SkyBridge Capital’s Anthony Scaramucci has revealed he believes GameStop’s Reddit-fueled rally, is positive for bitcoin as it exemplifies financial decentralization, furthering proof of the concept behind Bitcoin.

According to Bloomberg, Scaramucci argued that smartphones and low-cost trading are “democratizing” the formerly highly concentrated business of money management. He added:

The activity in GameStop is more proof of concept that Bitcoin is going to work. How are you going to beat that decentralized crowd? That to me is more affirmation about decentralized finance

Earlier this month, traders from the popular WallStreetBets subreddit piled into GameStop after activist investor and Chewy Inc Ryan Cohen joined its board, and in a bid to fight back against huge levels of short interest that were holding at about 140% of the float. Shorts bets by firms including Melvin Capital and Citron Research are facing a short squeeze.

Melvin Capital, according to CNBC, has taken a “huge loss” in its GameStop position and has now closed it, even after seeing Citadel and others infuse over $3 billion into the firm.

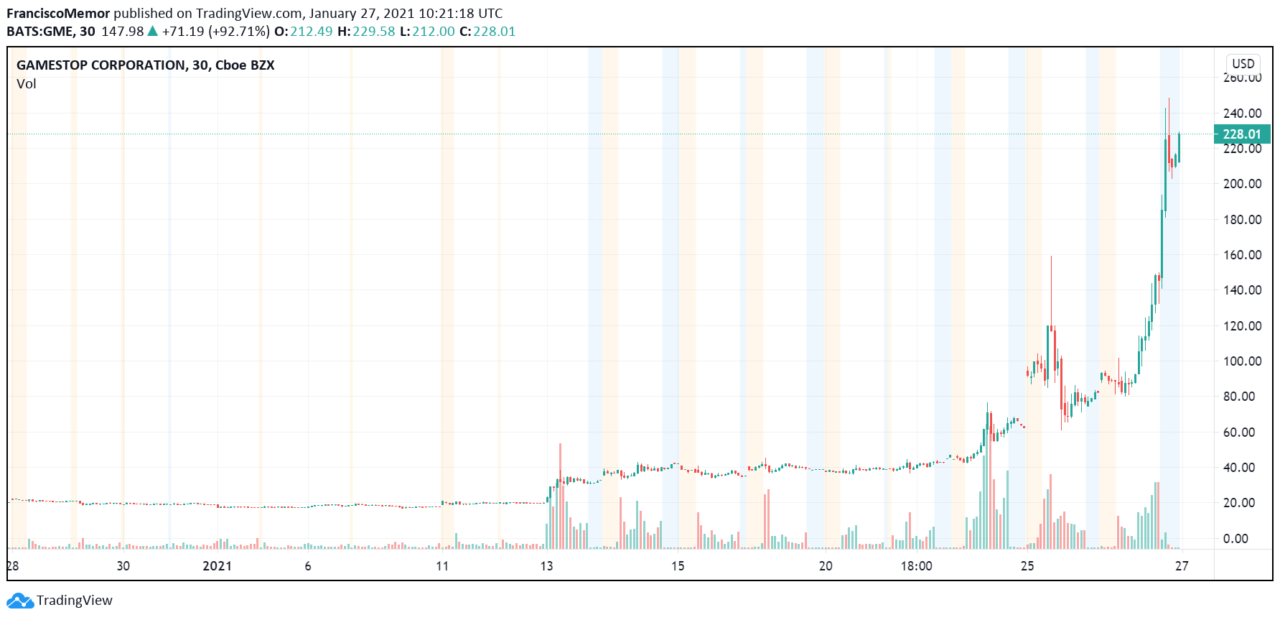

The price of GameStop (NYSE: GME) has surged from about $17.7 at the beginning of the year to over $148 at market close. The stock has since risen to $228 in pre-market trading as traders keep encouraging each other to keep betting on the company.

While institutional investors believe the company is doomed because of competition and the COVID-19 pandemic, retail investors believe in “giving it a second chance.”

The price of bitcoin has been rising over the last few months, but thanks to an increase in institutional and corporate interest in the flagship cryptocurrency, as more organizations adopt BTC as a hedge against currency debasement and inflation.

SkyBridge Capital’s bitcoin exposure is “around $385 million,” and its recently launched SkyBridge Bitcoin Fund now has about $60 million in it. Bitcoin’s price performance until now is believed to have mainly been fueled by retail investors. Similarly, GME’s price is rising as retail investors are in a battle against institutions short-selling it.

Scaramucci commented:

It’s the age of the micro investor and you better take it seriously, otherwise you’ll get taken to the cleaners.

Scaramucci has predicted the price of bitcoin could be $100,000 by the end of the year, of even $300,000 per coin if a bitcoin exchange-traded fund (ETF) is launched. SkyBridge Capital has described bitcoin as “digital gold” in an investor brochure.

Michael Burry, an analyst well-known for his mortgage traded during the 2008 financial crisis that was featured in “The Big Short,” has warned GME’s rally has gotten out of hand, writing there “ should be legal and regulatory repercussions. This is unnatural, insane, and dangerous.”

Featured image via Pixabay.