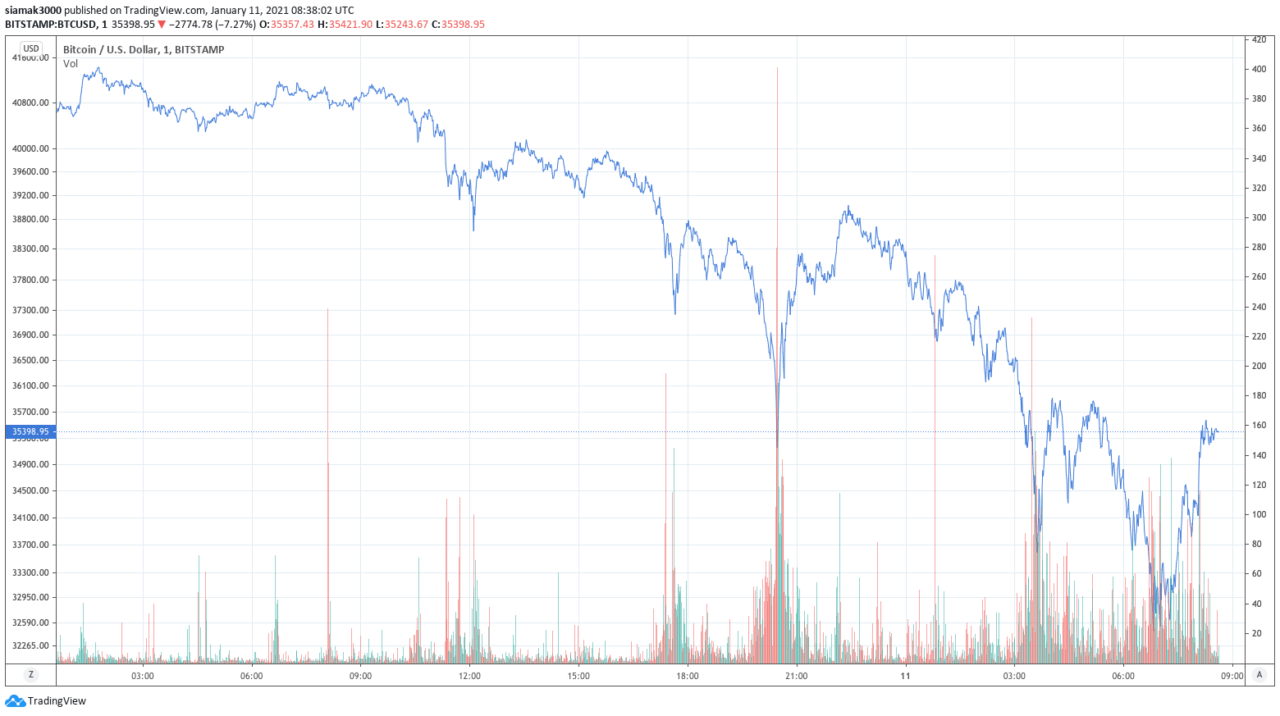

According to data by TradingView, around 06:49 UTC on Monday (January 11), on Coinbase, the Bitcoin price got dropped as low as $32,475.

This correction seems to have started around 10:52 UTC on Sunday (January 10) when Bitcoin was trading around $40,689.

Then at 11:15 UTC on Sunday, Ki Young Ju, the CEO of South Korean blockchain analytics startup CryptoQuant, tweeted that according to one of their BTC indicators — Miners’ Position Index (which is “the ratio of BTC leaving all miners wallets to its 1-year moving average” — some of the selling pressure was coming from miners.

Profit taking by BTC whales (such as miners), combined with liquidations of some highly-leveraged long positions on crypto derivatives exchanges, concerns over COVID-19 leading to lower prices for equities in both Asia and Europe, and the strengthening of the U.S. dollar (as measured by the U.S. dollar index, which has gone from a low of 89.22 last Wednesday to 90.31, where it is now), seem to have help played in their part in intensifying selling pressure on Bitcoin.

Here is Larry Cermak, Director of Research at The Block, with some analysis of the roughly $2.75 billion worth of liquidations of BTC long positions that took place in the past 24-hour period:

Crypto analyst Alex Krüger said earlier today:

Meanwhile, Scott Minerd, Global Chief Investment Officer of Guggenheim Partners, “a global investment and advisory firm with more than $295 billion in assets under management,” decided to tweet about Bitcoin at 04:52 UTC on Monday, around the time when Bitcoin was trading at $35,472.

Guggenheim Investments is “the global asset management and investment advisory division of Guggenheim Partners and has more than $233 billion in total assets across fixed income, equity and alternative strategies.” It focuses on “the return and risk needs of insurance companies, corporate and public pension funds, sovereign wealth funds, endowments and foundations, wealth managers and high net worth investors.”

On November 27, according to a U.S. SEC post-effective amendment filing, it became known that one of Guggenheim Investments’ fixed income mutual funds (“Macro Opportunities”) was considering investing in Bitcoin.

According to data by the Financial Times, this fund was launched on 30 November 2011, and its total net assets was $4.97 billion (as of 31 October 2020).

The SEC filing made on November 27 is known as an “SEC POS AM” (aka “post-effective amendment”) filing. This type of filing “allows a company registered with the SEC to update or amend its prospectus.”

This filing stated that the fund is considering getting some cryptocurrency exposure:

“Cryptocurrencies (also referred to as ‘virtual currencies’ and ‘digital currencies’) are digital assets designed to act as a medium of exchange. The Guggenheim Macro Opportunities Fund may seek investment exposure to bitcoin indirectly through investing up to 10% of its net asset value in Grayscale Bitcoin Trust (“GBTC”), a privately offered investment vehicle that invests in bitcoin.”

Then, on 16 December 2020, after the Bitcoin price had finally broken through the $20,000 level on all crypto exchanges to set a new all-time high, Minerd, the Guggenheim CIO, talked about Bitcoin during an interview on Bloomberg TV.

The interview started by the Guggenheim CIO being asked by Scartlet Fu, Bloomberg TV’s Senior Editor of the Markets Desk, about the Guggenheim Macro Opportunities Fund and the decision by its managers to invest “up to 10% of its net asset value in Grayscale Bitcoin Trust.” In particular, he was asked if Guggenheim had started buying Bitcoin yet and how much this decision was “tied to the Fed’s extraordinary policy.”

Minerd replied:

“To answer the second question, Scarlett, clearly Bitcoin and our interest in Bitcoin is tied to Fed policy and the rampant money printing that’s going on. In terms of our mutual fund, you know, we are not yet effective with the SEC. So, you know, we’re still waiting.

“Of course, we made the decision to start allocating toward Bitcoin when Bitcoin was at $10,000. It’s a little more challenging with the current price closer to $20,000. Amazing, you know, over a very short period of time, how big run-up we’ve had, but having said that, our fundamental work shows that Bitcoin should be worth about $400,000. So even if we had the ability to do so today, we’re going to monitor the market and see how trading goes, what evaluation that ultimately we have to buy it.”

Well, now, the Guggenheim CIO, perhaps frustrated by the fact that their SEC filing to invest in Bitcoin has not become effective yet (which means the Guggenheim Macro Opportunities Fund, which intends to invest up to $500 million in BTC, has not been able to buy Bitcoin yet), seems to want the Bitcoin price to come down because he is saying that it is “time to take some money off the table.”

According to data by CryptoCompare, currently (as of 09:32 UTC on January 11), Bitcoin is trading around this large price correction $35,371, down 13.35% in the past 24-hour period (but up 22.08% since the start of the year).

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.