On Wednesday (December 16), as the U.S. dollar index (DXY) hovers around 32-month lows, the Bitcoin price is surging toward the $20,000 level following U.S. Senate Majority Leader Mitch McConnel’s comments about further fiscal stimulus.

The “U.S. Dollar Index” (DXY)—which is “designed, maintained, and published by ICE (Intercontinental Exchange, Inc.)”—is “an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies”. These other currencies are EUR, GBP, JPY, CAD, SEK, and CHF.

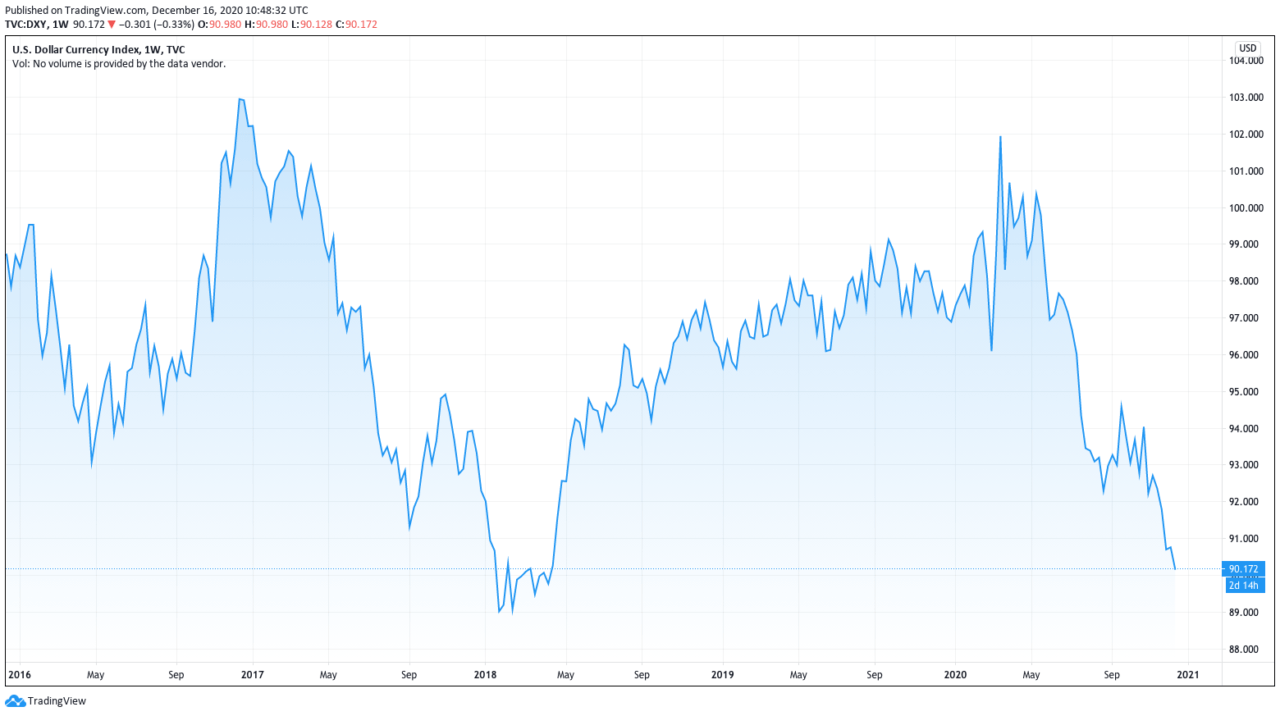

According to data from TradingView, the U.S. dollar index is currently (as of 10:48 UTC on December 16) trading around 90.172, which is around levels last seen in April 2018 and not that far away from the five-year low of 89.076, which was reached in February 2018.

On March 27, President Trump signed H.R.748, better knows as the “Coronavirus Aid, Relief, and Economic Security Act” or the CARES Act. This bill was created in response to the COVID-19 pandemic and “its impact on the economy, public health, state and local governments, individuals, and businesses.” In President Trump’s own words, this $2.2 billion fiscal stimulus package was “the single-biggest economic relief package in American history.”

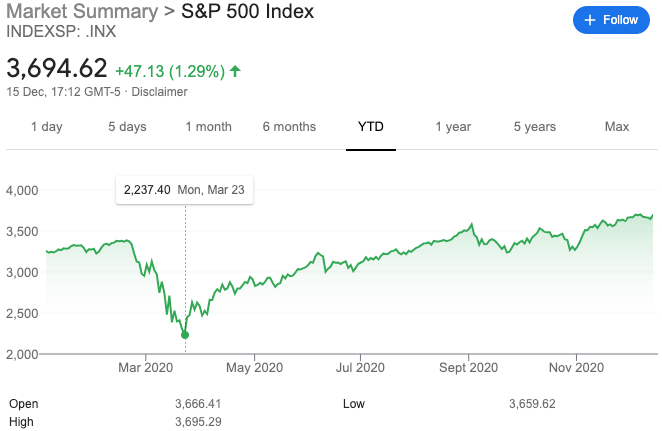

Four days earlier (i.e. on March 23), the Nasdaq Composite had closed at 6,860.67, its lowest level in the past 12-month period.

