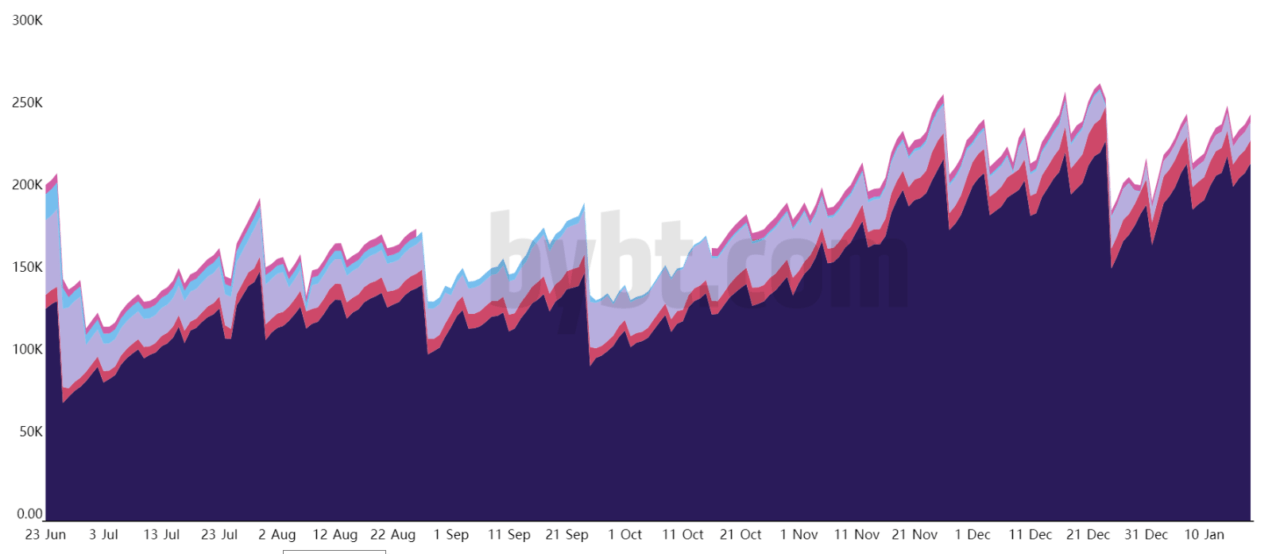

Open interest on Bitcoin options has increased steadily over the last few months to surpass $9 billion, $3.7 billion of which are set to expire on January 29 – a new record – as speculation and institutional adoption keeps growing.

According to data from crypto analytics website Bybt, open options contracts are now worth around 245,700 BTC – over $9 billion at press time – and most are traded on Deribit. Other top bitcoin options exchanges including OKEx, FTX, LedgerX, and the CME.

Bitcoin options contracts, it’s worth noting, give investors the right but not the obligation to buy or sell BTC at a specific pried within a set time period. Investors use options to bet on the future price of the cryptocurrency without having to trade it. Call options allow the holders to buy bitcoin at a stated price within the specific timeframe, while put options allow the holder to sell bitcoin.

Interest in bitcoin options has risen sharply over the last few months, after bitcoin’s price moved from about $11,000 to a new all-time high near $42,000 and subsequently corrected to $36,200 at press time, according to CryptoCompare data.

On January 29, options contracts worth around 101,000 BTC, or $3.7 billion, are set to expire. The figure is a new record and some analysts believe it could influence cryptocurrency markets. As Business Insider reports, open interest in calls – bets on BTC’s price rising – is considerably bigger than the open interest in puts – bets on BTC’s price falling.

Speaking to the publication Craig Erlam, market analyst at currency firm Oanda, said:

It reflects just how volatile [Bitcoin] has become, even by its own standards, over the last couple of months.

Per Erlam, the price movements we are now regularly seeing are “incredible,” and as such options are being more utilized. It’s believed that BTC has become more attractive as central banks are flooding economies with cash amid the coronavirus pandemic, leading to worries about possible inflation and currency debasement.

According to a website tracking bitcoin’s use in corporations’ treasuries, dozens of corporations now have exposure to BTC, and some have seen their investments appreciate significantly since they bought the cryptocurrency.

MicroStrategies’ $1.125 billion bet on the flagship cryptocurrency, for example, saw it buy 70,470 BTC, which are now worth over $2.5 billion. Similarly, Square’s $50 million are now $168 million. Some of the other publicly traded firms with bitcoin exposure include BTC mining firms like Hut 8 Mining, Argo Blockchain, and Riot Blockchain.

Nicholas Pelecanos, head of trading at NEM, said:

Due to the complexity involved with trading, options volumes give us a good indication of the number of sophisticated investors that have been trading Bitcoin.

As reported, crypto analysts believed bitcoin’s next move could make or break its bull run, based on Fibonacci retracement levels. Daniel Moss, a strategist at DailyFX, wrote that the cryptocurrency market has been under fire, and said that if BTC fails to “ gain a firm foothold above last week’s close ($38,200) would probably open the door for sellers to drive prices back towards psychological support at $30,000.

Featured image via Pixabay.