Oleg Gorokhovskyi, Co-founder and Commercial Director at Ukrainian mobile-only bank Monobank said last week that he expects the price of Bitcoin to reach $100,000 either this year or next year.

One day after Tesla disclosed in its latest annual report for the U.S. Securities and Exchange Commission (SEC) that it had invested $1.5 billion in Bitcoin, Gorokhovskyi made a post on Facebook, in which he talked about Bitcoin. The English translation of what he wrote appears below:

“I don’t like making predictions. But Tesla’s disclosure about investing $1.5 billion in Bitcoin has finally convinced me that Bitcoin is not going anywhere. I’ve had a big enough Bitcoin bag for a long time, and I recommend you to buy it too.

“I share the most optimistic predictions about its price and I believe in the price of 100K+ this or next year.“

Since Monobank was launched in Ukraine in November 2017 by Oleg Gorokhovskyi, Dima Dubilet, and Misha Rogalskiy, it has acquired around three million customers.

Two of Monobank’s three co-founders — Dubilet and Rogalskiy — launched credit provider startup Koto in the UK on 2 December 2020. Koto Card Limited is regulated by the Financial Conduct Authority (FCA) as a eMoney agent and Consumer Credit lender.

Koto CEO Rob Escott told UKTN:

“We are unique in offering a neobank quality of mobile experience with credit for near-prime customers. We do onboarding fintech-style. Customers can get a decision in 5-10 minutes and, once that’s done, a card is issued instantly. No plastic, and no waiting for the post.

“Koto is the first card provider in the UK to launch with both Apple Pay and Google Pay. As well as being a credit card, koto offers the functionality you’d expect from a current account like faster payments and direct debit.“

Escott also explained what they mean by a “near-prime” consumer:

“They are either new to credit, new to the country or have an incident in their credit history that means they are left behind by prime lenders. We call this group of consumers near-prime. Our typical customer is employed or self-employed, rents and has an income near to the national average.“

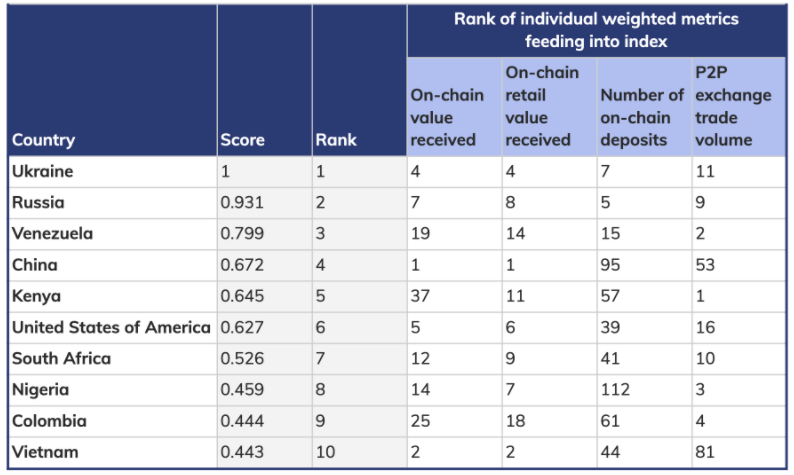

Lats September, blockchain analysis firm Chainalysis published its “2020 Geography of Cryptocurrency Report“. This report introduced “Global Crypto Adoption Index”. The goal is “to quantify the differences in adoption between countries across the globe.” The top three countries were Ukraine, Russia, and Venezuela.

Featured Image by “tombark” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.