On Tuesday (February 2), Ethereum (ETH) broke through the $1500 resistance level to set a new all-time high (ATH); interestingly, this came just four days after Grayscale Ethereum Trust resumed the private placement of its shares.

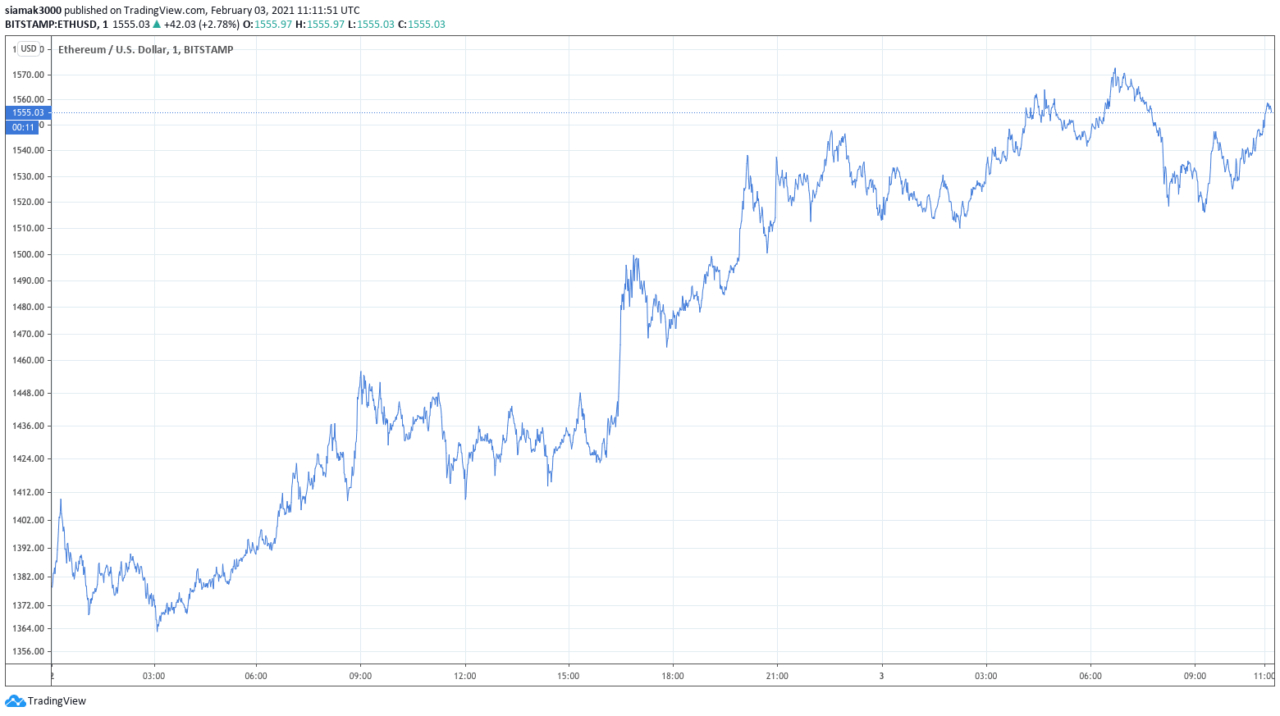

According to data by TradingView, on crypto exchange Bitstamp, at 19:55 UTC on February 2, Ether surged past the psychologically important $1500 level for the first time ever and reached its the intraday high of $1548.00 at 22:33 UTC.

As for today, at 06:42 UTC, ETH reached $1572.75, setting a new ATH. Currently (as of 11:26 UTC), ETH is trading at $1554.50, which makes Ether’s market cap around $178 billion.

To celebrate ETH entering price discovery zone, crypto analytics firm IntoTheBlock tweeted a few interesting facts about the world’s second most valuable cryptoasset:

Popular New Zealand-based crypto analyst Lark Davis (@TheCryptoLark on Twitter) expects Ether’s price rally to continue once the Galaxy Ethereum Fund, which is expected to launch around the middle of this month, becomes available to institutional investors.

Crypto analyst/trader Luke Martin (@VentureCoinist), who is also the host of the “Venture Coinist” podcast and the “Venture Coinist” YouTube channel, expects the Ether price to go much higher:

Mohit Sorout, Founding partner at Bitazu Capital, said earlier today that although many crypto market participants hesitated buying ETH when it was below $1500, last month there were only two dip buying opportunities and they did not last long.

In its “2020 in Review” report, Coinbase Prime had this to say about Ethereum:

“While our institutional clients predominantly bought Bitcoin in 2020, a growing number also took positions in Ethereum, the second largest crypto asset by market capitalization. Ethereum performed well against USD in 2020, outpacing Bitcoin to finish the year up 487% at $745.“

It went on to say:

“Today, most of our institutional clients think of Ethereum as a decentralized computing network that shares Bitcoin’s properties of trustless store and transmission of value, along with more flexible programmability via smart contracts that can be written using languages similar to Python and JavaScript. The case for owning Ethereum we hear most frequently from our clients is a combination of i) its evolving potential as a store of value, and ii) its status as a digital commodity that is required to power transactions on its network.”

One of the main supply sinks for Ether is the Grayscale Ethereum Trust (ETHE). On January 29, Grayscale Investments announced that it had reopened this investment vehicle to U.S. accredited investors.

According to data by Bybt, in the past 24-hour period, Grayscale added 24,796 ETH (worth roughly $48 million at current prices) to the Grayscale Ethereum Trust, which means that they are now holding around 2.96 million ETH.

As for how high the Ether price could go, yesterday, Cameron Winklevoss, Co-Founder and President of crypto exchange Gemini, feels that at current prices, ETH is still undervalued and that there is no real limit on how high the ETH price could go.

Featured Image by “elifxlite” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.