The market capitalization of the flagship cryptocurrency bitcoin has risen to surpass that of Berkshire Hathaway (NYSE: BRK.A, NYSE: BRK.B), a business giant led by legendary investor Warren Buffet, who has in the past said BTC is “probably rat poison squared.”

According to AssetDash, BTC’s market cap is now $540.9 billion, while Berkshire Hathway’s market capitalization is $538.8 billion. The cryptocurrency’s market capitalization has been rising thanks to investment from various corporations including MicroStrategy.

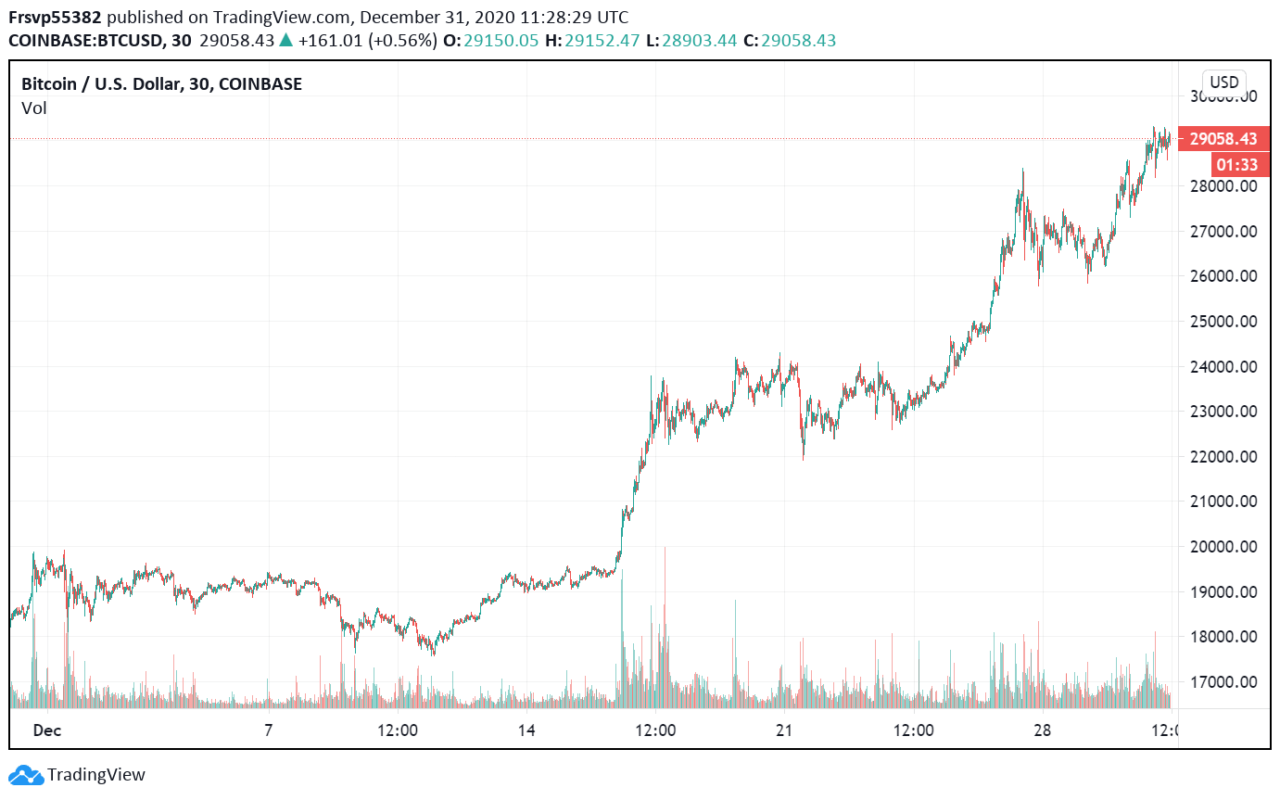

Its price, as a result, has surpassed the $29,000 mark at press time, after dipping from a new all-time high of $29,300 seen earlier today.

Bitcoin Treasuries, a website tracking the bitcoin investments of publicly-traded and private firms, shows that MicroStrategy has already invested a total of $1.125 billion into the flagship cryptocurrency. It now holds 70,470 BTC, worth just over $2 billion.

Next on the list is Galaxy Digital, which invested $134 million into bitcoin, and now holds $480 million worth of the cryptocurrency. Similarly, Square’s $50 million investment in the cryptocurrency is now worth over $136 million.

Other organizations, like Stone Ridge Holdings, MassMutual, and Ruffer Investment have also disclosed exposure to BTC, after PayPal surprised the crypto space by announcing a feature letting users buy, sell, and hold crypto on their accounts.

Bitcoin surpassing Berkshire Hathaway’s market capitalization is symbolic to cryptocurrency investors as in 2018 the conglomerate’s CEO, Warren Buffet, slammed BTC saying it’s “probably rat poison squared.”

The “Oracle of Omaha” said BTC isn’t a productive asset like land or corporate shares, and has no intrinsic value. He said:

In terms of cryptocurrencies, generally, I can say with almost certainty that they will come to a bad ending. If I could buy a five-year put on every one of the cryptocurrencies, I’d be glad to do it but I would never short a dime’s worth.

Charlie Munger, Berkshire’s vice chairman, and long-time Buffett collaborator, compared investing in cryptoassets to “dementia” and added it’s “somebody else is trading turds and you decide you can’t be left out.” Munger had, on a different occasion, called bitcoin “totally asinine” and “noxious poison.”

Buffett and Munger are well-known for dislike investments in gold. This year’s economic fallout over the COVID-19 pandemic and the Federal Reserve’s seemingly ever-increasing balance sheet saw many buy BTC. Berkshire Hathaway added Barrick Gold, a gold mining firm, to its portfolio presumably for the same reasons.

Featured image via Pixabay