurrency’s price, as well as market capitalization.

His research implied that just like BTC, the price of ETH would surge to a new all-time high near $20,000 before enduring a renewed bear market.

Featured image via Pixabay.