Being a successful trader isn’t easy, especially in the cryptocurrency space. According to Tradeciety, 80% of all day traders quit within their first two years, and active traders underperform market indices by 6.5% annually on average.

Meanwhile, the average individual investor only underperforms a market index by 1.5% a year, which would mean that most traders would be better off buying ETFs tracking market indices. There are, however, some who stand out.

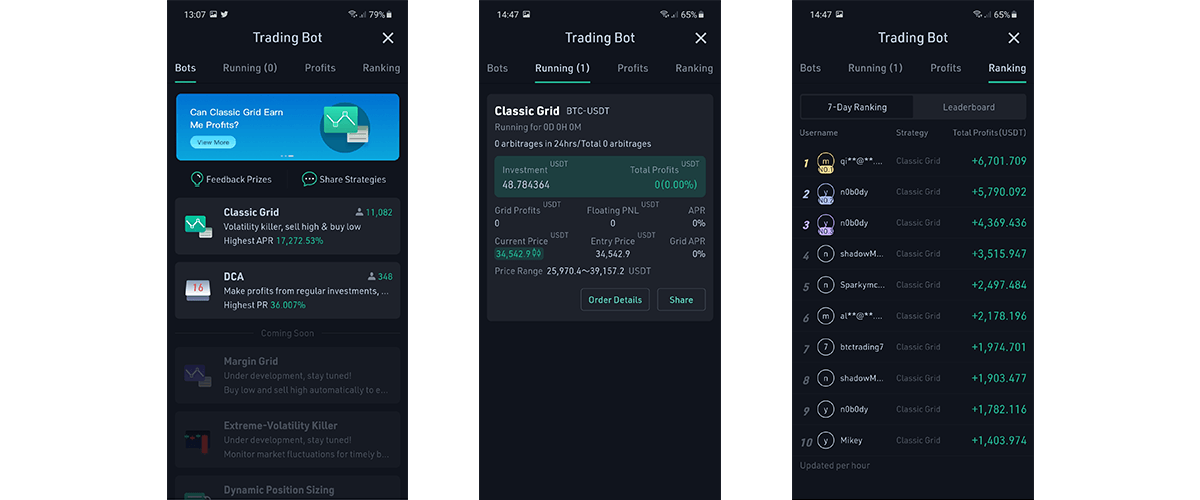

As we can see on crypto trading leaderboards, some traders manage to have returns above 100% per year or more, all while trading in a market as volatile as this one. To do so, one needs to not only thoroughly understand how the market works, but also keep up with new events new projects, and other developments.

Popular crypto exchange KuCoin has made it easier for those who want to get into trading to earn passive income through their new trading bot. KuCoin’s trading bot is currently available on its mobile application and currently has two settings: the “Classic Grid” and “DCA.”

How KuCoin’s Trading Bot Works

As mentioned, KuCoin’s trading bot currently supports two settings. DCA stands for dollar-cost averaging and simply sees the bot help you dollar-cost average your investments into a specific cryptocurrency.

Classic Grid is more complex, and essentially taken advantage of the volatility in crypto markets. KuCoin describes it as a type of quantitative trading that uses a grid to set up different price points. The bot waits for these price points to be reached, so it can either buy the cryptoasset low, or sell it high.

The exchange notes:

When the price drops into one of these grids, a buy order will be triggered; when it rises into another grid, a sell order will be triggered.

Setting up the bot, we have two main options to choose from: a minimum and maximum price in which the trading bot will operate, and a number of orders to be placed. The Min and Max price points determine the lowest and highest price the bot will buy the cryptoasset at. Above or below this range, the bot will stop trading.

The number of orders to be placed determines the price ranges the bot will operate on. A larger number of orders will see the bot take advantage of smaller price movements, buying after a small dip and selling after a small surge. A smaller number will see the bot buy after a significant drop, and sell after a surge.

Earning Passive Income with KuCoin’s Trading Bot

The bot’s parameters determine its trading strategy and are set by the user. An ideal strategy will depend on the trading pair you want it to operate on. Because of higher liquidity, we decided to pick BTC/USDT, and allowed the bot to choose the parameters on its own.

To ensure passive income can indeed be earned, the BTC price range should be large enough so that small price movements won’t force the bot to stop trading. Moreover, more orders being placed does not necessarily mean better performance. Instead, it’s ideal to find a balance based on the chosen trading pair, the price range, and the number of orders.

We’d recommend trying out the bot with a small amount first, until you find a winning strategy. Once you find it, you can increase the amount being invested if you are comfortable with the trading bot’s performance.

It’s also possible to copy the performance of those on KuCoin’s leaderboard. Some traders have APR’s of over 3,000% according to the leaderboard, and to copy them we simply need to click on their profiles, examine their parameters, and click to automatically copy the strategy.

KuCoin warns traders that different investment times could mean the performance of the bots will be different.

Managing Crypto Exposure

KuCoin’s trading bot is ideally used on volatile trading pairs, in which the cryptoasset users pick is preferably moving up. It’s also possible to manage your exposure to different crypto trading pairs, by giving the bot specific amounts to use on different trading pairs.

The bot can, as such, be used to not only earn passive income if you find the right strategy, but also to complement your own trading efforts or cryptocurrency investments. If the price of a cryptoasset is surging or plunging, it may be more profitable to just hold a long or short position.

The bot will soon have new features, including Margin Grid, Extreme-Volatility Killer, and Dynamic Position Sizing. The KuCoin app, through which you can use the bot, is available on app stores and can be directly downloaded here.

If you are to use the trading bot, there’s a discussion group on Telegram with users trying to find the best possible strategies.