On Friday (December 4), during an interview on CNBC’s “Squawk Box“, Brian P. Brooks, Acting Comptroller (since May) at the Office of the Comptroller of the Currency (OCC), said that “nobody is going to ban Bitcoin.”

Brooks is currently also a member of the Board of Directors of Federal Deposit Insurance Corporation (FDIC). Between September 2018 and March 2020, he served as Chief Legal Officer at crypto exchange Coinbase.

The OCC is “an independent bureau of the U.S. Department of the Treasury that charters, regulates, and supervises all national banks, federal savings associations, and federal branches and agencies of foreign banks. Its goal is to ensure that the banks it supervises “operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.”

Brooks’ comments about Bitcoin and cryptocurrencies in general came during an interview with Squawk Box co-anchors Melissa Lee and Joe Kernen.

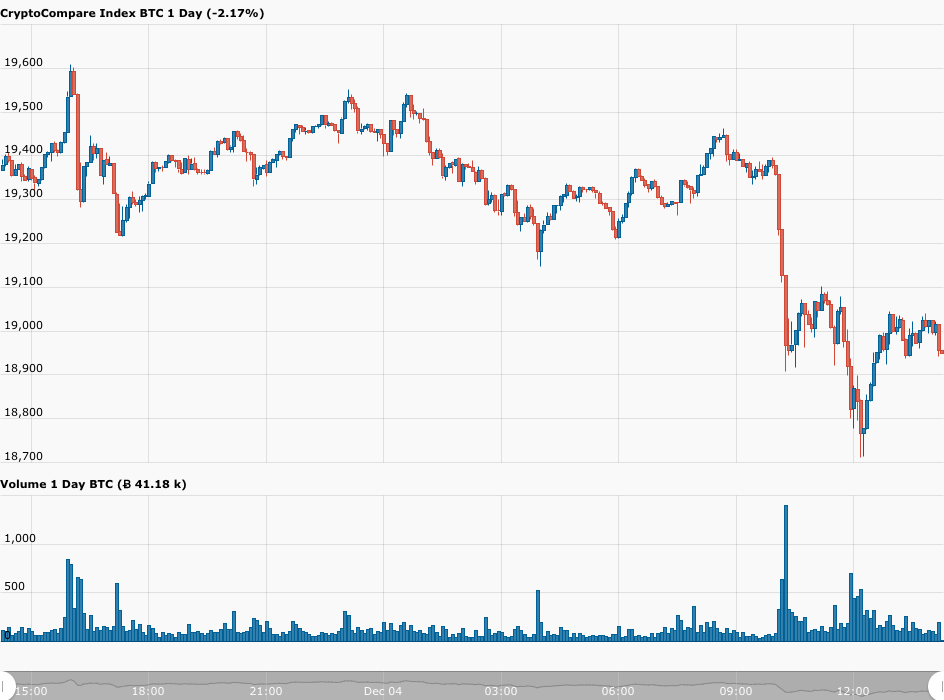

With Bitcoin trading around $19,000 at the time of today’s interview, Lee started the interview by asking Brooks about the tweet below by Coinbase CEO Brian Armstrong:

Brooks replied:

“Melissa, you know rumors abound within Bitcoin more than almost any other place, but I would tell you is we’re very focused on getting this right. We’re very focused on not killing this, and it’s equally important that we develop the networks behind Bitcoin and other cryptos…”

Lee then asked if there could be some new crypto regulations before the end of Trump’s first term in office.

Brooks answered:

“I think you’re going to see a lot of good news for crypto by the end of the Trump term. Some is going to have to do with banks connecting to blockchains, some of it is going be more clarity around the nature of these assets. So, believe me, there’s going to be very positive messages coming up.

“At the same time, it’s a dangerous world out there. We have to be honest about that, but nobody is going to ban Bitcoin. Nobody is going to ban some of these transmission technologies. I think it’s going to be a lot less bad than people worry about.”

On November 10, Brooks testified before the U.S. Senate Committee on Banking, Housing, and Urban Affairs, and as part of his prepared statement, spoke about cryptoassets.

Brooks was appearing as a witness at a committee hearing titled “Oversight of Financial Regulators“. The other witnesses were the Honorable Randal K. Quarles, Vice Chairman for Supervision, Board of Governors of the Federal Reserve System, the Honorable Jelena McWilliams, Chairman, Federal Deposit Insurance Corporation, and the Honorable Rodney E. Hood, Chairman, National Credit Union Administration.

With regard to crypto, here is what Brooks had to say about usage of cryptocurrencies (including stablecoins) in the U.S and what actions the OCC has taken to respond to this usage:

“Today, roughly 60 million Americans own some type of cryptocurrency, with a total market cap of nearly $430 billion. These figures clearly illustrate that this payment mechanism is now firmly entrenched in the financial mainstream. Cryptocurrency has become a popular mechanism for sending and receiving payments for goods and services because transactions post in real time and provide convenience and security. Cryptocurrency also describes categories of specific currencies of value, and the rise in the use of stablecoins demonstrates consumers’ comfort with its use.”