Since then, despite the fallout from the COVID-19 pandemic, this huge fiscal stimulus has resulted in increased investors’ appetite for risk-on assets (such as stocks and Bitcoin) and kept pressure on the dollar.

Although in the past few months, we have the second and third waves of COVID-19 cause higher infection rates in the U.S. and Europe, investors have not sold risk due to optimism over COVID-19 vaccines and the hope that once mass vaccinations have taken place, we will see a quick recovery in the U.S. (and the world) economy.

In particular, since March 23, the Nasdaq Composite index has gone up 85% (closing Tuesday’s regular trading session at 12595.06). Meanwhile, since that date, the U.S. dollar index, which was trading around 102.469 back on March 23, has gone down 12%.

As for the S&P 500 index, which also reached its 12-month low on March 23, from that date till yesterday (December 15), it has gone from 2,237.40 to 3,694.62, which is a gain of 65.13%.

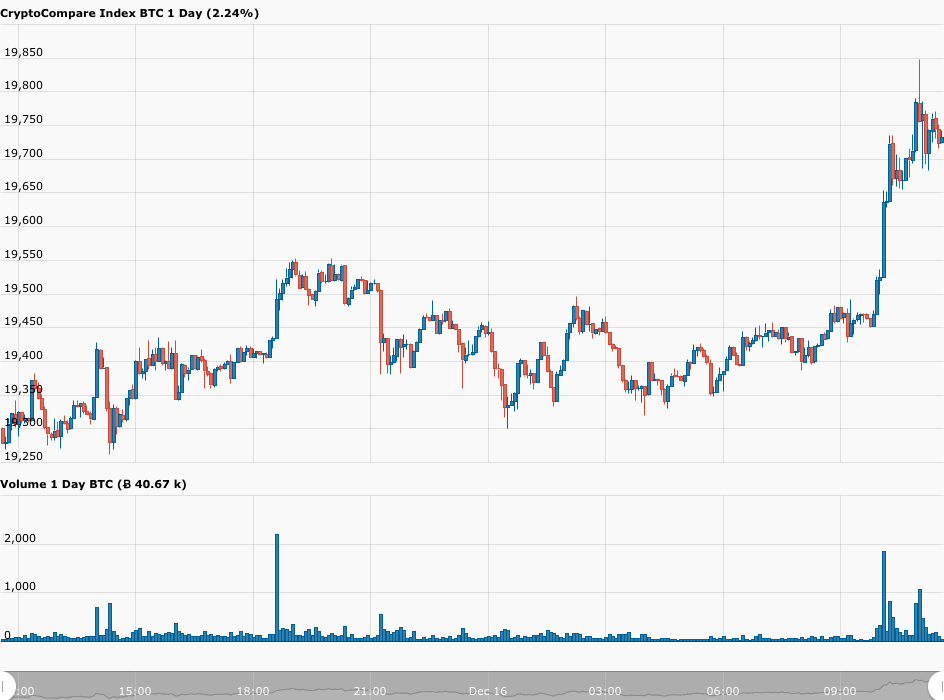

As for Bitcoin, according to data from CryptoCompare, currently (as of 11:35 UTC on December 16), it is trading around $19,740, up 2.26% in the past 24-hour period:

Since March 23, when the Bitcoin price was around $6,503, it has gone up 203.55%.

One main reason for today’s surge in the price of Bitcoin could be renewed optimism over the next COVID-19 relief package getting passed by the U.S. Congress this week following recent constructive talks between the White House (as represented by U.S. Treasury Secretary Steven Mnuchin) and congressional leaders.

According to a report by NBC News, following a meeting on Tuesday with House Speaker Nancy Pelosi, Senate Majority Leader Mitch McConnell, Senate Minority Leader Chuck Schumer, and House Minority Leader Kevin McCarthy, Senate Majority Leader Mitch McConnell had this to say:

“We’re making significant progress and I’m optimistic that we’re gonna be able to complete an understanding sometime soon.”

NBC’s report says that the “lawmakers are trying to hammer out an agreement by Friday, when Congress hits the deadline to pass legislation to keep the government funded.”

Popular crypto analyst and trader Michaël van de Poppe offered this bit of technical analysis of Bitcoin’s recent price action to his 88K followers on Twitter:

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.