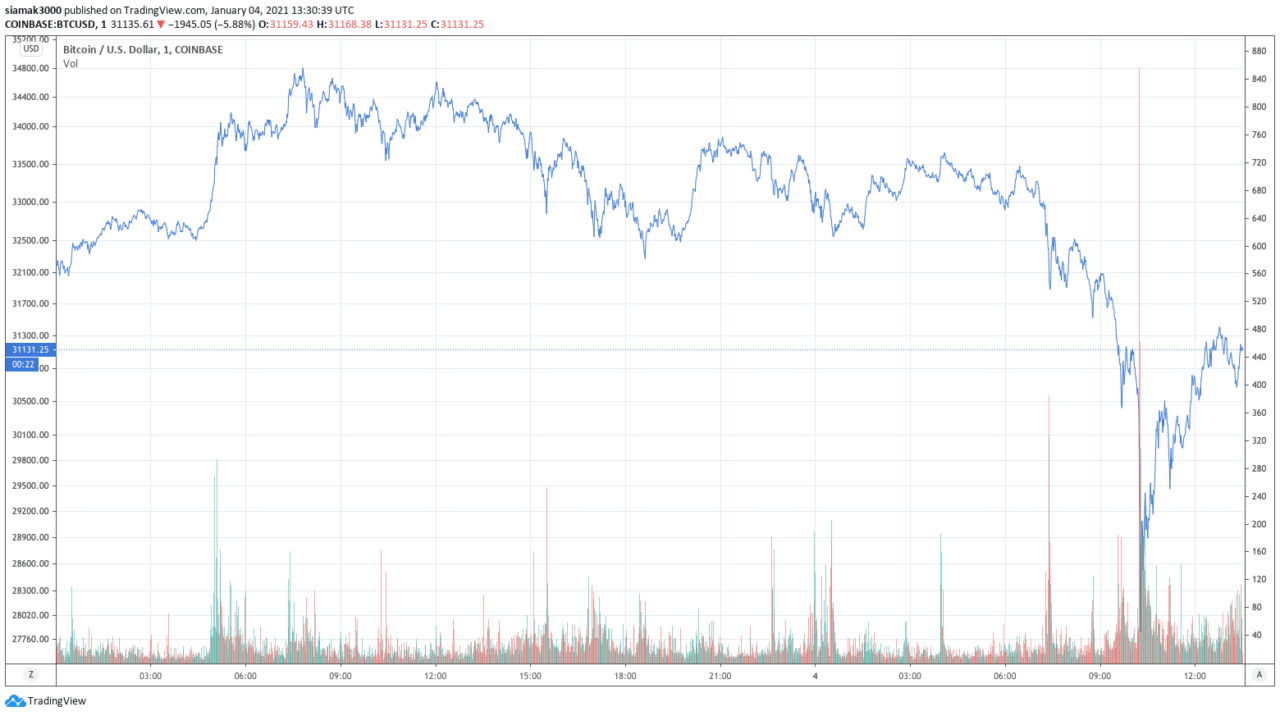

On Monday (January 4), according to data by TradingView, on Coinbase, the Bitcoin price, which had gone as high $34,806 the day before, plunged from $33,659 (at 04:05 UTC) to $27,845 (at 10:16 UTC). However, it soon made a strong rebound.

On Sunday (January 3), which was Bitcoin’s 12th birthday (i.e. 12th anniversary of the mining of the genesis block), on Coinbase, Bitcoin reached an all-time high of $34,806 at 07:48 UTC.

Later in the day, billionaire investor Mike Novogratz, Founder and CEO of Galaxy Digital, said during an interview with BBC World News that the two main drivers of Bitcoin’s strong bull run are the macro environment we are in (in which there is massive amounts of money printing being done by the world’s major central banks) and institutional investors moving into the crypto space with conviction.

Then at 21:45 UTC, the Financial Times tweeted the front page of the January 4th issue of its international edition. As you can see, Bitcoin’s price reaching almost $35,000 yesterday is the top story.

Earlier today, Ciara Sun, Head of Global Business and Markets at Huobi, pointed out that Googs Trends data is showing increasing global interest in the search term “Bitcoin.”

Then, in just over six hours — between 04:05 UTC and 10:16 UTC — the Bitcoin price crashed from $33,659 to $27,845, which is a fall of $5,814, or 17.27%.

Podcaster Peter McCormack told his over 100K Twitter followers not to panic about this dip and instead to use it as an opportunity to stack satoshis.

As usual, the main reason for such a large correction was liquidations of over-leveraged long positions on exchanges such as Binance.

According to BTC liquidations data by bybt, in the past 24-hour period, roughly $1.44 billion worth of BTC positions (around 45,650 bitcoins) got liquidated across crypto exchanges offering BTC perpetual swaps.

A few Bitcoin critics such as Nouriel Roubini were quick to take this opportunity to criticize Bitcoin.

However, some OG Bitcoiners, such as Blockstream CSO Samson Mow, reminded less experienced Bitcoiners that such price volatility was a normal part of the game for Bitcoin.

This sentiment was echoed by Gabor Gurbacs, Director of Digital Asset Strategy at VanEck/MVIS.

And by 14:17 UTC, the Bitcoin price had rebounded to $31,784, a nice 14% bounce from its intraday low.

Featured Image by “erikatanith” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.