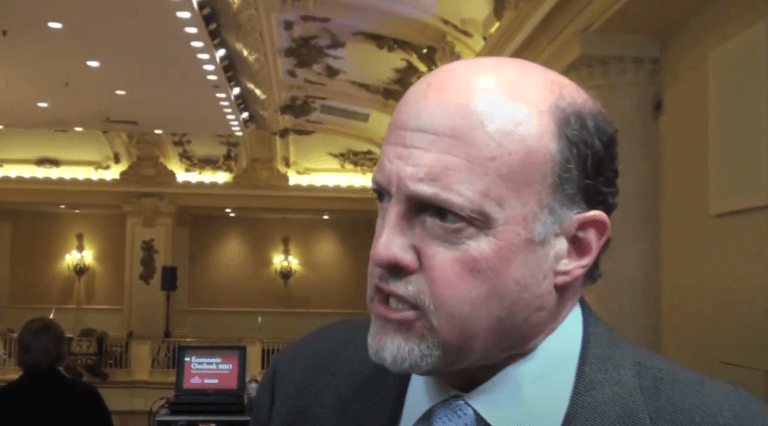

On Tuesday (February 9), former hedge fund manager Jim Cramer shared his latest thoughts on Bitcoin.

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet.

On Monday (February 8), Tesla filed its 2020 annual report (on Form 10-K) with the U.S. Securities and Exchange Commission (SEC); this report disclosed that the electric car maker had already invested $1.5 billion in Bitcoin:

“In January 2021, we updated our investment policy to provide us with more flexibility to further diversify and maximize returns on our cash that is not required to maintain adequate operating liquidity. As part of the policy, which was duly approved by the Audit Committee of our Board of Directors, we may invest a portion of such cash in certain alternative reserve assets including digital assets, gold bullion, gold exchange-traded funds and other assets as specified in the future.

“Thereafter, we invested an aggregate $1.50 billion in bitcoin under this policy and may acquire and hold digital assets from time to time or long-term. Moreover, we expect to begin accepting bitcoin as a form of payment for our products in the near future, subject to applicable laws and initially on a limited basis, which we may or may not liquidate upon receipt.“

The next day, on CNBC’s pre-market news and talk program “Squawk Box“, Andrew Ross Sorkin asked Cramer about the future of Bitcoin.

Cramer replied:

“Look, I have to think that Bitcoin is exciting. It’s something we can talk about endlessly. There are promoters of it. There don’t seem to be a lot of sellers of it. We’re going to hear from PayPal on an analysts meeting coming up about how it’s begun to be mainstream…

“As far as a way to be able to have a pastiche of things that you should do your cash with, I’m all for it. I think it’s almost irresponsible not to include it. Every treasurer should be going to Board of Directors saying ‘should we put a small portion of our cashi n Bitcoin? It seems to be an interesting way to hedge against the rest of the environment. Nice hedge against fiat currency.“

Cramer was then if Bitcoin is really a hedge against the stock market going down. He replied:

“Well, I believe in gold as a way to hedge. I believe in selling calls against certain stocks as a way to hedge… So, I think that it’s just a piece of the puzzle. I don’t think the company should invest big… I think Tesla put a lot of money in it. I don’t have that level of conviction, but I own Bitcoin. I’ve owned Bitcoin for some time as an alternative.

“I used to always say ‘own some gold, own some cash’, and now I say ‘own some cash, own some gold, and own some Bitcoin’. It’s a little inflated… but there are still playing people who think it’s going to $100,000. Novogratz was on everywhere saying it’s gonna to go to $100,000. All I know is I think it’s an alternative to having a cash position make absolutely nothing.“

Cramer is the host of CNBC show “Mad Money w/ Jim Cramer“. He is also a co-anchor of CNBC’s “Squawk on the Street“, as well as a co-founder of financial news website TheStreet.

On 10 September 2020, Anthony Pompliano (aka “Pomp”), who is a co-founder of Morgan Creek Digital as well as the host of “The Pomp Podcast”, told his almost 370K followers on Twitter that he had managed to convince Cramer to buy some Bitcoin (apparently during a recent podcast interview with Cramer).

Then on 11 December 2020, Cramer told Katherine Ross, a correspondent for TheStreet, that he had just bought more Bitcoin, and proceeded to explained why:

“Yeah, I just felt that back at $17[k] seemed like a decent level, and I will buy — like I usually do — as something comes down. I’ll get bigger and bigger and bigger.

“I just think that you want to diversify into all sorts of asset classes. I have gold. I’m going to diversify into some Bitcoin — not a big position for me — but it’s certainly important to be diversified, and Bitcoin is an asset and I want to have a balance of assets.”

Then on January 11, Ross asked Cramer during another interview what he thought about Bitcoin’s recent price action.

Cramer talked about what he thinks about the Bitcoin markets and explained why he had recently (before the large correction that started on Sunday) sold some of his Bitcoin holdings.

“There’s a belief that this somehow has a market that is not erratic. I have tried to do a trade in Bitcoin over a weekend, and it’s really really hard to do… and I think what people have to recognize is this market is not like any other market you’ve ever seen.

“We don’t know who’s buying, we don’t know who’s selling ,we don’t know what’s going on, we don’t know anything about where it’s going. So, what I have said to do is take something off the table. If you’re up big and everybody’s still up big at $32,000 unless you unfortunately came in at $42,000…

“My goal was to get my cash out so I don’t have to think about it. So, [it] went to $42,000, went to $30,000, I don’t care. If it goes back to under $20,000, I’m a buyer again, but I got my cost out, and I’m playing with the house’s money, and this is no different from an entirely erratic stock except for it trades 24/7.“