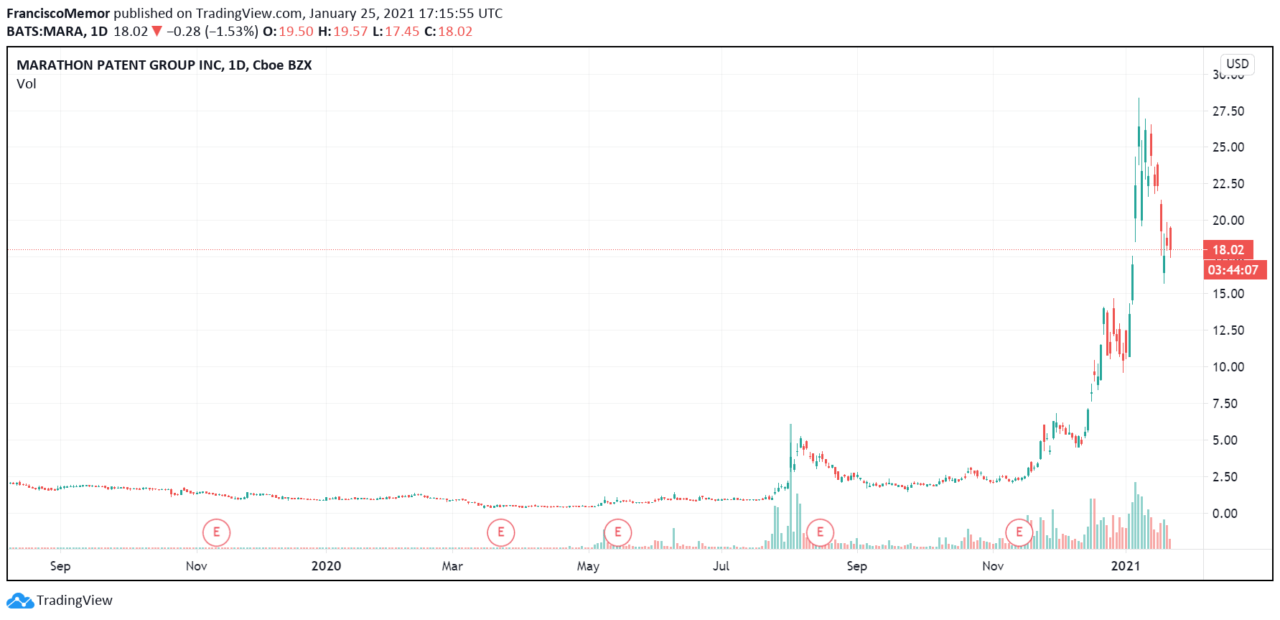

Cryptocurrency mining firm Marathon Patent Group has seen its stock price jump soon after it announced a purchase of over $150 million worth of bitcoin. The firm’s stock has been rising steadily over the last few months.

As first reported by Decrypt, Marathon’s stock has risen 2,800% over the last year, likely due to BTC’s price rise. The flagship cryptocurrency went from little over $4,000 in Mach 2020 to a near $42,00 all-time high earlier this year, before enduring a correcting and moving back to $34,000 at press time.

The firm’s stock price surged earlier after announcing it acquired 4,812.66 bitcoin for $150 million. The company’s CEO Merrick Okamoto said the BTC purchase was a “better long-term strategy than holding US Dollar,” presumably to hedge against potential currency debasement and inflation.

We believe that holding part of our Treasury reserves in Bitcoin will be a better long-term strategy than holding US Dollars.

Marathon is also reportedly set to receive over 103,000 bitcoin mining machines by next year, in a bid to expand its cryptocurrency mining business. Marathon worked with NYDIG to ensure its BTC purchase was conducted effectively.

Okamoto added in a press release that the purchases “accelerated the process of building Marathon into what we believe to be the de facto investment choice for individuals and institutions who are seeking exposure to this new asset class.”

The CEO cited “forward-thinking companies like MicroStrategy” as an example for buying Bitcoin to hold as part of the company’s treasury reserves. MicroStrategy, it’s worth noting, has invested $1.135 billion to buy 70,784 bitcoin, which are now worth $2.4 billion. Its latest purchase took advantage of BTC’s recent price dip below $30,000.

MicroStrategy’s stock price, just like that of Marathon, also surged thanks to its bitcoin investment. Some believe investors buy companies who invest in the cryptocurrency to gain exposure to it indirectly.

Featured image via Pixabay.