After falling below the $18,900 level, the Bitcoin price has staged a nice recovery that has taken it over $500 higher and seemingly back on the road toward breaking $20,000.

According to data by CryptoCompare, at On Thursday (December 3), at 05:40 UTC, the Bitcoin price fell to the intraday low of $18,888, but since then it has rallied, and BTC-USD is currently (as of 08:40 UTC) trading around $19,382, up 0.95% in the past 24-hour period.

Although, as usual, it is impossible to be 100% sure why Bitcoin is doing better right now, it seems reasonable to assume that it is at least in part due to increasing investors’ risk appetite. And the reason for that is mostly due to optimism over the number of effective COVID-19 vaccines currently waiting to be approved/deployed as well as renewed hopes that the U.S. fiscal stimulus in Washington, which recently restarted, will this time result in a badly needed COVID-19 relief package getting approved soon by U.S. Congress.

With regard to the former, as BBC News reported yesterday, the UK has become the first country to approve the Pfizer-BioNTech COVID-19 vaccine, with mass vaccination expected to start as early as next week. Also, laer today, the French government will be outlining its vaccine strategy. As for the U.S., according to CNBC, the Food and Drug Administration (FDA) said last month that it has scheduled a meeting on December 10 to discuss the emergency use authorization of the Pfizer-BioNTech approval request.

With regard to the latter, CNBC has reported that that House Speaker Nancy Pelosi and Senate Minirity Leader Chuck Schumer want Senate Majority Leader Mitch McConnel to consider using the bipartisan framework introduced in the Senate on Tuesday “as the basis for immediate bipartisan, bicameral negotiations” so that hopefully a relief bill can be approved by Congress as early as next week.

However, the $908 billion fiscal stimulus being proposed by the Democratic leaders is far higher than the $500 billion that McConnel seems happy for the government to spend. Also, he said on Tuesday that he wants to link any relief package to a government funding bill that needs to be passed by December 11.

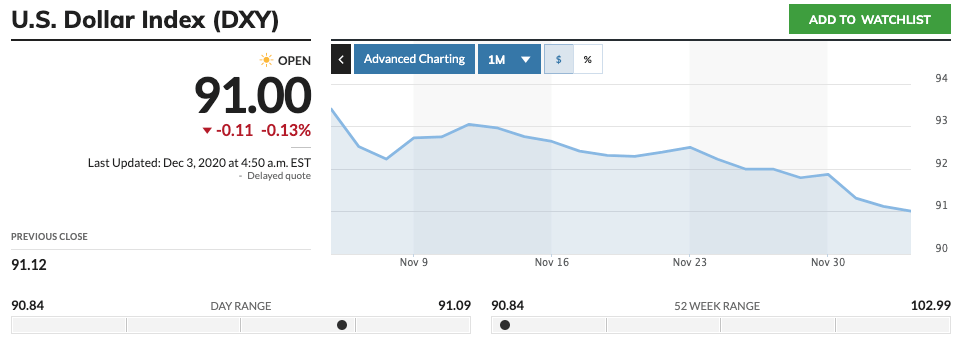

The small increase in risk appetite appears to have put further pressure on the U.S. dollar, with the U.S. dollar index (DXY) currently (as of 09:35 UTC) at 91.00, down 0.13% on the day. Previous to this week, the last time DXY was this low was back in April 2018.

On Wednesday, Travis Kling, Founder and CIO at Ikigai Asset Management, provided a great summary of all the bullish news from last month to explain why the there is so much excitement in the crypto community at the moment and why Bitcoin was able to set a new all-time high earlier this week.

Charles Edwards, Co-Founder of digital asset management firm Capriole Investments, has this to say to those who think they are arriving (or have arrived) too late to the Bitcoin party.

And he might be right. According to data from Google Trends, worldwide interest in the search term “Bitcoin” is nowhere as high as it was in December 2017 even though this week the Bitcoin price surpassed the last all-time high, which was set on 17 December 2017.

This suggests that Bitcoin’s current bull ran is not being mostly driven by retail investors like it was during the second half of 2017.

However, the propsect of the Bitcoin price going above $20,000 in the very near future does seem to have mainstream media excited again and talking about Bitcoin almost every day.

One of the latest examples comes from U.S. daily newspaper “New York Post”, which reported yesterday that “Visa, Evolve Bank and credit card firm Deserve are partnering with cryptocurrency startup BlockFi to offer a credit card that lets users earn bitcoin on purchases.”

Featured Image by “SnapLaunch” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.