On Thursday (December 3), CryptoCompare, a leading cryptoasset market data provider, launched the Bitcoin Volatility Index (BVIN), which was developed in partnership with the University of Sussex Business School.

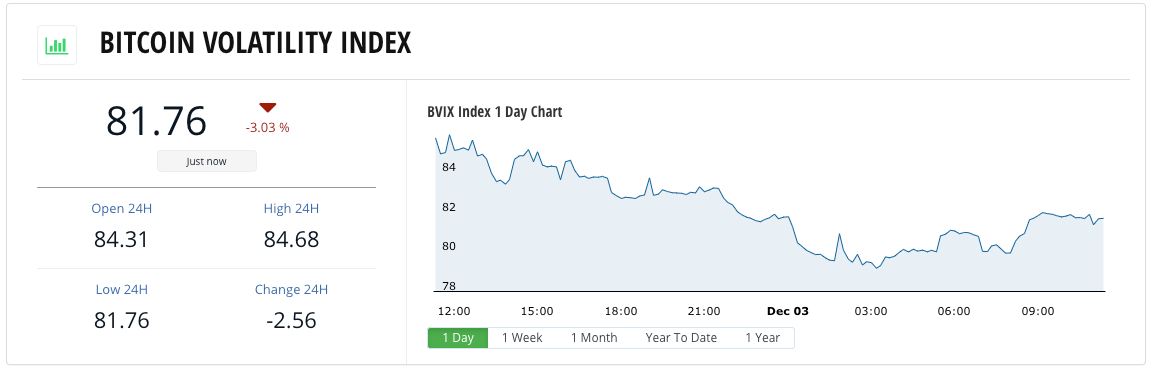

This innovative tool for Bitcoin traders provides a highly accurate way to understand Bitcoin’s 30-day implied volatility, i.e. how volatile Bitcoin prices are likely to be over the next 30 days based on traders’ expectations.

Implied volatility is measured by demand for options as hedging instruments. Unlike most/all previous efforts aimed at creating implied volatility indices, BVIN works by examining all available Bitcoin options across a particular crypto derivatives exchange (such as Deribit, which handles the vast majority of Bitcoin options trading volume) or a set of such exchanges, which means that it provides the most accurate method of quantifying Bitcoin’s implied volatility.

Currently, BVIN supports only 30-day implied volatility (since this variant is the most popular one among traders); however, in the near future, based on demand, CryptoCompare plans to add support for other periods (e.g. implied volatility over six months).

CryptoCompare’s Indices and Investable Instruments, led by Quynh Tran-Thanh, developed BVIN with the help of Dr. Carol Alexander, Professor of Finance at University of Sussex (UK) and Co-Editor of the Journal of Banking and Finance.

Professor Alexander holds degrees from the University of Sussex (BSc First Class, Mathematics with Experimental Psychology; PhD Algebraic Number Theory) and the London School of Economics (MSc Econometrics and Mathematical Economics). She has held several positions in financial institutions: Fixed Income Trader at UBS/Phillips and Drew (UK); Academic Director of Algorithmics (Canada); Director of Nikko Global Holdings and Head of Market Risk Modeling (UK); Risk Research Advisor, SAS (USA). Professor Alexander is widely considered one of the leading experts in volatility theory and option pricing.

BVIN represents a valuable tool for institutional investors to price Bitcoin volatility risk, and trade/hedge on Bitcoin volatility. CryptoCompare uses proprietary methods to live stream BIVIN following the research design of Professor Alexander and her team at the University of Sussex Business School.

According to CryptoCompare’s press release, Quynh Tran-Thanh, Head of Indices and Investable Instruments at CryptoCompare, had this to say:

“We have created the Bitcoin Volatility Index (BVIN) so that investors can use a reliable and transparent barometer to monitor and eventually hedge against bitcoin volatility. By bringing together our indexing capabilities and Carol Alexander’s expertise, we are delighted to introduce the first Bitcoin implied volatility index to digital asset market participants.”

As for Professor Alexander, she stated:

“Live-streaming a well-known market sentiment index like the VIX has been an intellectual challenge made pleasurable by working with Quynh and her fabulous team at CryptoCompare. And the University of Sussex Business School is delighted to recognise the practical implementation of my research with Arben Imeraj, published in the Journal of Alternative Investments.”

Featured Image Credit: Photo via Pixabay