With the Bitcoin price comfortably above the $19,000 level, popular crypto analyst and trader Alex Krüger pointed out to those people who are still feeling bearish that he finds “real money” buying Bitcoin “obscenely bullish.”

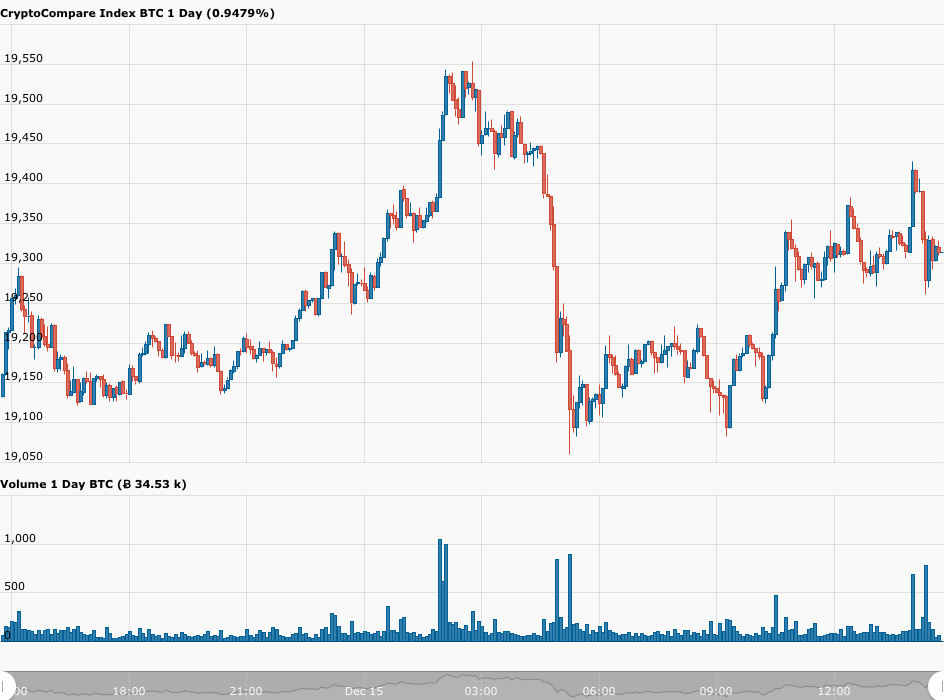

According to data from CryptoCompare, the Bitcoin price has been above the $19,000 level since 23:00 UTC on December 13. Currently (as of 14:45 UTC on December 15), Bitcoin is trading around $19,324, up 0.56% in the past 24-hour period.

This means that Bitcoin’s market is roughly $359 billion, and its market cap dominance is 62.7%.

Bitcoin’s return-on-investment (vs USD) in the year-to-date (YTD) period is +169%.

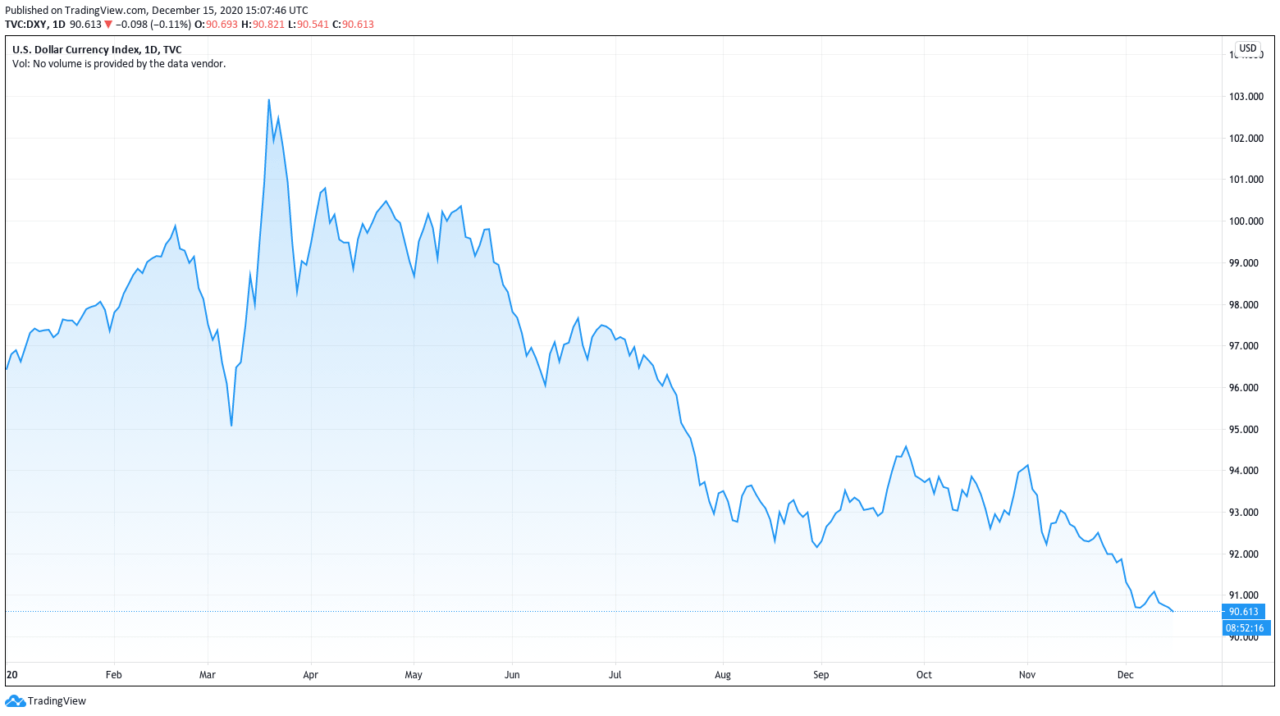

According to data from TradingView, as of 15:07 UTC on December 15, the U.S. dollar index (DXY) is at 90.613, down 11.97% since March 19 (when it was at 102.936).

Besides U.S. dollar weakness, another reason for Bitcoin currently holding steady above $19,300 is optimism over the current fiscal stimulus talks in Washington; although there is no guarantee that the latest bipartisan proposal that was unveiled on Monday (December 14) will get approved, there is hope that a modified version of this $908 billion fiscal stimulus package will get approved by the U.S. Congress this week.

U.S. Representative Josh Gottheimer, who represents New Jersey’s Fifth Congressional District and co-chair of the bipartisan House Problem Solvers Caucus, told CNBC on Monday:

“It doesn’t have to be every single word that we hand [congressional leaders] … but this is a clear road map for them.”

Earlier today, crypto analyst and trader Alex Krüger explained why he is so bullish (long term) on Bitcoin.

Krüger went on to say:

“Real money includes pension funds, insurance companies, mutual funds and endowments. Unlike fast money, real money is usually long only and has extended holding periods. Fast money may dump on you. Real money may do so indirectly as it rebalances exposure.

“Real money buying bitcoin is obscenely bullish.”

Meanwhile, another prominent crypto analyst and trader, Michaël van de Poppe, is short-term bearish, but long-term bullish, expecting the Bitcoin price to go as high as $200,000 in the next several years.

Crypto analyst Josh Rager offered this technical analysis of Bitcoin’s recent price action:

Michael J. Saylor, Co-Founder, Chairman, and CEO of Nasdaq-listed business intelligence company MicroStrategy Inc. (NASDAQ: MSTR), the treasury of which is using BTC as its main reserve asset, says that Bitcoin is “a way of life.”

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.