Cryptocurrencies may be one of the best assets for day trading. Not only because the market is open 24 hours a day, 7 days a week, but also because it is volatile.

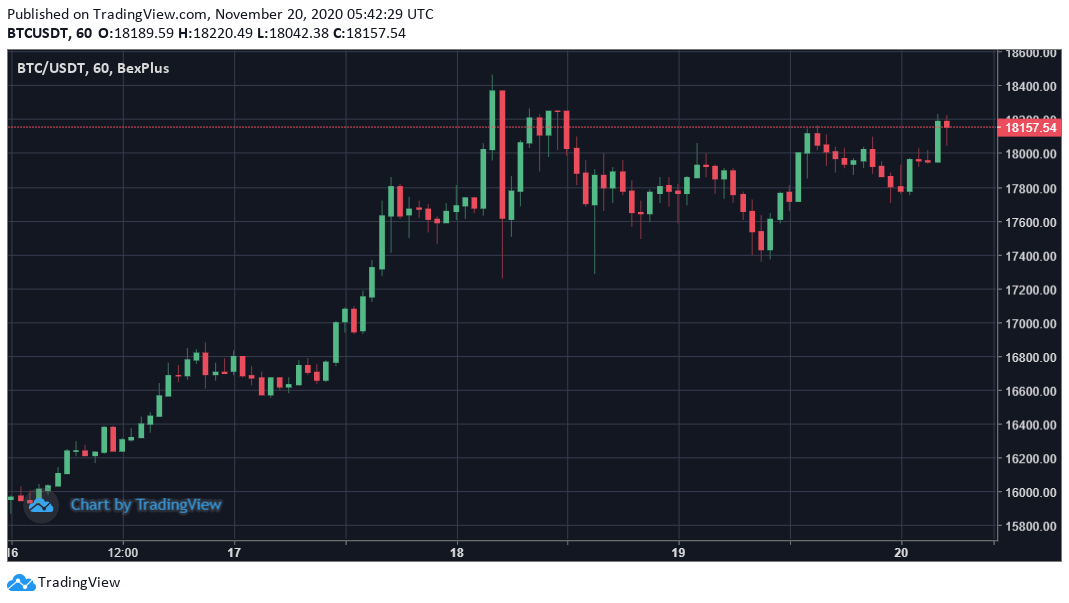

Take Bitcoin as an example. Its volatility has exceeded 10% in the past 2 days, but it has fallen by 50% in a week in March 2020. Although high volatility may lead to a large number of liquidations, it provides traders with juicy opportunities to make money.

Leading crypto futures trading platform Bexplus is presenting some tips for day traders to follow so they could better protect their funds in volatile markets. Keep in mind trading any type of asset could always lead to losses.

Tip 1: Start small

Starting small enables you to go a long way. Traders are advised to initially divide their funds into multiple positions to hedge if the markets move against them, and to allow them to allocate funds to adjust their positions.

Remember, in futures trading, the buying power can significantly be enlarged with the help of leverage. For example, if you open a position using 0.01 BTC and use 100x leverage, the position will worth 1 BTC.

Tip 2: Practice and improve your skills

Earning money by speculating on price movements may feel like gambling, but it’s not. Successful traders are those who learn to analyze the market, keep themselves on top of market news, and keep trying out different strategies.

Choose a platform that offers a built-in trading simulator for you to practice. A good demo account serves as a sandbox for you to improve your skills and get familiar with the fast-changing market. Besides, some platforms even offer consulting services or personal account managers to users.

Tip 3: Follow a plan

One mistake almost all traders makes during their careers is losing their heads.. It is so easy to succumb to emotions that we fail to exit a losing position or take profit while we can. To become an experienced trader, you need a proper plan so that you know when to sell and when to purchase.

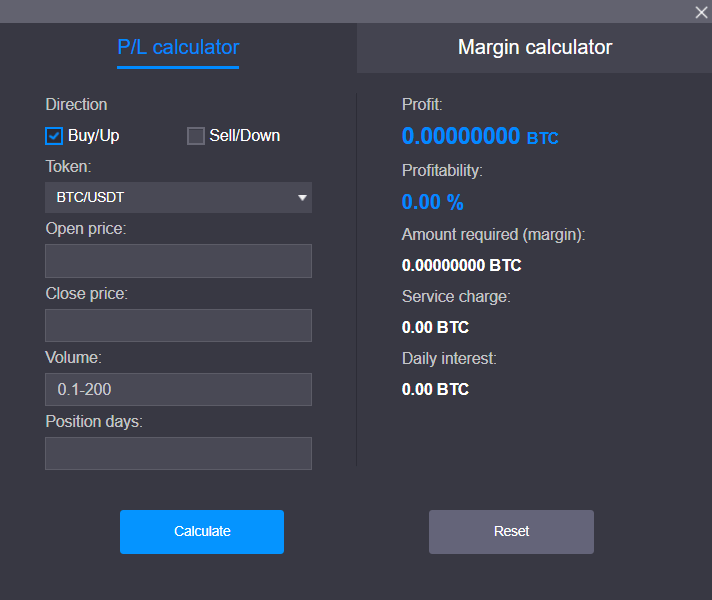

It will allow you to make the decisions that are best for you. Besides, you can choose a platform with a profit and loss calculator so you can know in advance when to close your positions.

Tip 4: Trade on support and resistance levels

Support is a level where the price tends to resist a downward trend. This means that the price is more likely to recover from this level instead of falling below it. Resistance levels are those in which sellers seem to take the upper hand, making it hard for the price of the asset to break above it.

If the price is close to support at an uptrend, you could put in a long order.

For instance, let’s say your analysis finds hat the $18,000 level is considered a bitcoin resistance level, while the $17,000 mark is seen as support. Knowing this, you can leverage your position 100x to open a long position for 0.1 BTC at $17,000 and close it as you get close to $18,000. If successful the trade will earn ($18,000 – $17,000) * 10 BTC/$18,000 = 0.55 BTC.

Tip 5. Keep up with the market

When it comes to investing and trading, news can make or break a trader. This is especially true for Bitcoin, which is traded around the clock and is notorious for its high volatility.

There are a variety of news websites focusing on cryptocurrencies. Besides those, social media is a go-to source for news for many analysts, as industry leaders like to share their insights on social media. Some platforms also offer daily market analysis and industry news on their website to traders.

Bexplus is a recommended leverage trading platform that doesn’t require any KYC. Registration can be done through E-mail verification and users can get a demo account with 10 BTC. The Bexplus platform provides its users with a 100% deposit bonus, an affiliate program with up to 50% commission rewards and 24/7 customer support.