With Bitcoin price breaking through the $22,000 level less than 24 hours after setting a new all-time high (ATH) by going over $20,000, Frank Sinatra’s “Fly Me to the Moon” might soon become many Bitcoiners’ new favorite song.

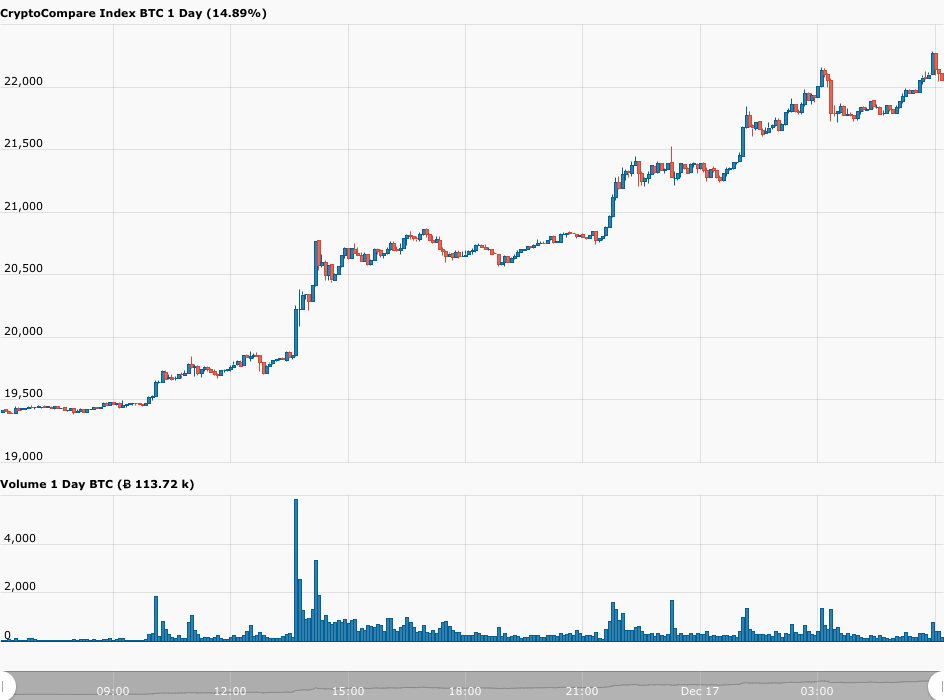

According to data from CryptoCompare, on Wednesday (December 16), between 13:35 UTC and 13:40 UTC, the Bitcoin price finally broke the psychologically important $20,000 level, before reaching $20,257.

This prompted Cameron Winklevoss, Co-Founder and President of crypto exchange Gemini to declare:

The shattering of the $20K ceiling was significant enough to FT Alphaville reporter Jemima Kelly — one of Bitcoin’s harshest critics — to write on Wednesday an op-ed piece titled “Bitcoin goes to the moon!” and conclude it with these words:

“You might not want to go into church this Christmas so as to protect your granny, but rejoice! For once again we can worship at the altar of the coin of bits.”

In a note shared with CryptoGlobe, Charles Hayter, Co-Founder and CEO of leading cryptoasset market data provider CryptoCompare, had this to say about the factors driving the current Bitcoin bull run:

“The corporate investments in Bitcoin from the likes of Square, MicroStrategy, and more recently MassMutual and Ruffer, have caught the attention of the investing world. This growing demand is simply outstripping Bitcoin’s low and fixed supply. I expect more corporations to follow suit in 2021.

“With the macroeconomic backdrop of unprecedented monetary expansion and negative real interest rates spurred on by COVID-19, it is no wonder that investors of all types are looking at hard assets like Bitcoin as an alternative to gold. Unlike the retail-driven bull run in 2017, institutional investors can allocate capital effectively and with considerably lower risk as the markets are more mature, efficient and regulated.”

By 21:00 UTC, Bitcoin was trading around $20,800. Although Bitcoin’s price action yesterday was looking very impressive, there was concern among some members of the crypto community that once the Asian trading session started, some Bitcoin whales based over there (e.g. BTC miners) would dump some of their BTC holdings to take profits, which could lead the Bitcoin price to drop below $20K.

For example, here is Ki Young Ju, CEO of on-chain analysis startup CryptoQuant, who is long-term bullish on Bitcoin, explaining at 17:24 UTC on December 16 why he had shorted BTC at $20,807:

Some other traders who are strong believers in technical analysis, were shorting Bitcoin yesterday just because they felt that they had listen to their charts, which were telling there would soon be a pullback. For those people, Scott Melker, a crypto trader at Texas West Capital, offered this advice:

We don’t know how many Bitcoin whales locked-in some profits by selling part of their BTC holdings, but it wasn’t enough to stop Bitcoin’s wild ride.

According to data by CryptoCompare, at 21:45 UTC on December 16, the Bitcoin price broke $21,000 (reaching a high of $21,144), and by 03:00 UTC on December 17, it broke through the $22,000 level (reaching a high of $22,004). Currently (as of 06:00 UTC on December 17), Bitcoin is trading around $22,221, up 14.28% in the past 24-hour period.

13 minutes after Bitcoin broke through the $22K level, Tyler Winklevoss, Co-Founder and CEO of crypto exchange Gemini, tweeted:

As for how high the Bitcoin price can go, well, in the short-term, that’s pretty much impossible to predict, but given that Bitcoin got from $20,000 to $22,000 in just 13 hours, the fact that Bitcoin price breaking $20K is currently receiving mainstream media coverage all over the world (even in China where fiat-crypto exchanges are banned), and the non-stop flow of highly bullish news about major institutional investors buying Bitcoin as an inflation hedge asset, means that — the Bitcoin price could easily reach $25,000 before Christmas Day.

Dovey Wan, a Founding Partner of blockchain-focused venture investment firm Primitive Ventures, thinks that some people in China who usually trade stocks could soon FOMO into Bitcoin:

Antoni Trenchev, co-founder and managing partner of Nexo, told Bloomberg on Wednesday that “we have a new line in the sand and the focus shifts to the next round number of $30,000.” He then added that this “is the start of a new chapter for Bitcoin,” and that “it’s a narrative the media and retail crowd can properly latch onto because they’ve been noticeably absent from this rally.”

And prominent on-chain Willy Woo seems to be saying that he does not see much resistance for Bitcoin until $50,000:

As for the long-term outlook for Bitcoin, it might be worth listening to what Scott Minerd, who is the Global Chief Investment Officer of Guggenheim Partners and the Chairman of Guggenheim Investments. Guggenheim Investments is “the global asset management and investment advisory division of Guggenheim Partners and has more than $233 billion in total assets across fixed income, equity and alternative strategies.” Yesterday, during an interview with Bloomberg TV, Minerd said that “Bitcoin should be worth about $400,000.”

Featured Image by “rkarkowski” via Pixabay.com

The views and opinions expressed by the author are for informational purposes only and do not constitute financial, investment, or other advice.