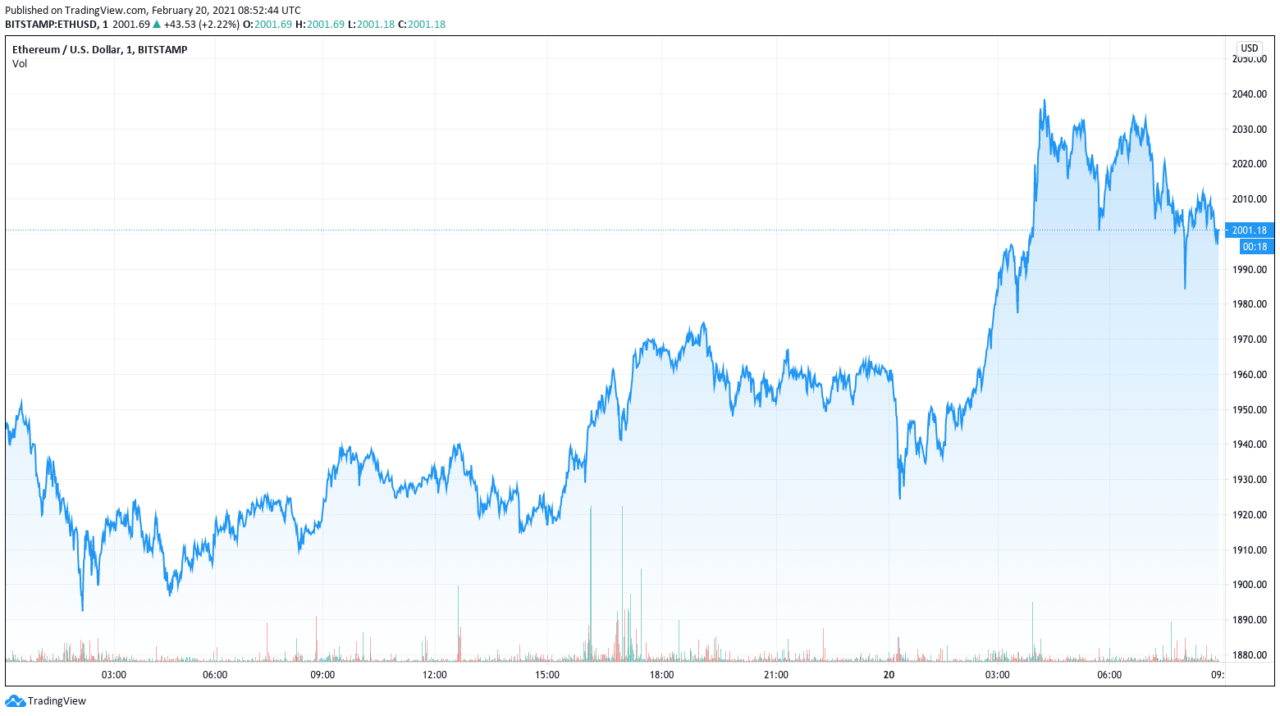

On Saturday (February 20), the price of Ether (ETH), the fuel of the ecosystem of Ethereum, the smart contract and decentralized application platform proposed by Russian-Canadian programmer Vitalik Buterin in 2013, went above $2,000 for the first time.

Data from TradingView indicates that on crypto exchange Bitstamp the ETH price went above $2,000 a 03:54 UTC and at 04:13 UTC, it reached the intraday high of $2,038.52, which is the new all-time high.

Of course, over the past three years, many layer 1 (L1) blockchain projects have been proposed as Ethereum killers, including Cardano, EOS, Cosmos, and Tezos, and more recently, Polkadot, Solana, and Binance Smart Chain.

Earlier today, this is what Binance Co-Founder and CEO Changpeng Zhao (aka “CZ”) said that the success of Binance Smart Chain (BSC) is not bad for Ethereum since this is not a zero-sum game:

And roughly one hour before this tweet, he said on Twitter:

- “#Binance mining pool is now the 11th largest #ETH mining pool. We still support ETH very much. Lots of love.”

- “As expected, I get a bit of ‘heat’ from #ETH lovers given the increased adoption of #BSC. I have no issues with ETH. We support it. We trade it. We futures it. We mine it. As a #BNB holder, I will of course continue to relentlessly shill #BSC and #BNB.”

Angel investor Qiao Wang, a former Director of Products at Messari, said yesterday that despite the lead that Ethereum currently enjoys, we should expect to live in a multi-chain world.

Wang, who admits that Ethereum is his favortie decentralized app platform, then explained why there will continue to exist several successful L1 blockchains:

- “The most obvious reason why we’ll have multiple chains is communities. Not the tech. Products that have been built on Ethereum *will* be copied elsewhere, and more importantly *localized*. Users from different cultures have different habits and preferences.”

- “Why can’t they be localized on Ethereum, you asked? Because the developers don’t feel they belong to the Ethereum. They don’t feel they are owners of Ethereum. They need a different chain where they can create a sense of belonging and ownership for themselves.”

And this is the reason that he likes investing in both decentralized finance (DeFi) and blockchain interoperability solutions:

He later added:

“Both DeFi projects and interoperability projects can design cash flow into their token value accrual. Ideally you want to hold those with cash flow. I sleep better at night holding these than pure utility tokens.“

With regard to the Ether price, another thing that is noteworthy is that prior to the launch of CME Group’s Ether futures on February 8, there were some naysayers who were claiming that Ether’s price would start to crash since Bitcoin’s fall from almost $20K in December 2017 coincided with the introduction of Bitcoin futures.

However, instead, what happened on February 8 was that Ether set a new all-time high of $1779.25 at 15:00 UTC (according to data by CryptoCompare).

And the ETH price rally has kept on going since then.

Featured Image by “elifxlite” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.