On Wednesday (December 30), hedge fund manager and CNBC contributor Brian Kelly (aka “BK”) explained why that Bitcoin was designed and created for the current macro environment.

According to his bio on the CNBC website, Kelly is the founder and CEO of BKCM LLC, an asset management firm focused on “global macro and currency investing, including investing in digital currencies.” Furthermore, he is the portfolio manager of the BKCM Digital Asset Fund and the REX BKCM Blockchain ETF.

Kelly is also the author of the book “The Bitcoin Big Bang: How Alternative Currencies Are About to Change the World” (which was published by Wiley in November 2014).

Kelly’s latest comments on Bitcoin came yesterday during a special edition of CNBC’s post-market show “Fast Money”.

A viewer from New Jersey if with all the money printing being done by central banks around the world Bitcoin made sense as a long-term investment for the next 5-10 years.

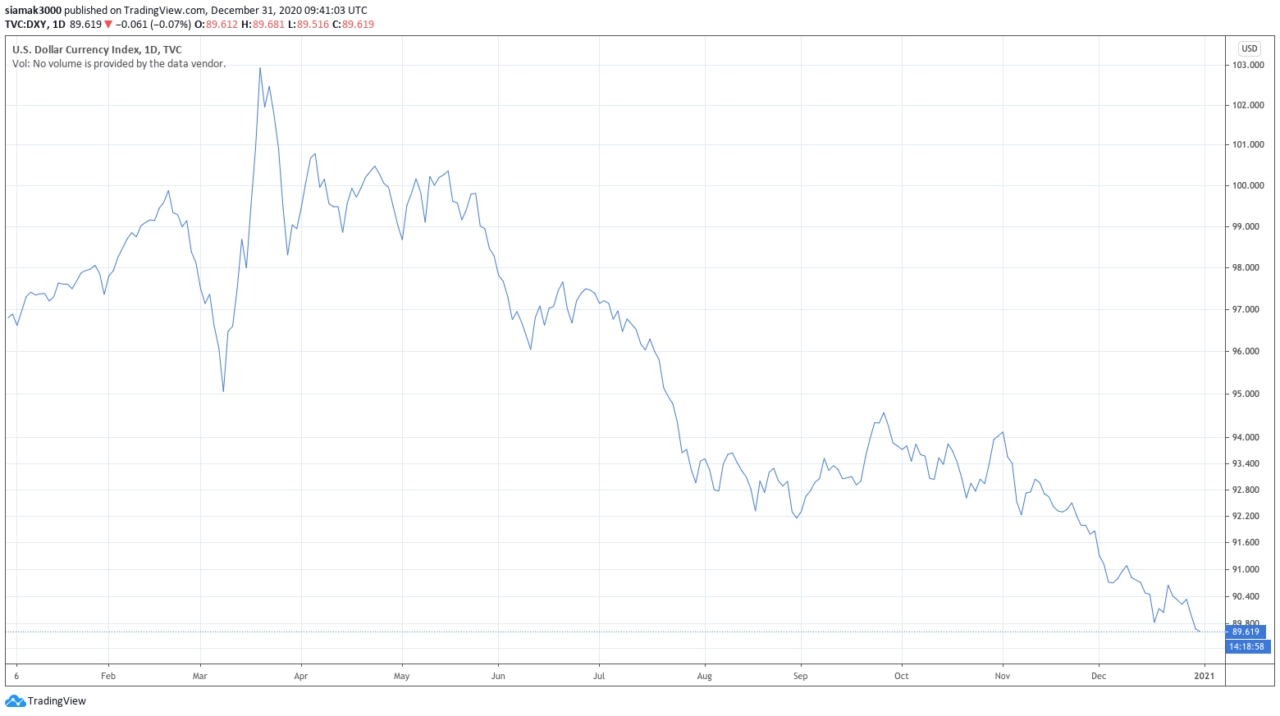

As you can see in the year-to-date U.S. dollar index (DXY) chart below by TradingView, since March 19, DXY has gone from 102.936 to 89.600, where it is at 09:45 UTC on December 31. The last time DXY was this low was back in March 2018.

Fats Money host Melissa Lee asked BK if dollar debasement would continue in 2021.

He replied:

“Yeah, I think it is. I think that’s a great point that he brought. This is the exact environment that Bitcoin was designed and created for. Every central bank in the world is printing money. No central bank wants a strong currency.

“In fact, the European Central Bank today came out and said ‘listen, we’re watching the euro very closely, we don’t like it this strong’. Last week, the Bank of Japan came out and said a hundred US dollar yen is where they’re gonna draw the line in the sand, ‘we don’t want the yen to be any stronger’. I would imagine the British pound is probably next on that list. So, if you go across the world, you’re looking at every single country in the world wants a weaker currency.

“So, how do you short all fiat currencies? You buy Bitcoin.”

BK went on to say that, in the long-term, Bitcoin is a “relative no-brainer.”

Featured Image by “petre_barlea” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.