On Friday (December 18), India’s Business Standard reported that Christopher Wood, Global Head of Equity Strategy at financial services company Jefferies, has recently reduced the gold exposure in his “long-only global portfolio for US dollar-denominated pension funds” in favor of Bitcoin.

On 30 May 2019, Jefferies announced the appointment of Christopher Wood as Global Head of Equity Strategy. Jefferies’ press release stated that Wood has been “ranked the top Equity Strategist in almost all major broker polls in Asia during the last two decades.” On the same day, Jefferies launched its first edition of Chris Wood’s weekly institutional research newsletter GREED & Fear.

The Business Standard report went on to say that Wood had said the following about gold and Bitcoin in his weekly newsletter:

“The 50 per cent weight in physical gold bullion in the portfolio will be reduced for the first time in several years by five percentage points with the money invested in Bitcoin. If there is a big drawdown in bitcoin from the current level, after the historic breakout above the $20,000 level, the intention will be to add to this position.”

Sumit Gupta, co-founder and CEO at crypto exchange CoinDCX, told Business Standard:

“On fundamental level, Bitcoin’s growth is largely attributed to how it is designed and in May 2020, we witnessed third halving, a supply shock event, where the number of daily mined Bitcoin gets cut in half. In the previous two halvings, Bitcoin and overall crypto market cap has risen exponentially, and we are witnessing a start of similar bull trend.”

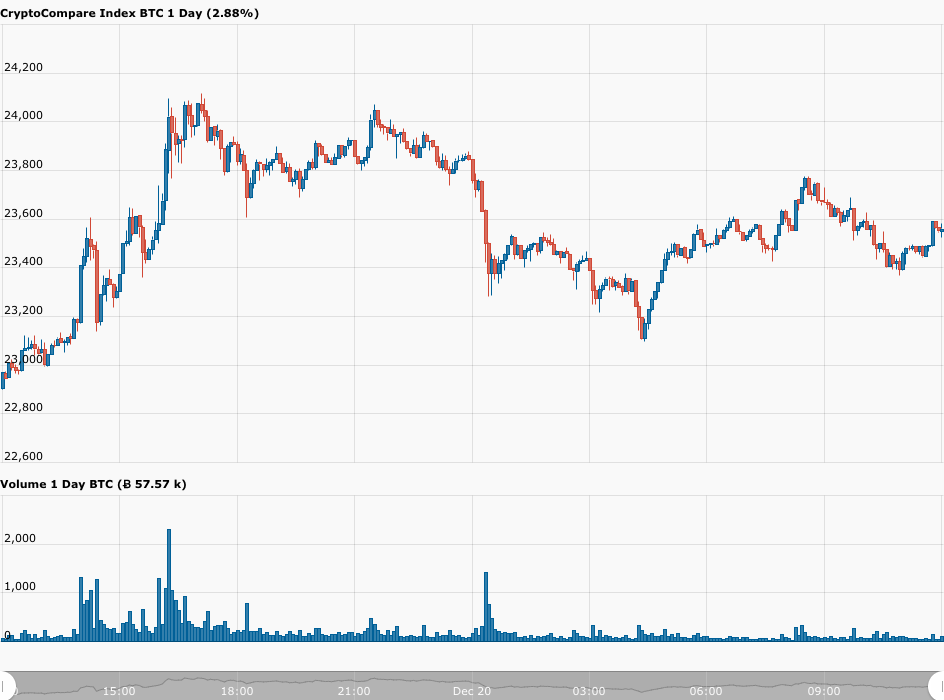

Currently (as of 12:05 UTC on December 20), according to data from CryptoCompare, Bitcoin is trading at $23,560, up 2.4% in the past 24-hour period.

Featured Image by “petre_barlea” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.